West Virginia Amendments to certificate of incorporation

Description

How to fill out Amendments To Certificate Of Incorporation?

Are you presently within a position in which you require files for sometimes company or specific reasons just about every working day? There are tons of authorized document web templates available on the Internet, but locating types you can trust isn`t straightforward. US Legal Forms offers a large number of form web templates, like the West Virginia Amendments to certificate of incorporation, that happen to be created in order to meet state and federal needs.

Should you be already knowledgeable about US Legal Forms web site and also have a free account, basically log in. Following that, it is possible to acquire the West Virginia Amendments to certificate of incorporation web template.

If you do not provide an account and want to begin to use US Legal Forms, adopt these measures:

- Get the form you need and make sure it is for the proper town/county.

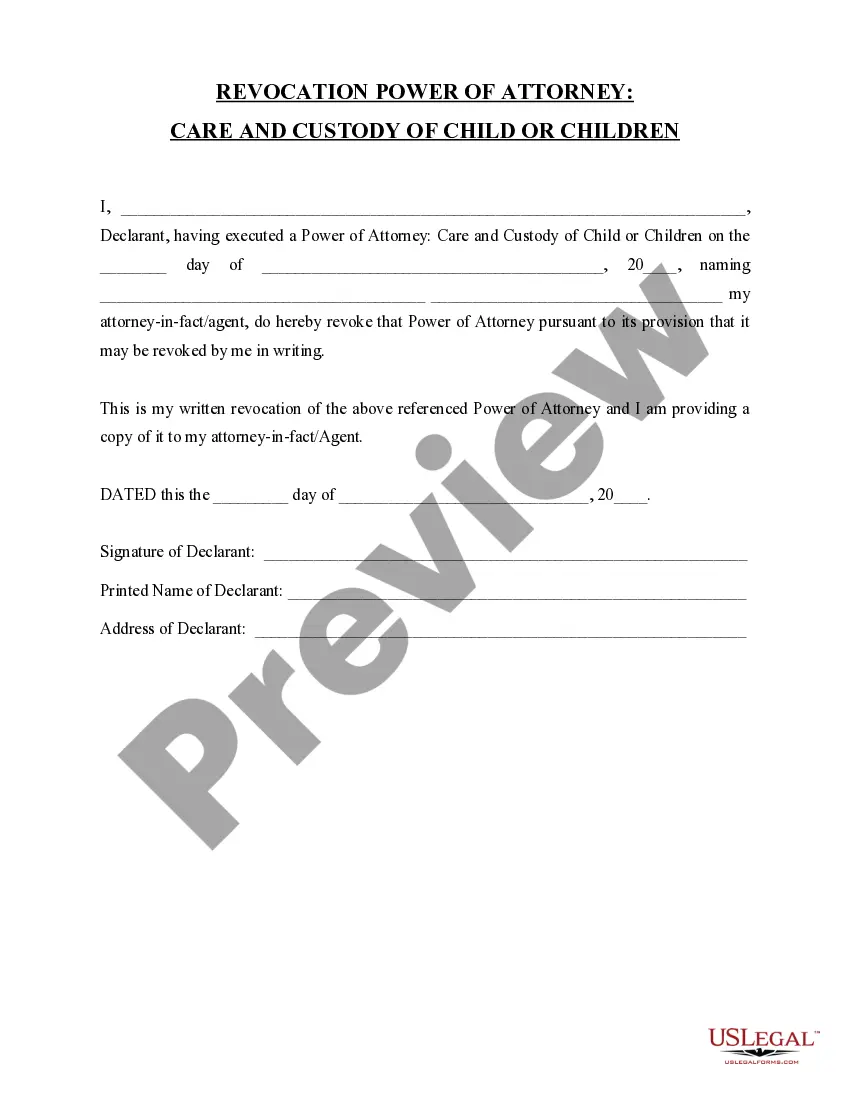

- Use the Preview option to check the form.

- Read the explanation to ensure that you have chosen the right form.

- If the form isn`t what you`re seeking, take advantage of the Research area to find the form that suits you and needs.

- When you get the proper form, click on Acquire now.

- Select the rates prepare you desire, complete the desired details to generate your bank account, and pay for the transaction using your PayPal or credit card.

- Choose a handy paper file format and acquire your version.

Discover every one of the document web templates you possess bought in the My Forms food selection. You can aquire a extra version of West Virginia Amendments to certificate of incorporation at any time, if required. Just click the necessary form to acquire or print out the document web template.

Use US Legal Forms, one of the most extensive collection of authorized kinds, to conserve efforts and prevent blunders. The support offers professionally produced authorized document web templates which you can use for an array of reasons. Generate a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

The followings are exempt from the transfer tax: (1) wills; (2) testamentary or inter vivos trusts; (3) deeds of partition; (4) deeds made pursuant to mergers of corporations, limited liability companies, partnerships, and limited partnerships; (5) deeds made pursuant to conversions to limited liability companies; (6) ...

West Virginia Code §11-22-1, provides for exemptions to paying the Transfer Tax Fee. Deeds must specifically state the reason for exemption, otherwise, the Transfer Tax Fee will be charged. Every Deed recorded requires a completed Sales Listing Form to be attached. The Sales Listing Form can be found here.

The first $20,000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt. Household goods and personal effects not used for commercial purposes.

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification ...

(a) A parent is barred from inheriting from or through a child of the parent if: (1) The parent's parental rights were terminated by court order and the parent-child relationship has not been judicially reestablished; or (2) the child died before reaching 18 years of age and there is clear and convincing evidence that ...

How to Order a Certified Copy of Articles of Organization or a Certified Copy of Articles of Incorporation From the State of West Virginia. A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone, in person, or online, but we recommend online.

-- Every employer maintaining an office or transacting business within this state and making payment of any wage taxable under this article to a resident or nonresident individual shall deduct and withhold from such wages for each payroll period a tax computed in such manner as to result, so far as practicable, in ...

Any amendment to the Constitution of the State may be proposed in either house of the Legislature at any regular or ex- traordinary session thereof; and if the same, being read on three several days in each House, be agreed to on its third reading, by two thirds of the members elected thereto, the proposed amend- ment, ...