Wisconsin Checklist - Health and Disability Insurance

Description

How to fill out Checklist - Health And Disability Insurance?

Are you presently engaged in a circumstance where you will require documentation for potentially business or personal activities almost every day.

There are numerous legal document templates available online, but finding versions you can rely on is not simple.

US Legal Forms provides thousands of form templates, including the Wisconsin Checklist - Health and Disability Insurance, which are designed to meet federal and state regulations.

When you find the appropriate form, click Purchase now.

Select the pricing plan you want, enter the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Checklist - Health and Disability Insurance template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

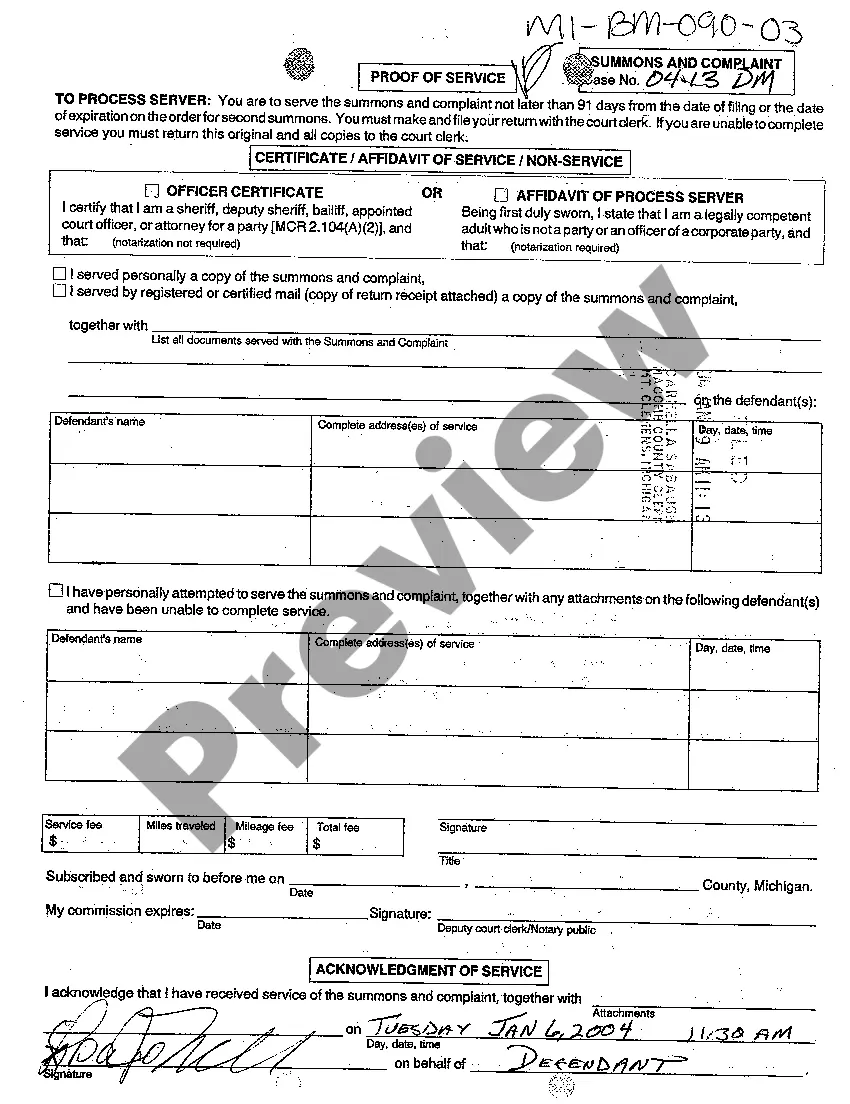

- Use the Preview button to review the form.

- Read the information to confirm that you have selected the right form.

- If the form isn’t what you are seeking, utilize the Search field to locate the form that meets your needs and specifications.

Form popularity

FAQ

The 5 year rule regarding disability insurance in Wisconsin states that individuals must have contributed to the insurance system for at least five out of the last ten years to be eligible for certain benefits. This requirement ensures that you have a significant contribution history before receiving support. For clarity on how this rule applies to your personal circumstances, consult the Wisconsin Checklist - Health and Disability Insurance.

Conditions that are regarded as disabilities in Wisconsin include chronic diseases, mental health disorders, injuries, and developmental disabilities, among others. Each condition affects individuals uniquely, which is why the Wisconsin Checklist - Health and Disability Insurance is a valuable tool. This checklist can help you identify whether your situation qualifies for disability benefits.

To qualify for disability in Wisconsin, you must demonstrate that your condition impedes your ability to work or carry out daily responsibilities. Your incapacity should be documented by medical professionals through evaluations and ongoing treatment. Using resources such as the Wisconsin Checklist - Health and Disability Insurance can streamline your application process and ensure you meet established requirements.

In Wisconsin, a disability generally involves a physical, mental, or emotional condition that hinders your ability to perform essential daily activities. To be recognized, the condition must significantly limit your functional capacity. It is important to refer to the Wisconsin Checklist - Health and Disability Insurance to understand the specific criteria applicable to your situation.

Disability insurance typically does not cover pre-existing conditions, which can leave you vulnerable if you already have a medical issue. Additionally, it often excludes certain circumstances like self-inflicted injuries or normal pregnancy. It is vital to read the policy details carefully and clarify any uncertainties with your provider. This will ensure you stay informed while navigating your Wisconsin Checklist - Health and Disability Insurance.

Carrying disability insurance provides peace of mind, knowing that you will receive income if you cannot work due to illness or injury. This financial safety net helps cover living expenses, healthcare costs, and unforeseen bills during a tough time. Many people choose this coverage to protect their long-term financial stability. Be sure to include disability insurance in your Wisconsin Checklist - Health and Disability Insurance.

Going on disability does not automatically mean you will lose your health insurance. In many cases, your health insurance will remain in effect while you are on disability leave. However, it's essential to check with your insurance provider to understand your specific policy's terms. This is an important consideration in your Wisconsin Checklist - Health and Disability Insurance.

Disability insurance can come with high premiums that may strain your budget. Additionally, not all conditions qualify for coverage, which may leave you unprotected if you encounter an unforeseen illness or injury. Keep in mind that you also need to meet certain criteria to start receiving benefits. Understanding these aspects is crucial when using the Wisconsin Checklist - Health and Disability Insurance.