Wisconsin Collections Agreement - Self-Employed Independent Contractor

Description

How to fill out Collections Agreement - Self-Employed Independent Contractor?

If you need to acquire, obtain, or print valid document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require. A wide range of templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to get the Wisconsin Collections Agreement - Self-Employed Independent Contractor with just a few clicks of the mouse.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Wisconsin Collections Agreement - Self-Employed Independent Contractor. Each legal document template you purchase is yours forever. You will have access to every form you acquired in your account. Click the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Wisconsin Collections Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Wisconsin Collections Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct area/state.

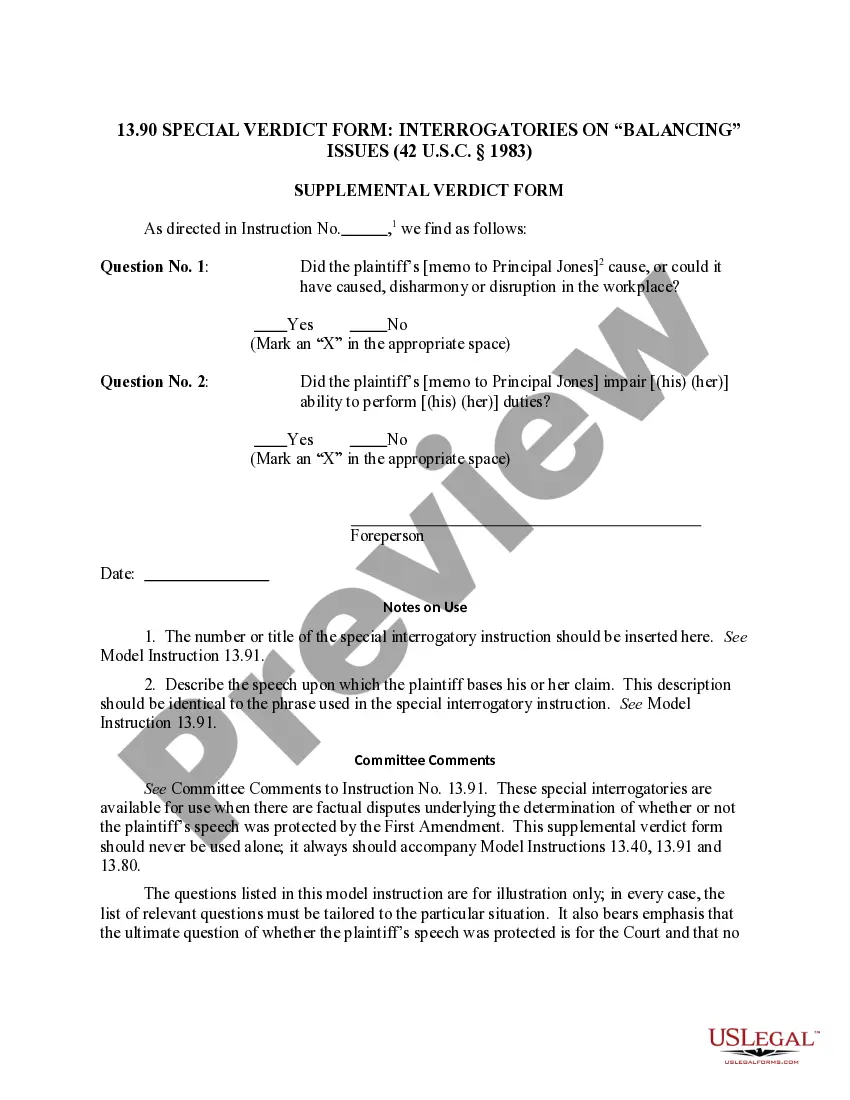

- Step 2. Use the Preview option to review the form's contents. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form collection.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

The basic independent contractor agreement typically includes essential elements such as the scope of work, payment terms, and deadlines. This agreement serves as a foundation for a productive working relationship and ensures both parties are aligned. Incorporating aspects of the Wisconsin Collections Agreement - Self-Employed Independent Contractor can enhance the clarity of payment structures. For convenience, you can find templates on platforms like US Legal Forms that cater to your specific needs.

The independent contractor agreement in Wisconsin outlines the terms of the relationship between the contractor and the client. This document specifies payment terms, deliverables, and deadlines, ensuring both parties have clear expectations. A well-drafted Wisconsin Collections Agreement - Self-Employed Independent Contractor can protect your rights and provide a solid framework for disputes. Template options are available through platforms like US Legal Forms to simplify the process.

In certain circumstances, a contractor in Wisconsin can file a lien even without a formal contract. However, it is essential to understand the specifics of Wisconsin lien laws and the Wisconsin Collections Agreement - Self-Employed Independent Contractor. Documentation of work performed and communications with the client may serve as evidence of your claim. Consulting legal resources and platforms like US Legal Forms can provide more clarity on filing liens without contracts.

In Wisconsin, independent contractors must meet specific legal requirements to operate effectively. They should ensure they have a valid business license and properly classify themselves for tax purposes. Understanding the Wisconsin Collections Agreement - Self-Employed Independent Contractor is crucial for maintaining compliance. It's also essential to record income and expenses meticulously to support your independent status.

Creating an independent contractor agreement is essential for outlining the terms of your working relationship. To start, include details such as the scope of work, payment terms, and deadlines. Using a Wisconsin Collections Agreement - Self-Employed Independent Contractor template can simplify this process significantly. Platforms like US Legal Forms provide ready-made templates that meet legal standards, ensuring your agreement is solid and protects both parties.

To fill out an independent contractor agreement, start by entering the contractor and client information accurately. Specify the services to be rendered, payment terms, and the duration of the agreement. Make sure you align with the Wisconsin Collections Agreement - Self-Employed Independent Contractor standards for optimal compliance. Resources from US Legal Forms can assist you with structured formats that make this process efficient and straightforward.

Filling out an independent contractor form involves gathering essential information such as the contractor's name, contact details, and tax identification number. You should also include the nature of the services provided and payment details. Keep in mind the requirements of the Wisconsin Collections Agreement - Self-Employed Independent Contractor, which can help protect both parties. US Legal Forms offers user-friendly templates that guide you through the necessary steps.

To write an independent contractor agreement, start by clearly defining the scope of work. Include essential details such as the contractor's responsibilities, payment terms, and timelines. It is vital to ensure the agreement complies with relevant laws, particularly under the Wisconsin Collections Agreement - Self-Employed Independent Contractor framework. Utilizing platforms like US Legal Forms can simplify the process by providing templates tailored to your needs.

Certain accounts are protected from garnishment under the law. For example, retirement accounts, such as IRAs and 401(k)s, typically cannot be garnished. Furthermore, some government benefits and certain trust accounts may also offer protection. Knowing these exemptions is essential for anyone under a Wisconsin Collections Agreement - Self-Employed Independent Contractor.

Yes, your wages can be garnished even if you are classified as an independent contractor. Under a Wisconsin Collections Agreement - Self-Employed Independent Contractor, creditors can seek garnishment of your earnings if you owe debts. However, the process may vary depending on your income structure. It is crucial to understand the implications of any agreements you enter into.