Wisconsin Loan Term Sheet

Description

How to fill out Loan Term Sheet?

You can spend hrs online attempting to find the legitimate papers design which fits the state and federal specifications you will need. US Legal Forms provides a huge number of legitimate types that happen to be analyzed by professionals. You can actually acquire or produce the Wisconsin Loan Term Sheet from your service.

If you currently have a US Legal Forms account, you are able to log in and then click the Obtain button. Afterward, you are able to complete, change, produce, or sign the Wisconsin Loan Term Sheet. Every single legitimate papers design you purchase is the one you have for a long time. To get another duplicate associated with a obtained form, check out the My Forms tab and then click the related button.

If you work with the US Legal Forms web site initially, stick to the easy directions under:

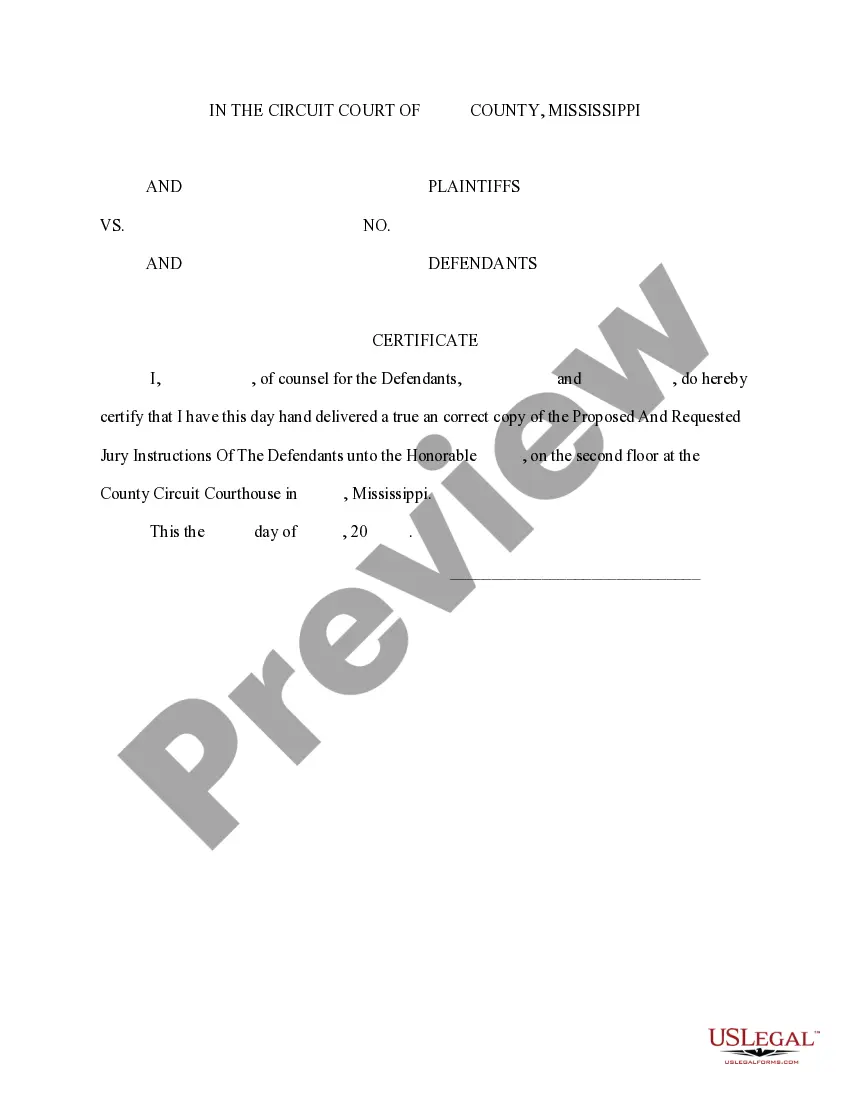

- First, make certain you have chosen the best papers design for your region/metropolis of your liking. Look at the form description to make sure you have picked out the proper form. If available, use the Review button to check from the papers design as well.

- In order to get another variation in the form, use the Look for area to obtain the design that meets your needs and specifications.

- When you have discovered the design you desire, simply click Purchase now to carry on.

- Select the costs plan you desire, type your references, and register for an account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal account to cover the legitimate form.

- Select the file format in the papers and acquire it to the device.

- Make modifications to the papers if required. You can complete, change and sign and produce Wisconsin Loan Term Sheet.

Obtain and produce a huge number of papers layouts while using US Legal Forms website, that offers the most important selection of legitimate types. Use skilled and express-certain layouts to handle your company or specific requires.

Form popularity

FAQ

Many lenders offer online applications, which are quick and convenient. Some lenders, particularly traditional banks, may require you to apply in person. Either way, the loan application will ask for personal and financial information, like your name, home address, and employment information.

Economic details. This includes the term, loan size, interest rate, and other financial matters common to debt. Risk mitigation preferences. The lender will often require specific conditions be met or specific information be provided on a recurring, timely manner.

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.

Frequently asked questions Visit our personal loan page and click on 'APPLY' Enter your 10-digit mobile number and OTP. Fill in the application form with your basic details and click on 'PROCEED'. Enter the loan amount and tenure that you need. Complete your KYC and submit your application.

A term sheet is designed to help the parties to the loan to set out clearly and in advance, the terms on which the loan will be made. It serves as a non-binding letter of intent which summarises all the important financial and legal terms as well as quantifying the amount of the loan and its repayment.

Getting a personal loan online is just as safe as any other digital financial transaction. The key is to make sure you find a reputable lender that takes measures to ensure that your data is well protected.

How it Works Apply with Ease. Complete your online application. Immediate Decision. Submit your personal and income info, and receive a quick loan decision. Choose Your Loan Amount. If you're approved, select the amount of money you'd like to borrow up to your limit. Sign Paperwork. ... Get Cash. ... Repay.

Online lenders, as well as many banks and credit unions, offer online loan applications. Applications are conveniently available 24 hours a day, so you aren't limited by the hours of a brick-and-mortar location.