West Virginia Sample Letter for Foreclosure Services Rendered

Description

How to fill out Sample Letter For Foreclosure Services Rendered?

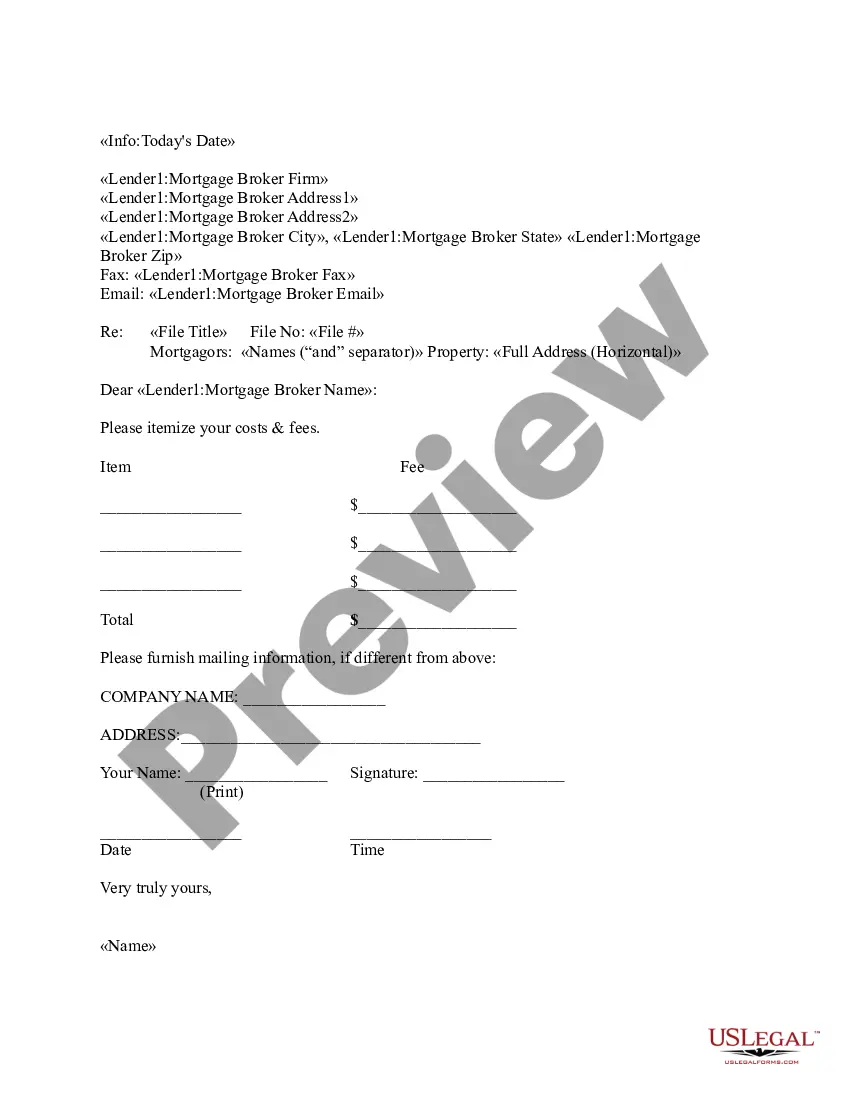

Finding the right legal record format can be a struggle. Naturally, there are a variety of layouts accessible on the Internet, but how will you obtain the legal type you want? Take advantage of the US Legal Forms web site. The support offers thousands of layouts, such as the West Virginia Sample Letter for Foreclosure Services Rendered, that can be used for business and private needs. Every one of the kinds are examined by pros and meet federal and state demands.

Should you be presently listed, log in to the accounts and click the Obtain switch to find the West Virginia Sample Letter for Foreclosure Services Rendered. Utilize your accounts to look throughout the legal kinds you possess bought previously. Visit the My Forms tab of your respective accounts and get an additional version of your record you want.

Should you be a new consumer of US Legal Forms, here are straightforward guidelines for you to stick to:

