Wisconsin Shared Earnings Agreement between Fund & Company

Description

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

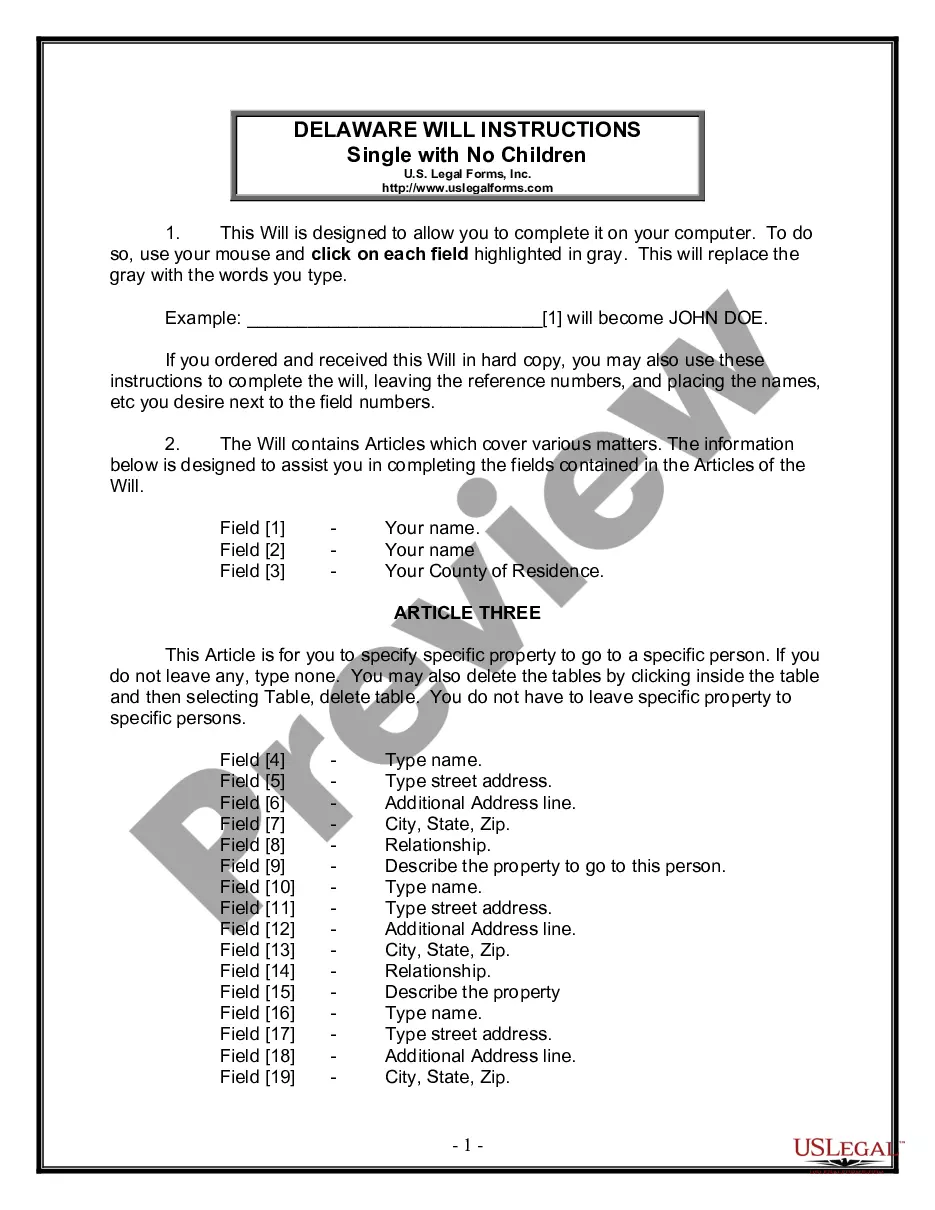

How to fill out Shared Earnings Agreement Between Fund & Company?

US Legal Forms - one of several largest libraries of legal types in America - delivers a variety of legal document templates you may download or print out. Making use of the website, you can get thousands of types for organization and personal purposes, sorted by types, claims, or keywords and phrases.You will discover the newest versions of types like the Wisconsin Shared Earnings Agreement between Fund & Company within minutes.

If you currently have a monthly subscription, log in and download Wisconsin Shared Earnings Agreement between Fund & Company through the US Legal Forms collection. The Down load option can look on each and every develop you see. You get access to all previously delivered electronically types in the My Forms tab of your own accounts.

If you wish to use US Legal Forms the very first time, allow me to share basic instructions to get you began:

- Make sure you have selected the correct develop for your personal area/area. Select the Preview option to analyze the form`s content. Read the develop explanation to ensure that you have chosen the right develop.

- When the develop does not match your demands, utilize the Research industry near the top of the display screen to get the one who does.

- Should you be pleased with the form, confirm your choice by clicking on the Buy now option. Then, pick the rates strategy you prefer and provide your accreditations to register for the accounts.

- Procedure the financial transaction. Utilize your charge card or PayPal accounts to complete the financial transaction.

- Pick the file format and download the form on the gadget.

- Make changes. Fill out, change and print out and indicator the delivered electronically Wisconsin Shared Earnings Agreement between Fund & Company.

Each and every web template you put into your bank account does not have an expiration particular date and it is your own property permanently. So, in order to download or print out one more duplicate, just check out the My Forms portion and click around the develop you will need.

Gain access to the Wisconsin Shared Earnings Agreement between Fund & Company with US Legal Forms, one of the most considerable collection of legal document templates. Use thousands of expert and state-particular templates that meet your small business or personal requires and demands.

Form popularity

FAQ

Similar to federal Schedule K-1, an estate or trust uses Schedule 2K-1 to report to you your share of the estate's or trust's income, deductions, etc.

State-shared revenue distributes sales tax collected by the State of Michigan to local governments as unrestricted revenues.

If you have an approved electronic filing waiver, send your amended Form 3 to the Wisconsin Department of Reve- nue, PO Box 8965, Madison, WI 53708-8965.

The Shared Revenue Program is one of the main sources of money for local governments in Wisconsin. These funds go toward our parks, libraries, streets, police, EMS, fire departments and many other resources in Wisconsin communities.

Use the. Schedule 5K-1. window to enter Wisconsin-specific shareholder information for Schedule 5K-1 - Tax-Option (S) Corporation Shareholder's Share of Income, Deductions, among others. You'll need to have a client with Wisconsin attached.

While Milwaukee continues to send more and more tax revenue to the state government every year, the shared revenue it gets back from the state has declined from $250 million in 2003 to $230 million in 2022. Had state shared revenue payments simply kept pace with inflation, the city would now be receiving $347 million.

Schedule 3K-1 shows each partner's share of the partnership's income, deductions, credits, etc., which have been sum- marized on Schedule 3K. Like Schedule 3K, Schedule 3K-1 requires an entry for the federal amount, adjustment, and amount determined under Wisconsin law of each applicable item.

The recently enacted local government funding legislation (2023 Wisconsin Act 12) imposes significant changes to the shared revenue program, eliminates the personal property tax, and creates an innovation fund to encourage consolidation and transfer of services to promote cost savings.

?Shared Revenue includes County and Municipal Aid, Utility Aid and Expenditure Restraint Aid. It is distributed to Wisconsin municipalities and counties in July and November each year under sec. 79.02, Wis. Stats.