Wisconsin Expense Report

Description

How to fill out Expense Report?

Finding the appropriate format for legal documents can be challenging.

There are numerous templates available online, but how do you obtain the legal form you require.

Visit the US Legal Forms website. This service offers thousands of templates, including the Wisconsin Expense Report, that can be utilized for both business and personal purposes.

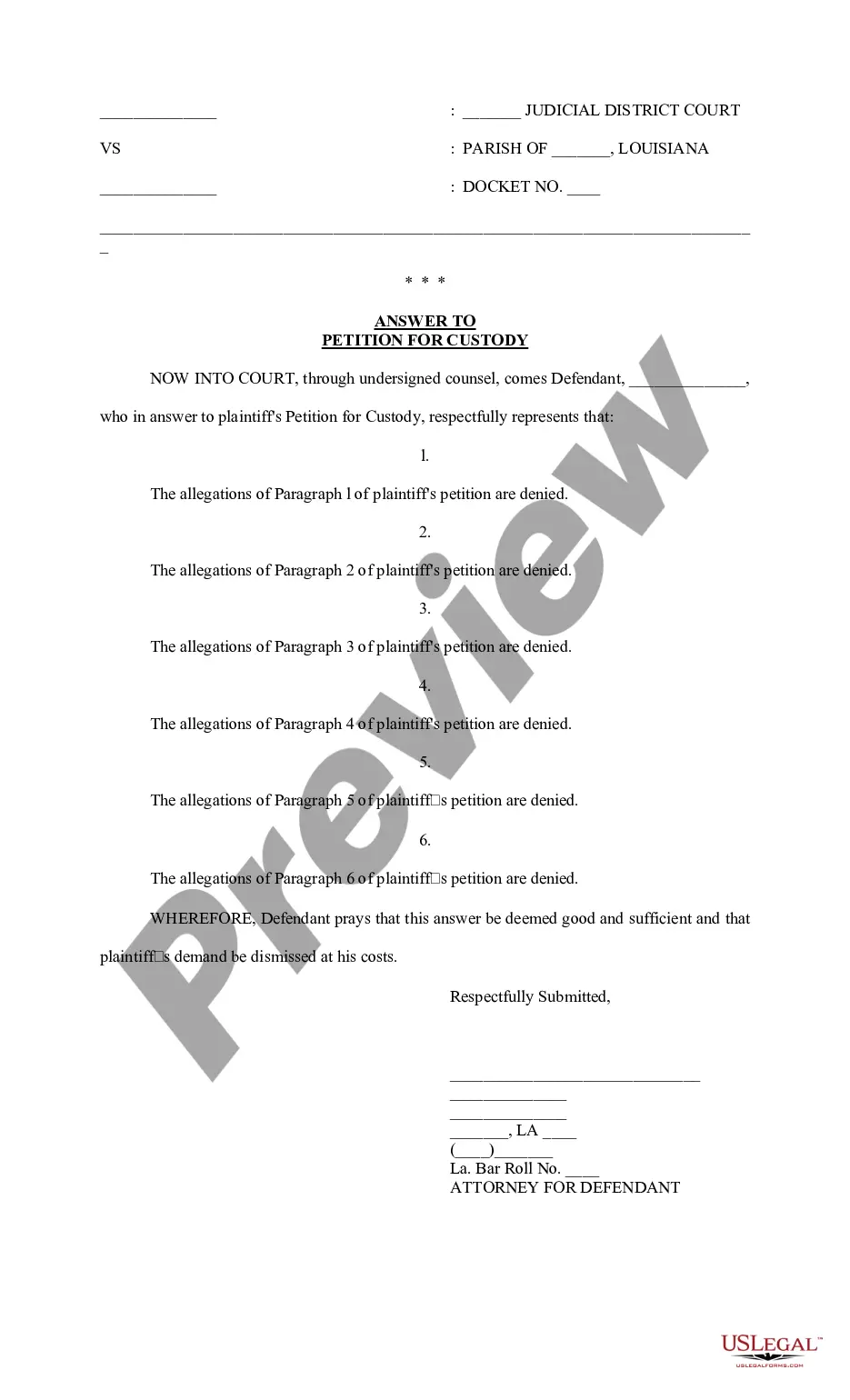

You can preview the form using the Review button and read the form description to ensure it is the right one for you.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Get button to download the Wisconsin Expense Report.

- Use your account to access the legal forms you have previously purchased.

- Visit the My documents section in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- Firstly, make sure you have chosen the correct form for your city/state.

Form popularity

FAQ

The $2500 expense rule refers to the IRS guideline that allows businesses to write off certain expenses without detailed documentation. For your Wisconsin Expense Report, if your total expense is below this threshold, you might not need to provide receipts. However, keeping a clear record is advisable to avoid complications during tax filing.

Filing an expense report typically involves completing a structured document that outlines your expenses. An effective Wisconsin Expense Report should categorize expenses, provide total amounts, and include pertinent receipts. Once completed, submit your report to the appropriate party, such as your finance department, for review and reimbursement.

The IRS requires that expense reports include adequate documentation to justify claimed expenses. For each entry in your Wisconsin Expense Report, retain receipts, notes, and any forms that support your claims. This documentation must clearly show the business purpose of each expense to satisfy IRS requirements.

To format an effective expense report, begin with a title and include your name, date, and purpose. Use a table to list each expense, along with columns for dates, descriptions, amounts, and total costs. This organized approach helps anyone reviewing your Wisconsin Expense Report quickly grasp the information.

When you report expenses on your taxes, you must detail all deductible costs incurred while generating income. A thorough Wisconsin Expense Report will simplify this process, as it organizes your expenses into clear categories. Do not forget to retain documentation, as the IRS may require proof of these expenses.

To effectively record your expenses, start by documenting each transaction as soon as it occurs. Utilize a structured format, such as a spreadsheet or an app designed for Wisconsin Expense Reports, where you can categorize expenses by type. Make sure to keep all relevant receipts and invoices since they serve as proof for each entry.

Filling out a Wisconsin Expense Report requires a few key steps. First, gather your receipts and identify the expenses that qualify for reimbursement. Next, enter the details such as date, amount, and type of expense clearly into the form. Finally, review for completeness and accuracy before submitting, ensuring a smooth reimbursement process.

An invoice is a request for payment that a vendor sends to a customer for services rendered or products delivered. In contrast, a Wisconsin Expense Report is a document employees submit to request reimbursement for costs they incurred while performing work duties. Understanding this distinction helps ensure accurate financial records.

To write an effective expense report, start with a clear title and date. List each expense, including the date, type of expense, amount, and a brief description. Incorporate a summary section at the end, detailing the total expenses. Finally, ensure that you attach copies of all relevant receipts for approval.

An example of an expense in a Wisconsin Expense Report could be travel costs incurred while attending a business conference. This might include airfare, lodging, and meals. Additionally, any materials purchased for work can also qualify as an expense. Always keep your receipts to support your claims.