Wisconsin Worksheet - New Product or Service

Description

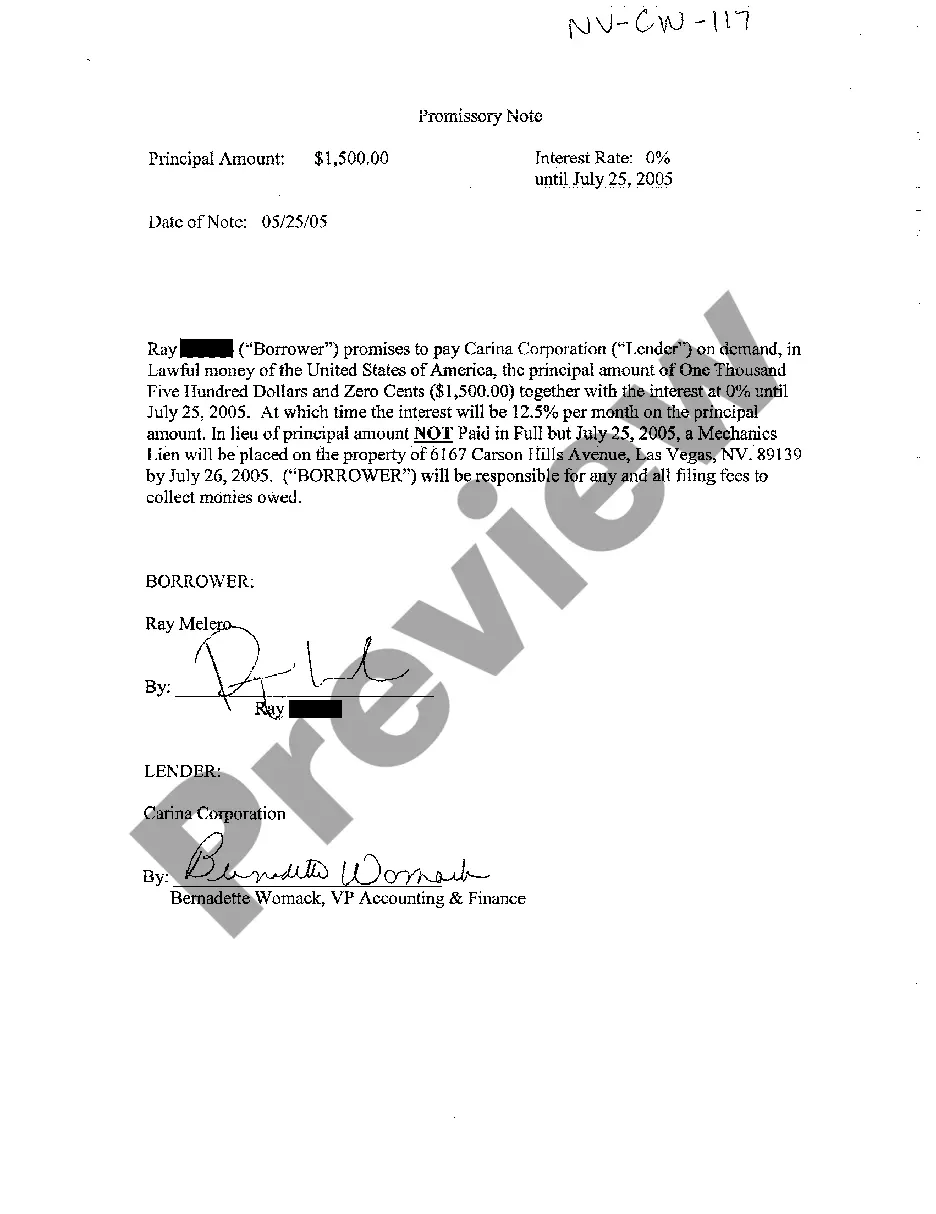

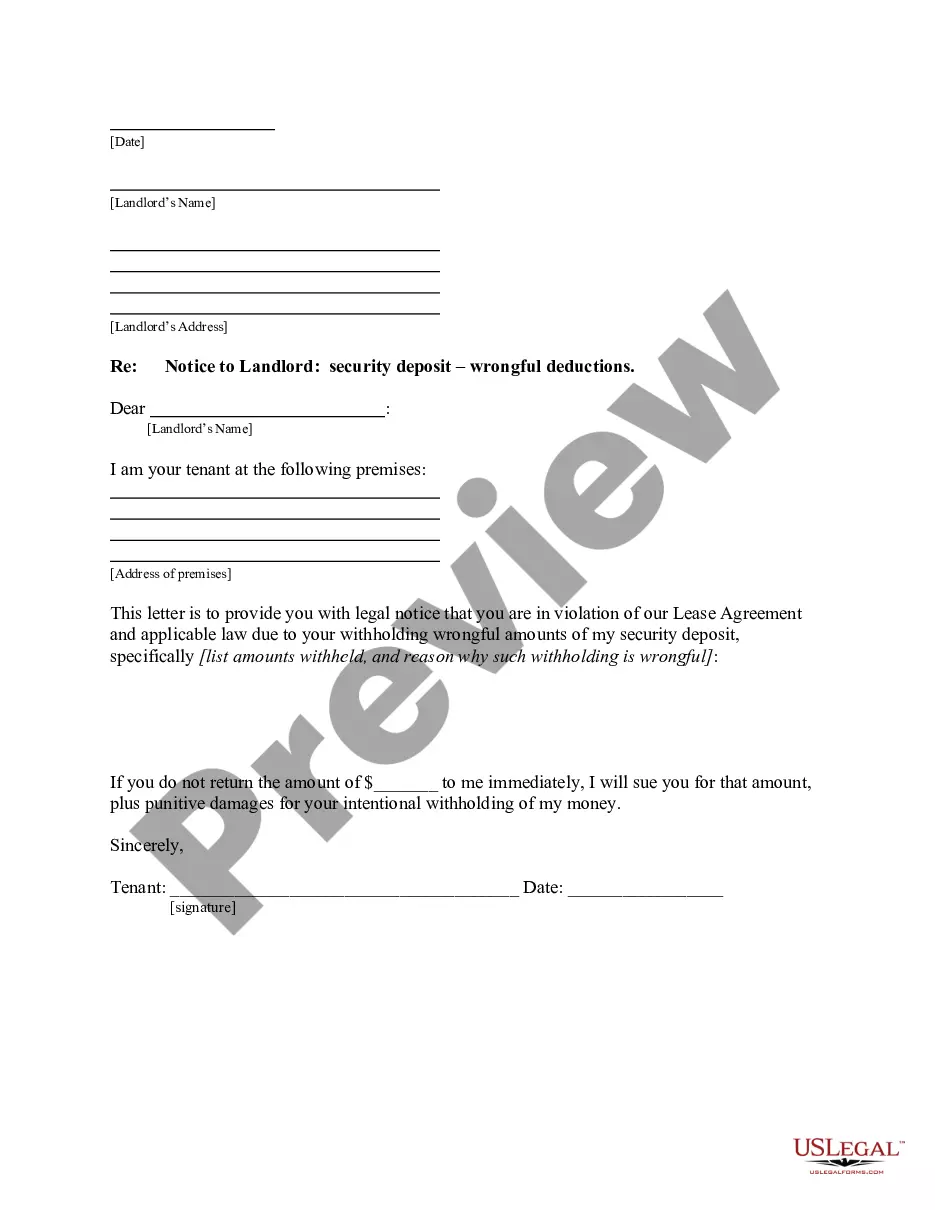

How to fill out Worksheet - New Product Or Service?

If you wish to obtain thorough, download, or print authentic document templates, utilize US Legal Forms, the top selection of legitimate forms, accessible online.

Employ the website's straightforward and convenient search feature to acquire the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Wisconsin Worksheet - New Product or Service with just a few taps.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to get the Wisconsin Worksheet - New Product or Service.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Preview option to review the form's contents. Don't forget to read the details.

- Step 3. If you aren't satisfied with the form, use the Search box at the top of the screen to find alternative templates in the legal form format.

Form popularity

FAQ

Worksheets, including the Wisconsin Worksheet - New Product or Service, are typically not submitted directly to the IRS. Instead, they serve as support documentation for tax forms that you do submit. While you retain these worksheets for your records, they play a crucial role in accurately reporting your income and expenses. Keeping detailed worksheets can help you if you are ever audited.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. If too much is withheld, you will generally be due a refund.

For a single individual who has a Wisconsin adjusted gross income of more than $50,830, the standard deduction is $0. For a married couple filing jointly that has an aggregate Wisconsin adjusted gross income of less than $10,000, the standard deduction is $7,560.

Which services are taxable? Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include: Admission and access privileges to amusement, athletic, entertainment, or recreational places or events.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

That means the contractor must pay sales or use tax on those purchases, and the contractor's sale to their customer is not taxable. However, when a contractor sells, installs or repairs tangible personal property, they are considered the retailer of the property.

Prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Wisconsin are subject to sales tax.

Prescription medicine, groceries, and gasoline are all tax-exempt. Some services in Wisconsin are subject to sales tax.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.