West Virginia Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

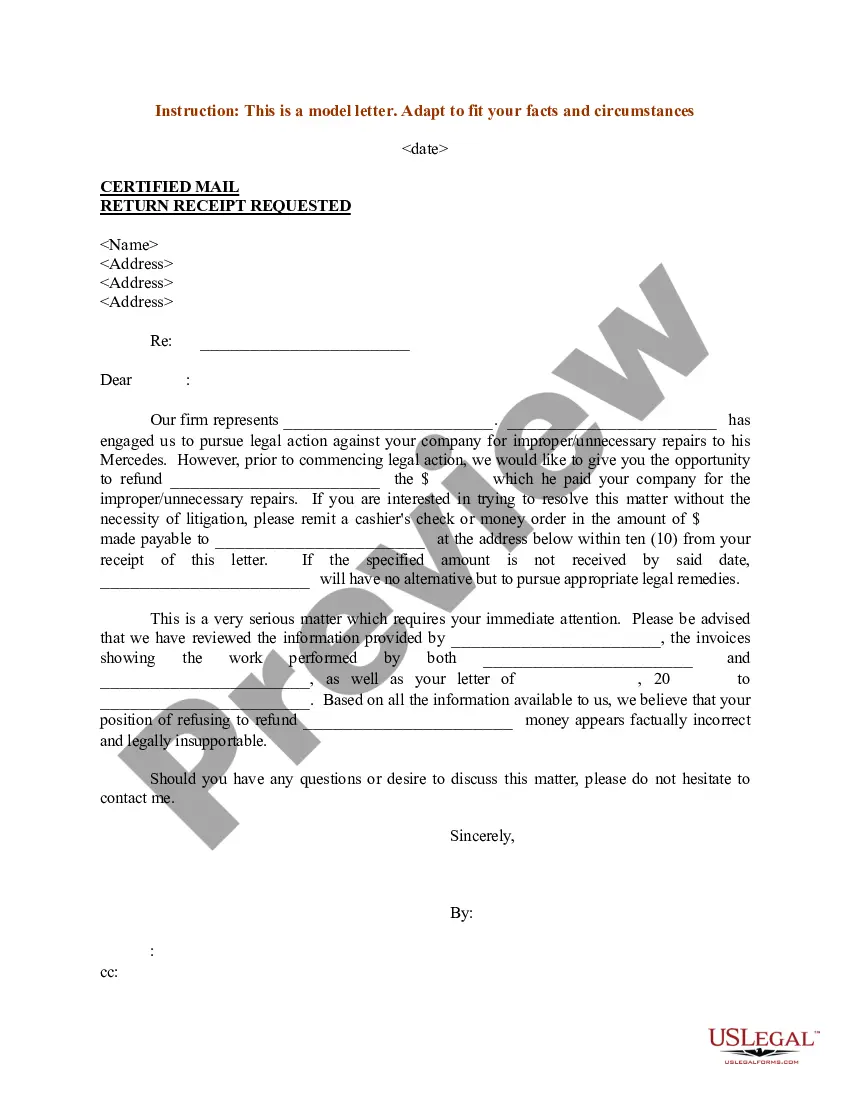

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

If you need to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the largest repository of genuine forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you need.

Various templates for both business and personal applications are organized by categories and titles, or keywords.

Step 4. Once you have located the form you need, select the Buy now option. Choose your preferred pricing plan and provide your information to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it onto your device. Step 7. Fill out, edit, and print or sign the West Virginia Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

- Utilize US Legal Forms to acquire the West Virginia Acknowledgment Form for Consultants or Self-Employed Independent Contractors in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download option to obtain the West Virginia Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

- You can also access forms you have previously saved from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form format.

Form popularity

FAQ

Homeowners are exempt from the State of West Virginia requirement for being a licensed contractor if they perform the work on their own house they reside in. Homeowners performing their own work must declare this when they apply for a building permit before work starts.

Work performed on a residential project under $5,000 or a commercial project under $25,000 (materials and labor, total contract - not just the work you are performing) does not require a license, other than a West Virginia State Tax Business License.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Determine the Type of Contractor License You Need In the state of West Virginia, work performed under $2,500 (materials and labor, total contract) does not require a contractor license. However: Electrical Contractor's License - if a project exceeds $1,000.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Specifically, a person shall be classified as an independent contractor if there is a written contract between the principal and the individual that states the principal's intent to engage the services of the person as an independent contractor and contains acknowledgments that the person understands: (1) they are

RMO License One of the most common, and often easiest ways that people without any prior experience can gain access to a contractor license is by utilizing either an RMO or RME.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.