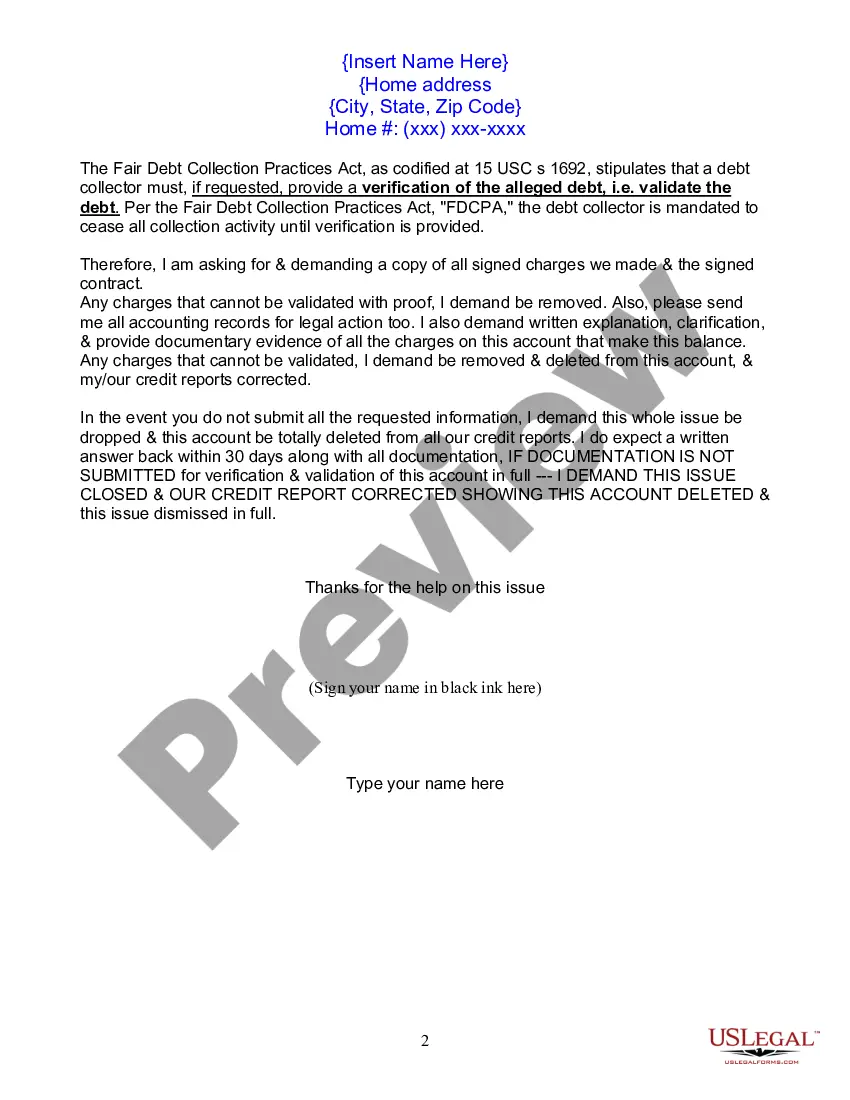

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Wisconsin Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

Are you in a location where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a vast array of template forms, such as the Wisconsin Letter of Dispute - Complete Balance, which are designed to comply with state and federal regulations.

You can find all the document templates you have purchased in the My documents menu.

You can obtain another copy of the Wisconsin Letter of Dispute - Complete Balance anytime, if necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Letter of Dispute - Complete Balance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