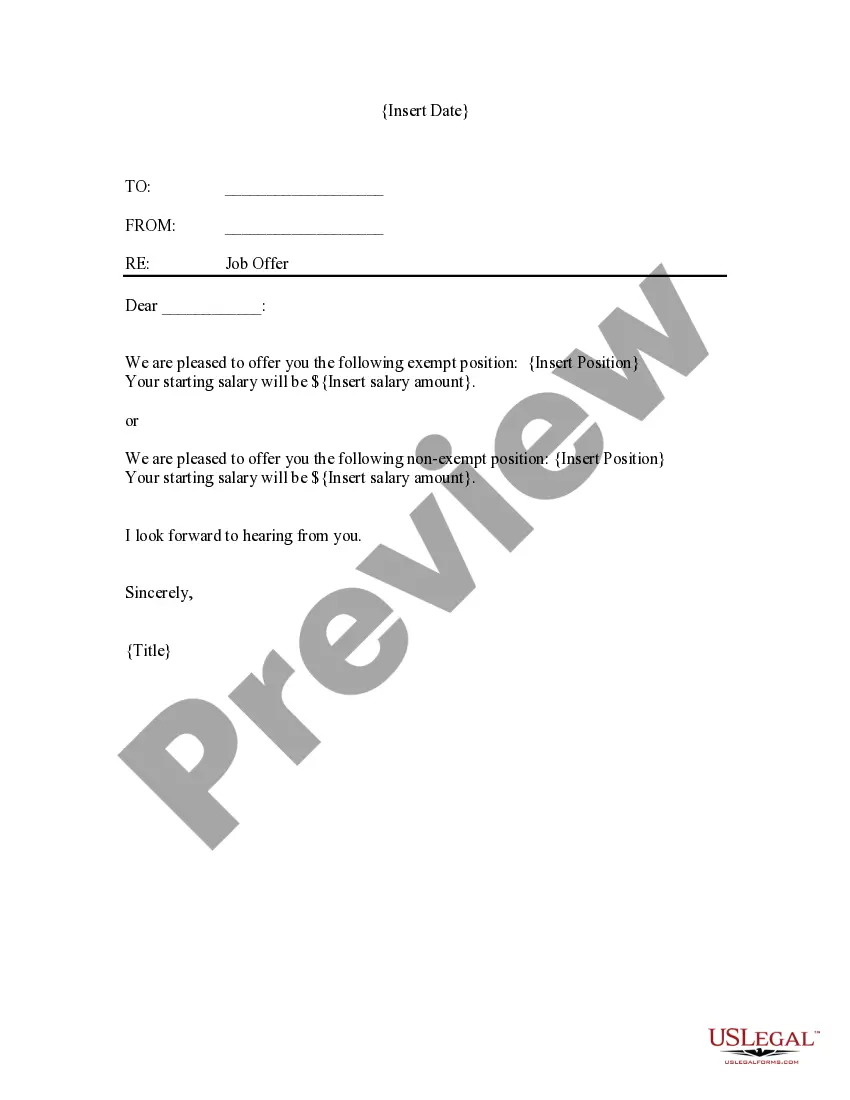

- First, ensure you have chosen the correct type for your personal city/area. You may look over the form utilizing the Preview switch and browse the form outline to ensure this is the right one for you.

- In the event the type does not meet your requirements, take advantage of the Seach industry to get the proper type.

- Once you are certain the form is proper, go through the Purchase now switch to find the type.

- Choose the pricing program you want and enter the essential info. Make your accounts and buy the transaction utilizing your PayPal accounts or bank card.

- Pick the document format and acquire the legal record format to the system.

- Comprehensive, revise and print and sign the acquired West Virginia Sample Letter for Foreclosure Services Rendered.

US Legal Forms may be the biggest collection of legal kinds for which you can discover numerous record layouts. Take advantage of the service to acquire professionally-made papers that stick to state demands.

Form popularity

FAQ

In West Virginia, a homeowner will receive two notices before losing the home to foreclosure. First, the bank must issue a notice of default. Then, a notice of sale must go out. The trustee will also publish the notice of sale in a newspaper.

Stopping Mortgage Foreclosure & Keeping your Home: Repayment Plan. ... Forbearance Plan. ... Getting a Loan Modification. ... Hamp Modification. ... Pennsylvania Housing Finance Agency. ... Refinancing. ... Filing a Chapter 7 Bankruptcy Petition. ... Filing a Chapter 13 Bankruptcy Petition.

Under West Virginia law, the lender has to personally deliver or mail a notice of default, which may be sent after you (the borrower) have been in default for five days, to your last known address. This notice gives you ten days to cure the default. But you'll lose the right to cure after three defaults.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Your Rights under North Carolina Law If you rent a house or an apartment in a complex that has fewer than 15 units, state law allows you to end your lease anytime between 10 and 90 days after the foreclosure sale without paying early termination fees if you give your landlord written notice.

You can potentially file for bankruptcy or file a lawsuit against the foreclosing party (the "bank") to possibly stop the foreclosure entirely or at least delay it. If you have a bit more time on your hands, you can apply for a loan modification or another workout option.

How Can I Stop a Foreclosure in West Virginia? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.

A West Virginia foreclosure can take place in about 60 days if it occurs through the non judicial foreclosure process and is uncontested. If the borrower contests the foreclosure or if the lender seeks a judicial foreclosure then the process is likely to take more than 60 days.