West Virginia Subcontract to Perform Work and Furnish Materials, Equipment and Labor for its Portion of Work, Together with all Plant, Tools, Machinery, Appliances, Winter Protection and all other Necessary Protection

Description

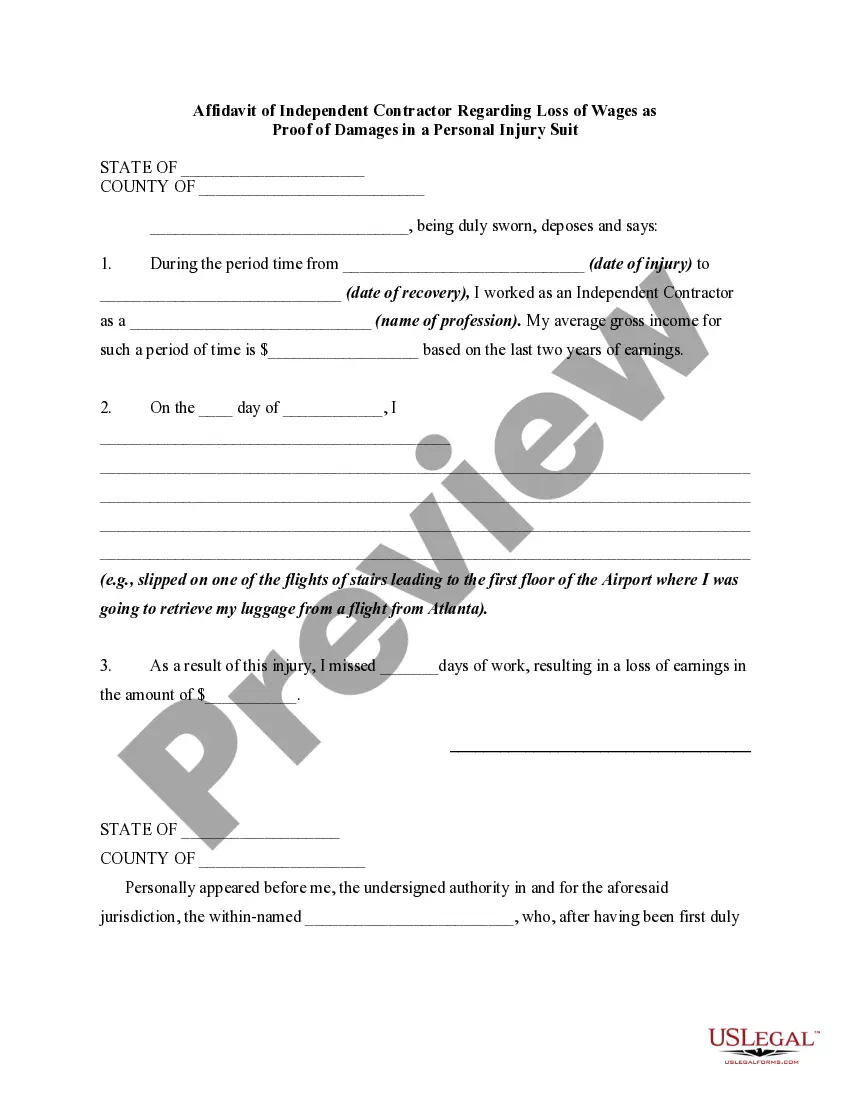

How to fill out Subcontract To Perform Work And Furnish Materials, Equipment And Labor For Its Portion Of Work, Together With All Plant, Tools, Machinery, Appliances, Winter Protection And All Other Necessary Protection?

Are you currently in a position where you need documents for both business or personal reasons almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

