Wisconsin Receipt for Balance of Account

Description

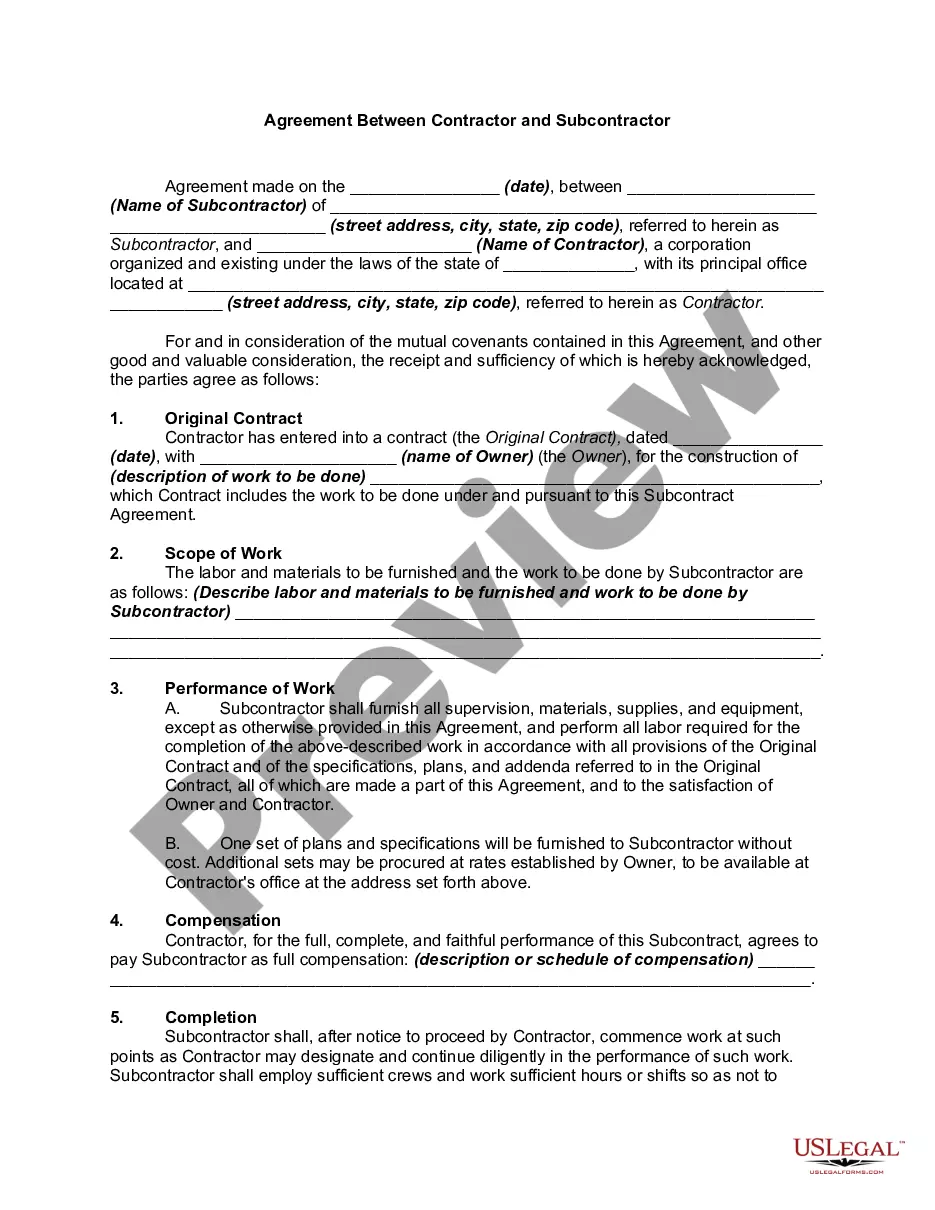

How to fill out Receipt For Balance Of Account?

If you require thorough, download, or create legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Make use of the site’s straightforward and efficient search to locate the documents you seek.

Various templates for business and personal uses are organized by categories and states, or keywords. Use US Legal Forms to acquire the Wisconsin Receipt for Balance of Account in just a few clicks.

Every legal document template you purchase is yours permanently. You can access every form you acquired within your account. Visit the My documents section and select a form to print or download again.

Be proactive and download, and print the Wisconsin Receipt for Balance of Account with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain option to locate the Wisconsin Receipt for Balance of Account.

- You can also access forms you have previously obtained within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now option. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Complete the payment process. You may use your Mastercard or Visa or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Wisconsin Receipt for Balance of Account.

Form popularity

FAQ

Why did I get a letter from the Department of Revenue about my identity? We want to protect you and your identity. We safeguard your information to help prevent someone from using your identity to file a false tax return to get a tax refund.

If you receive a bill, you may pay your tax due using the credit card payment option. The tax payment and convenience fee charge will be posted to your credit card account the next billing cycle after making the payment.

200bThe 2009 Wisconsin Act 28 authorizes the State Debt Collection (SDC) program. This act allows state agencies to partner with the Department of Revenue (DOR) in collection of debt to enhance current collections operations.

What is Form WT-7 file transmission? It is a secure process developed by the Department of Revenue (DOR) for employers and/or their representatives to transmit their Employers Annual Reconciliation of Wisconsin Income Tax Withheld from Wages (Form WT-7) data to DOR via an electronic file over the Internet.

The Wisconsin Department of Revenue (DOR) is an agency of the Wisconsin state government responsible for the administration of all tax laws, as well as valuing property and overseeing the wholesale distribution of alcoholic beverages and enforcement of liquor laws.

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

If you receive an Identity Verification letter after you file your Illinois tax return, it does not mean your identity has been compromised. It is simply a check to make sure YOU or your authorized designee filed the return, and it was not an unauthorized individual attempting to commit fraud.

Wisconsin e-file provides four options for paying: Direct Debit/Withdrawal You can file your 2021 return now and pay electronically anytime through April 18th. If you file after April 18th, choose the options to pay by check or money order, then submit your direct debit/withdrawl payment at tap.revenue.wi.gov/pay.

If this is a collection payment mail to: PO Box 8901. Madison, WI 53708-8901.If this is an individual income tax payment mail to: PO Box 8903. Madison, WI 53708-8903.

NOTE: To confirm a caller is a DWD investigator, the claimant should ask the caller to provide their (1) first name, (2) adjudicator code, and (3) phone number. The claimant may then call the help center at (414) 435-7069 or toll-free (844) 910-3661 to verify the investigator's identity.