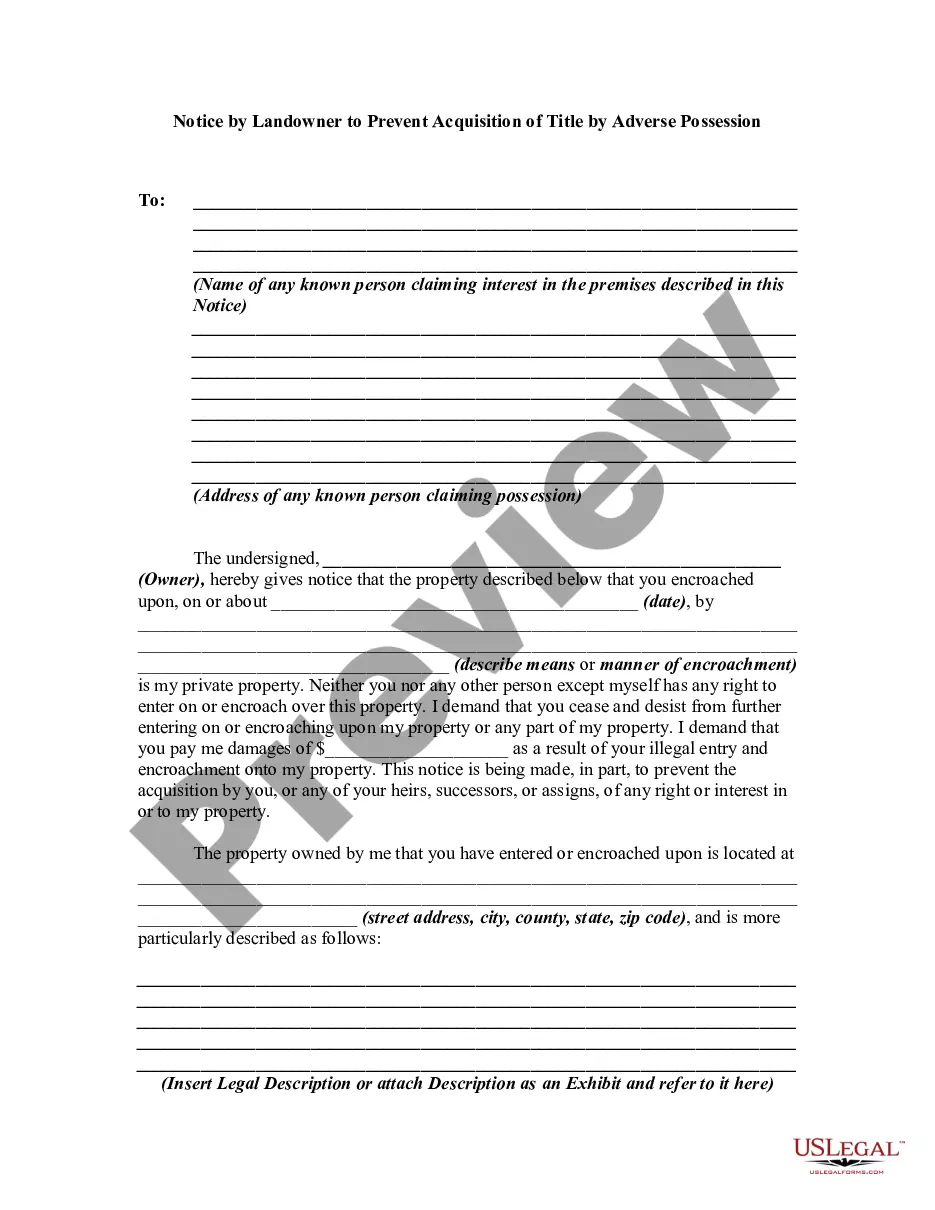

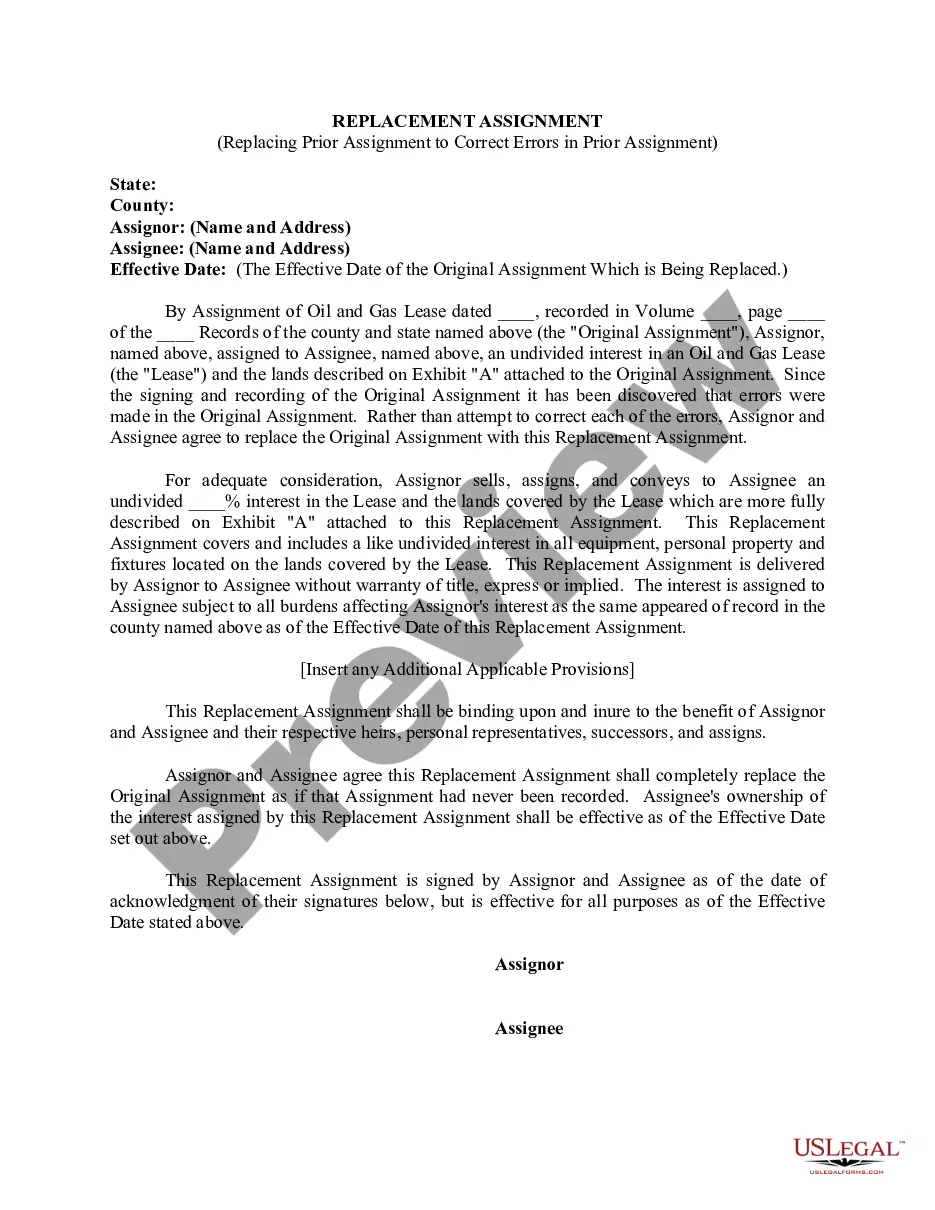

- Utilize the Review option to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are seeking, use the Search box to locate the form that fits your requirements.

- Once you find the right form, click Get now.

- Select the payment plan you prefer, provide the needed information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

In Wisconsin, creditors can pursue a debt for a period defined by the statute of limitations, usually six years for most debts. After this time, they lose the legal right to sue you for repayment. However, creditors may still attempt to collect the debt through other means, such as phone calls or letters. A Wisconsin Letter of Dispute - Complete Balance can be an effective tool to assert your rights and clarify your position with creditors.

To send a dispute letter to a debt collector, start by writing a clear and concise letter stating your intent to dispute the debt. Include your personal information, the account number, and any relevant details regarding the debt. You can then send this letter via certified mail to ensure that you have proof of delivery. Using a Wisconsin Letter of Dispute - Complete Balance template from USLegalForms can streamline this process and ensure you include all necessary information.

A debt may become uncollectible when the statute of limitations expires, which in Wisconsin is typically six years for written contracts. Once this period passes, creditors can no longer legally pursue the debt through the courts. Additionally, if a creditor fails to contact you about the debt for a significant period, it may also be considered uncollectible. Utilizing a Wisconsin Letter of Dispute - Complete Balance can help clarify your position and protect your rights.