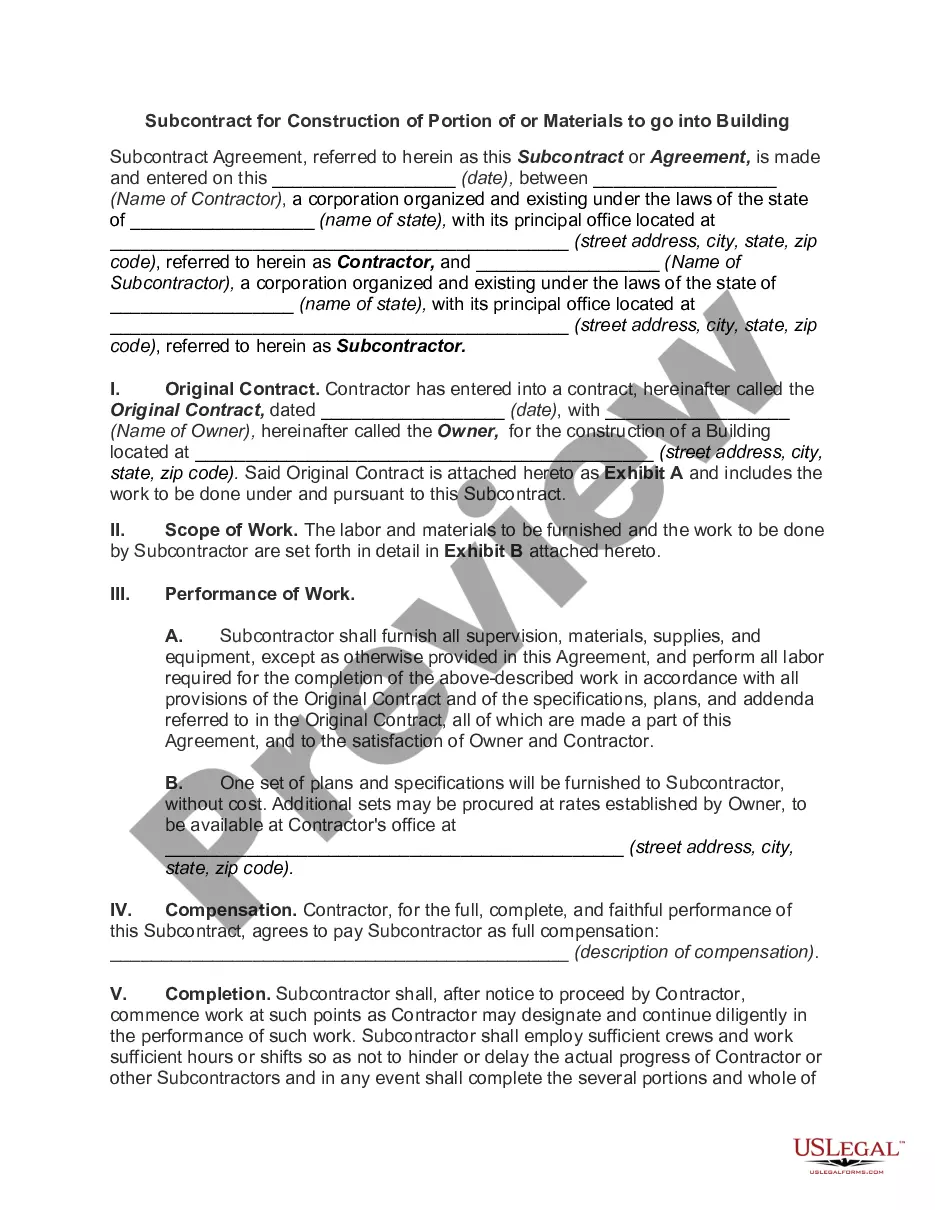

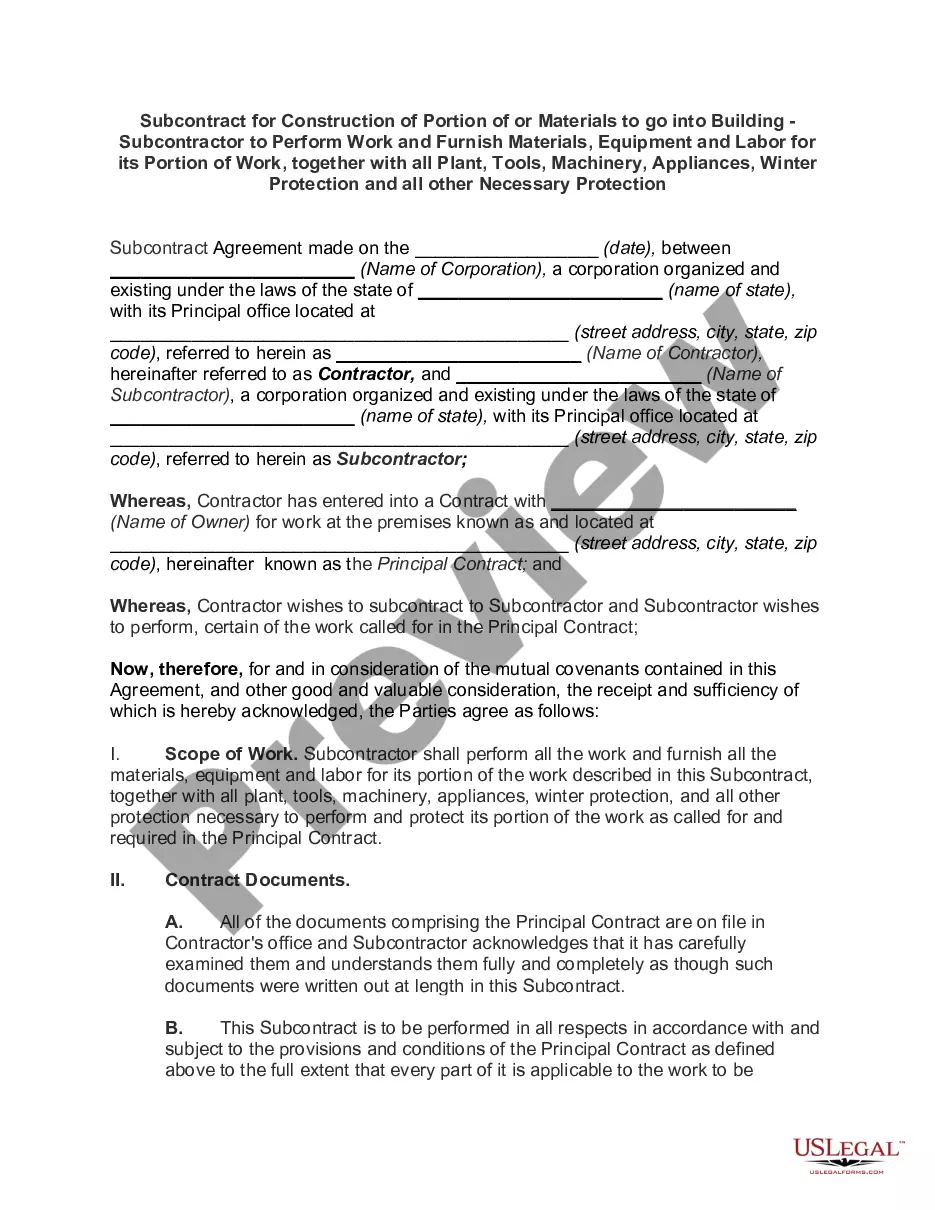

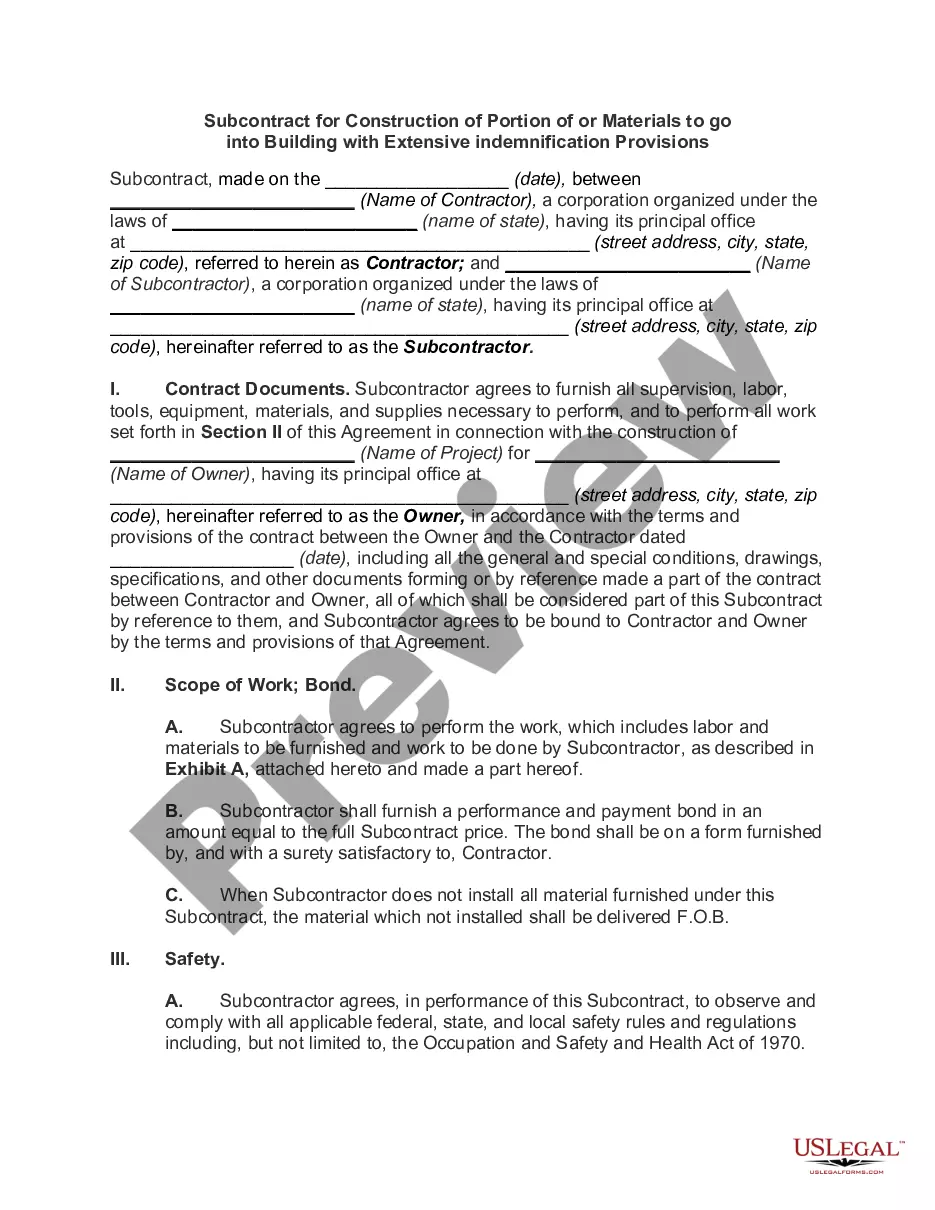

US Legal Forms offers a vast selection of form templates, such as the West Virginia Subcontract to Perform Work and Furnish Materials, Equipment and Labor for its Portion of Work, Along with all Plant, Tools, Machinery, Appliances, Winter Protection and all other Necessary Protection, designed to meet federal and state requirements.

Once you find the correct form, click on Get now.

Select the pricing plan you prefer, fill out the necessary details to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the West Virginia Subcontract to Perform Work and Furnish Materials, Equipment and Labor for its Portion of Work, Together with all Plant, Tools, Machinery, Appliances, Winter Protection and all other Necessary Protection template.

- Should you not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

- Use the Preview button to review the form.

- Check the description to ensure that you have selected the correct form.

- If the form does not match your needs, utilize the Search area to find the form that satisfies your requirements.

Form popularity

FAQ

