West Virginia Estate Planning Data Sheet

Description

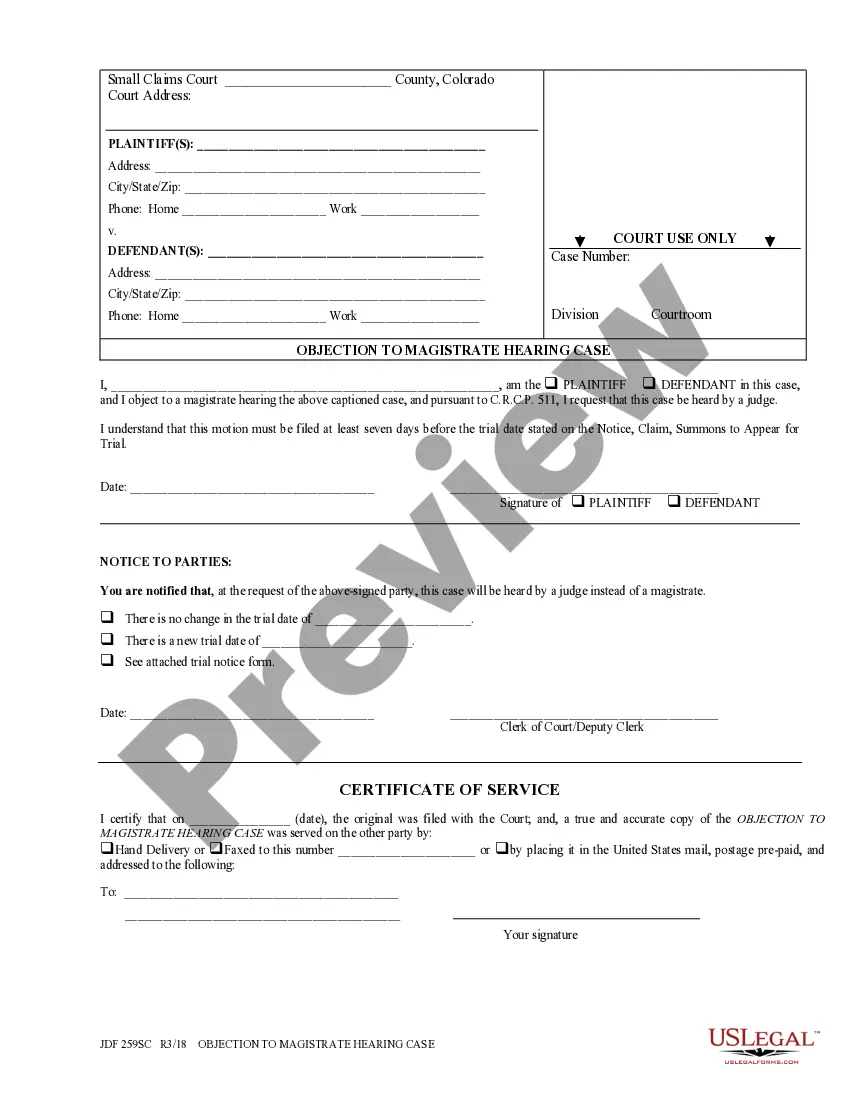

How to fill out Estate Planning Data Sheet?

US Legal Forms - among the largest libraries of legal varieties in the USA - provides an array of legal document web templates you can download or print out. While using web site, you can find thousands of varieties for enterprise and individual reasons, sorted by types, claims, or keywords.You will find the most recent models of varieties like the West Virginia Estate Planning Data Sheet within minutes.

If you have a subscription, log in and download West Virginia Estate Planning Data Sheet from the US Legal Forms library. The Acquire key can look on every type you see. You get access to all earlier downloaded varieties within the My Forms tab of your account.

If you would like use US Legal Forms for the first time, listed here are easy directions to help you started out:

- Be sure you have picked the correct type for your personal town/state. Select the Review key to analyze the form`s information. Read the type description to actually have selected the correct type.

- In case the type does not match your requirements, use the Research field near the top of the screen to obtain the one that does.

- In case you are satisfied with the shape, affirm your choice by visiting the Purchase now key. Then, pick the pricing prepare you favor and provide your accreditations to register for the account.

- Process the deal. Utilize your bank card or PayPal account to perform the deal.

- Choose the format and download the shape on the gadget.

- Make alterations. Complete, edit and print out and sign the downloaded West Virginia Estate Planning Data Sheet.

Every single design you added to your account lacks an expiration time and it is yours permanently. So, if you want to download or print out an additional version, just check out the My Forms segment and then click around the type you require.

Get access to the West Virginia Estate Planning Data Sheet with US Legal Forms, by far the most comprehensive library of legal document web templates. Use thousands of professional and condition-specific web templates that fulfill your company or individual requires and requirements.

Form popularity

FAQ

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

There two ways to close the estate: (1) final settlement; or (2) waiver of final settlement. Generally, you must close the estate within 5 years of starting the probate process. W. Va.

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

To initiate a probate case in West Virginia, you need to obtain and file in the appropriate county a certified copy of the death certificate within 30 days of the date of death. If the decedent left a will, that should be filed in the court as well.

Assets won't need to go through probate if they are listed in a will or living trust. Additionally, West Virginia does not require probate for estates worth less than $100,000. Real estate assets do not count toward the $100,000 total.

In West Virginia, the question often arises about how long an executor has to settle an estate. While the timeline can vary widely, it usually ranges from several months to over a year.

Assets include real property, personal property, bank accounts, stocks and bonds, retirement accounts, life insurance and other types of securities.

Assets won't need to go through probate if they are listed in a will or living trust. Additionally, West Virginia does not require probate for estates worth less than $100,000. Real estate assets do not count toward the $100,000 total.