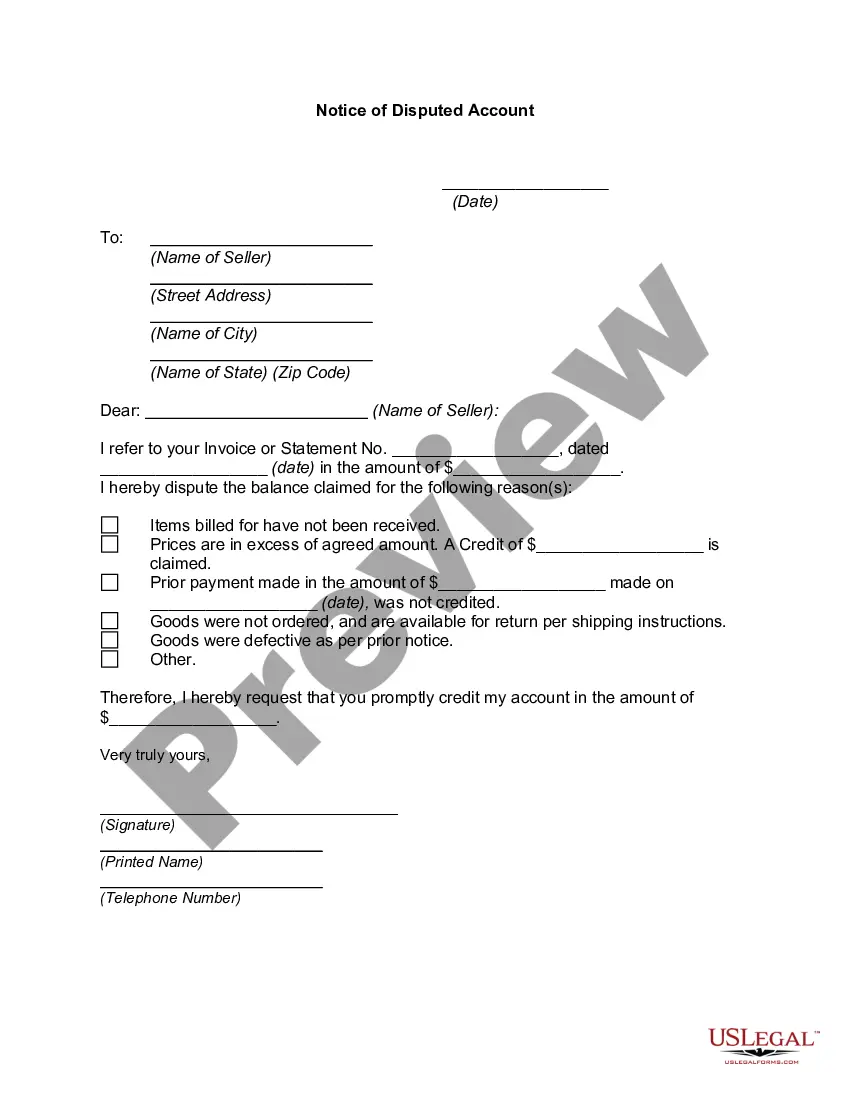

When writing a payment dispute letter, begin with your account details and the specifics of the disputed payment. Clearly state the reason for your dispute, referencing any relevant documents or agreements. A Wisconsin Letter of Dispute - Complete Balance can serve as a helpful guide in formatting your letter. Always keep your tone professional and polite, while firmly asserting your position to ensure a constructive dialogue.

To write a successful dispute letter, start by clearly identifying yourself and mentioning your credit report details. Next, refer to the specific information you dispute, using a Wisconsin Letter of Dispute - Complete Balance as a template if needed. Be concise and factual, providing any supporting documents or evidence to back your claim. Lastly, ensure you include your contact information, so the credit bureau can reach you easily.

A 609 dispute letter is a formal request that you send to credit reporting agencies, asking them to verify or remove inaccurate information from your credit report. For instance, if you find an entry that you believe is incorrect, you can use a Wisconsin Letter of Dispute - Complete Balance as an example to draft your letter. This letter typically includes your identification, details about the disputed item, and a request for verification. Using a well-structured letter increases your chances of a successful dispute.

An example of a billing dispute letter includes a clear statement of the dispute, your identification details, and a request for verification of the debt. In the Wisconsin Letter of Dispute - Complete Balance, you can outline your reasons for disputing the billing, such as incorrect charges or unauthorized transactions. Using US Legal Forms can provide you with a structured template to help you present your case clearly and professionally.

The best dispute reason often depends on your specific situation, but common reasons include inaccuracies in the amount owed or a lack of verification of the debt. When using the Wisconsin Letter of Dispute - Complete Balance, you can assert that the debt is not yours or that the balance is incorrect. Always choose a reason that accurately reflects your case, as this will strengthen your position and help resolve the issue effectively.

To write a dispute letter to a debt collector, start by clearly stating your intention to dispute the debt. Include your personal information, details of the debt, and any relevant account numbers. Use the Wisconsin Letter of Dispute - Complete Balance template available on US Legal Forms to ensure you include all necessary components and follow the correct format. This approach helps protect your rights and creates a formal record of your dispute.

To write a debt dispute letter, start with your name and contact information, followed by the date. Clearly state that you are disputing the debt, mention the account number, and provide details about the debt. Use a polite and professional tone, and include any evidence that supports your claim. Utilizing the Wisconsin Letter of Dispute - Complete Balance from US Legal Forms can simplify this process.