Virginia Code § 58.1-609.5 2 provides an exemption from the retail sales and use tax for "an amount separately charged for labor or services rendered in installing, applying, remodeling or repairing property sold."

27a2 Professional Services and Certified Public Accountants - Sales of services recognized as professional under West Virginia law, such as those provided by doctors, lawyers, engineers, architects and CPA's. Purchases by professionals for use in providing professional services are taxable.

Persons in the construction trades must collect sales tax on both the services (labor) provided to their customers and on any appliances, equipment or materials sold to their customers in conjunction with the work they perform and remit the tax collected to the state unless they are engaged in activity constituting a

The West Virginia (WV) state sales tax rate is currently 6%. Depending on local municipalities, the total tax rate can be as high as 7%. Amazon.com owns and operates a customer service center in West Virginia.

Traditional Goods or Services Goods that are subject to sales tax in West Virginia include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medicine, groceries and gasoline are tax-exempt.

The West Virginia (WV) state sales tax rate is currently 6%. Depending on local municipalities, the total tax rate can be as high as 7%. Amazon.com owns and operates a customer service center in West Virginia.

Are services subject to sales tax in West Virginia? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In West Virginia, services are taxable unless specifically exempted.

The Sales Tax and Use Tax on the sales, purchases and uses of food and food ingredients intended for human consumption has ceased. However, the cessation of tax does not apply to sales, purchases and uses by consumers of prepared food, food sold through vending machines and soft drinks.

West Virginia is a destination-based sales tax state. So if you sell an item to a customer through your online store, collect sales tax at the tax rate where your product is delivered. (I.e. the Buyer's ship to address.) The West Virginia state sales tax rate is 6%.

Sales Tax Exemptions in West Virginia Also exempt is contracting services , so long as it is constructing, altering, repairing, decorating, or improving a real property, and certain medical paraphernalia, such as drugs, durable medical goods, prescribed prosthetic devices, and mobility enhancing equipment.