West Virginia Installment Promissory Note and Security Agreement

Description

How to fill out Installment Promissory Note And Security Agreement?

Selecting the optimal legal document format can be a challenge.

Of course, there is a range of templates accessible online, but how can you acquire the legal document you require.

Utilize the US Legal Forms website. The platform provides a vast selection of templates, such as the West Virginia Installment Promissory Note and Security Agreement, suitable for both business and personal purposes.

You can preview the form by clicking on the Preview button and read the form details to confirm that it is the right one for you.

- All forms are reviewed by experts and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the West Virginia Installment Promissory Note and Security Agreement.

- Use your account to search through the legal forms you have ordered previously.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for the city/region.

Form popularity

FAQ

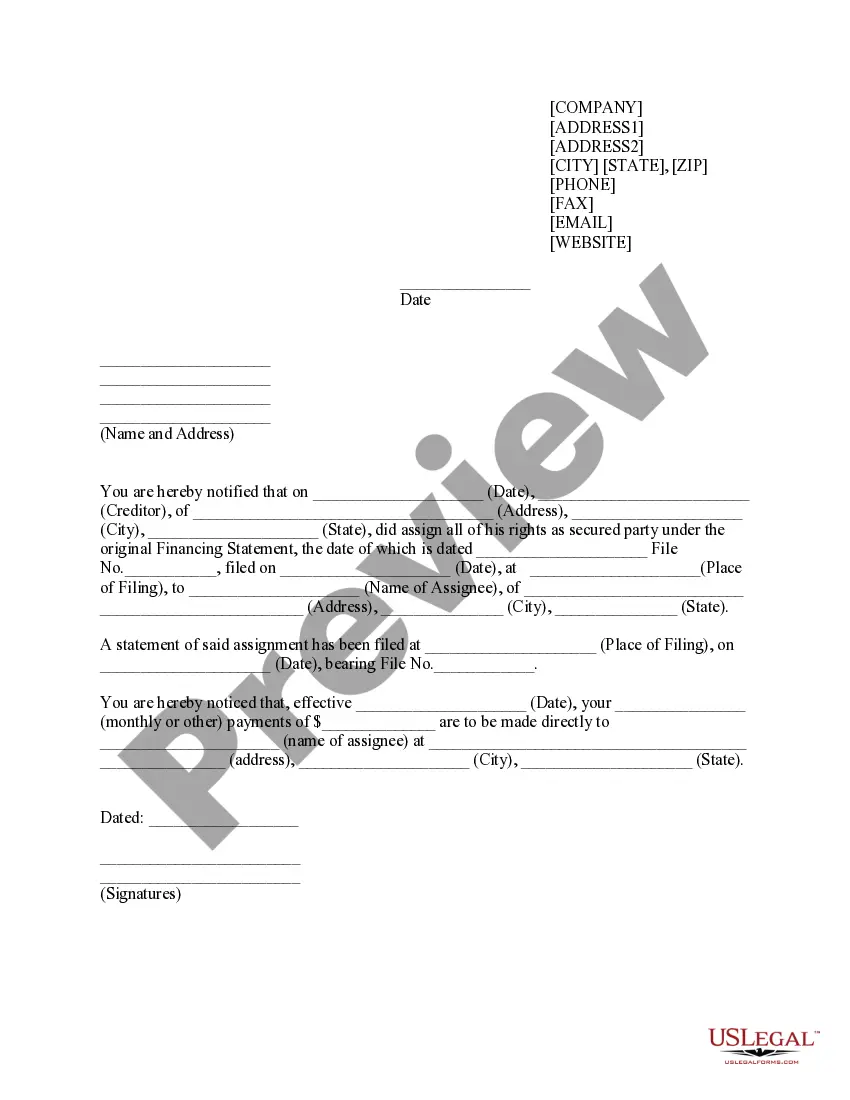

It is an agreement to repay debt between the parties at a future point in time. However, loan note instruments are usually more complicated than a simple loan agreement and can include multiple lenders (although they can be between two parties) and often include more complicated repayment terms.

A promissory note is often included in a mortgage, student loan, car loan, business loan or personal loan agreement. Borrowers will typically sign the promissory note as one of the last steps to receiving their borrowed funds.

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

A Promissory Note with Installment Payments is a lending contract that sets terms for a loan to be repaid in installments. This Promissory Note specifies that the loan will be paid back with consistent, equal, payments. Whether you're the lender or the borrower, you know exactly what each payment will be.

An installment note is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note.

Should be signed by the maker It is mandatory for the person making the promissory note to sign it. The promissory note can even be signed by maker's agent, who has been so authorised to do so by the maker himself. The pro note should be clear about the identity of the person undertaking to pay.

Most Virginia promissory notes do not need to be notarized. If the promissory note involves real estate, it must be executed in front of a notary. The borrower must sign and date the promissory note to make it legally binding.

Types of Promissory NotesSimple Promissory Note.Student Loan Promissory Note.Real Estate Promissory Note.Personal Loan Promissory Notes.Car Promissory Note.Commercial Promissory note.Investment Promissory Note.

If the sum is not huge and the relationship is trustworthy, it is preferred to go with a promissory note to avoid potential legal issues. However, if the sum of money is huge and the relationship is not entirely trustable, make sure to use a secured loan agreement to ensure your money is safe with the borrower.