Wisconsin Sample Letter for Deed of Trust and Promissory Note

Description

How to fill out Sample Letter For Deed Of Trust And Promissory Note?

You may invest hrs on-line looking for the lawful file template that suits the state and federal needs you will need. US Legal Forms provides thousands of lawful varieties which can be examined by specialists. You can actually down load or produce the Wisconsin Sample Letter for Deed of Trust and Promissory Note from your service.

If you have a US Legal Forms profile, you may log in and then click the Obtain button. After that, you may complete, edit, produce, or signal the Wisconsin Sample Letter for Deed of Trust and Promissory Note. Each and every lawful file template you buy is yours permanently. To get one more copy for any bought develop, proceed to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms web site initially, adhere to the simple recommendations beneath:

- Initial, make sure that you have selected the correct file template to the state/area of your choice. See the develop outline to ensure you have chosen the correct develop. If readily available, utilize the Review button to appear from the file template at the same time.

- If you want to get one more model of your develop, utilize the Look for discipline to get the template that meets your needs and needs.

- After you have identified the template you desire, just click Purchase now to proceed.

- Find the pricing prepare you desire, type in your credentials, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal profile to cover the lawful develop.

- Find the structure of your file and down load it for your device.

- Make changes for your file if needed. You may complete, edit and signal and produce Wisconsin Sample Letter for Deed of Trust and Promissory Note.

Obtain and produce thousands of file layouts utilizing the US Legal Forms website, which provides the greatest selection of lawful varieties. Use specialist and condition-specific layouts to deal with your business or individual requirements.

Form popularity

FAQ

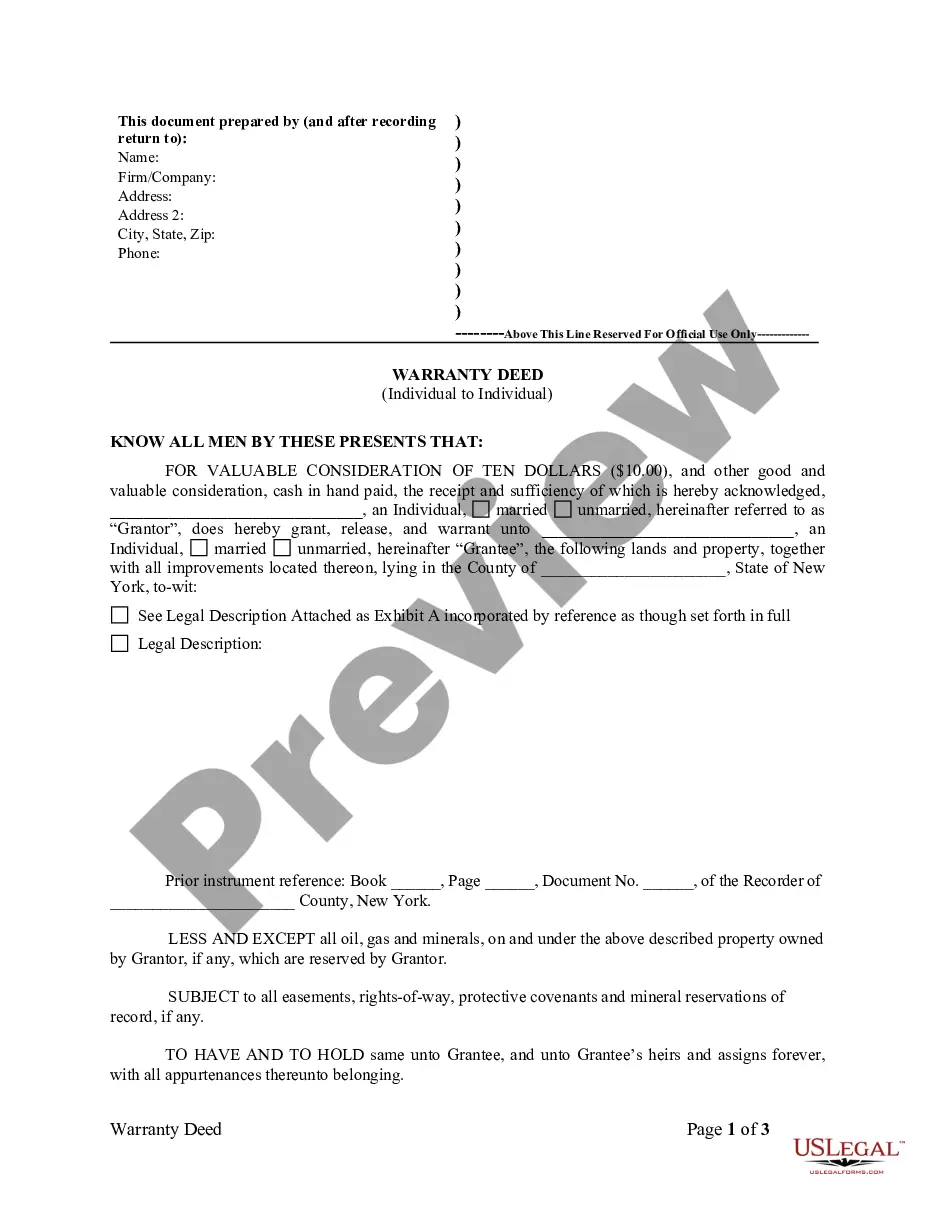

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Your lender will keep the original promissory note until your loan is paid off.

If the borrower pays off the loan without defaulting (as happens in most cases), the beneficiary (lender) will request the trustee execute and record a deed reconveying the property to the borrower.

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

When a deed of trust is used as a security instrument, who holds the deed and the note? The trustee holds the deed, and the lender holds the note.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.