Wisconsin Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

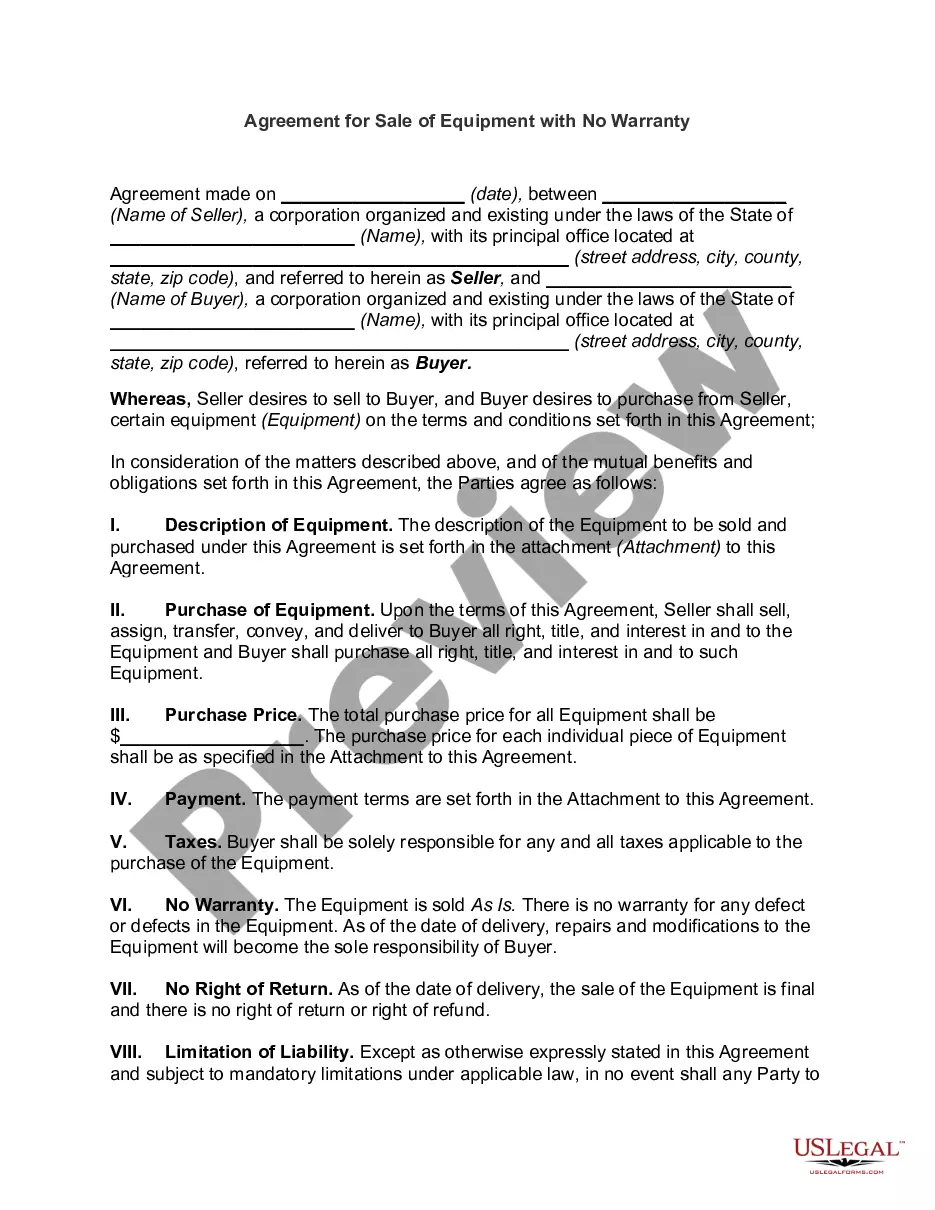

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

You are able to invest hrs online searching for the legitimate record design that meets the state and federal specifications you need. US Legal Forms supplies a large number of legitimate varieties that happen to be evaluated by specialists. It is simple to acquire or printing the Wisconsin Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors from my assistance.

If you already have a US Legal Forms bank account, you are able to log in and click the Down load key. Next, you are able to total, change, printing, or indication the Wisconsin Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors. Every legitimate record design you acquire is your own eternally. To have an additional backup associated with a obtained kind, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site initially, follow the basic guidelines below:

- Very first, make sure that you have selected the right record design for your state/city that you pick. Browse the kind description to make sure you have chosen the proper kind. If readily available, make use of the Review key to check through the record design as well.

- If you would like get an additional version in the kind, make use of the Look for discipline to find the design that fits your needs and specifications.

- After you have identified the design you need, click on Buy now to proceed.

- Select the costs plan you need, key in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal bank account to pay for the legitimate kind.

- Select the formatting in the record and acquire it to the system.

- Make alterations to the record if possible. You are able to total, change and indication and printing Wisconsin Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors.

Down load and printing a large number of record web templates using the US Legal Forms web site, that provides the biggest selection of legitimate varieties. Use expert and state-certain web templates to take on your small business or person requirements.

Form popularity

FAQ

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.