Wisconsin Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description

How to fill out Lease Of Computer Equipment With Equipment Schedule And Option To Purchase?

Locating the appropriate legal document template can be challenging.

Of course, there are numerous templates accessible online, but how do you locate the legal form you desire.

Utilize the US Legal Forms website. The platform provides an extensive collection of templates, including the Wisconsin Lease of Computer Equipment with Equipment Schedule and Option to Purchase, suitable for business and personal purposes.

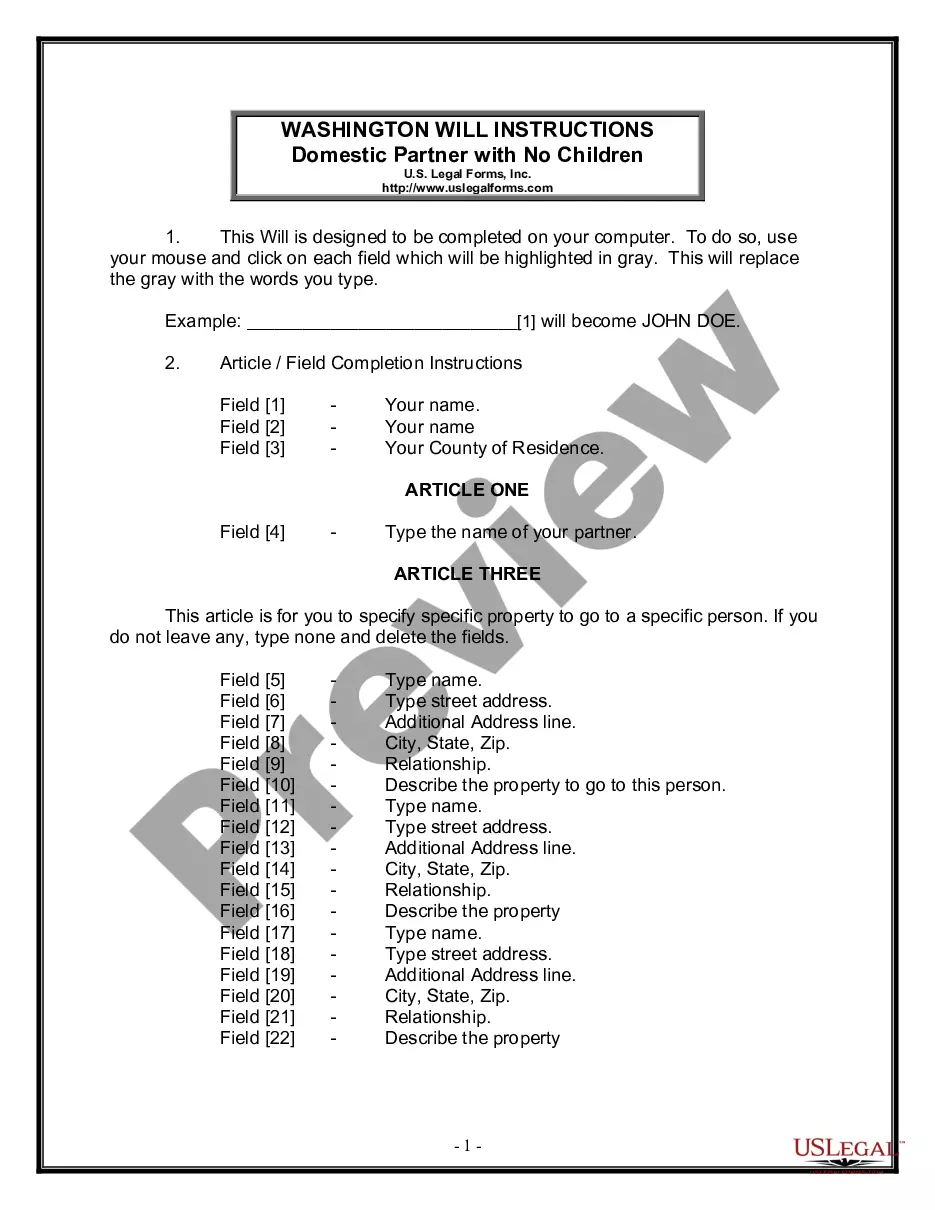

First, ensure you have selected the correct form for your city/state. You can browse through the form using the Review button and examine the form details to make sure it suits your requirements.

- All templates are verified by experts and satisfy state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Wisconsin Lease of Computer Equipment with Equipment Schedule and Option to Purchase.

- Use your account to review the legal documents you have previously acquired.

- Navigate to the My documents section of your account to download an additional copy of the document you require.

- If you are a new customer of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

An operating lease agreement for equipment is used when leasing equipment such as leasing a new technology for your business if you can't purchase it outright.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Equipment Leasing Definition: Obtaining the use of machinery, vehicles or other equipment on a rental basis. This avoids the need to invest capital in equipment. Ownership rests in the hands of the financial institution or leasing company, while the business has the actual use of it.

What Are the Pros and Cons of Equipment Leasing?Less Upfront Cost for Equipment Purchases.Easy to Upgrade to Better Models.Greater Flexibility than Other Business Financing Options.You Don't Own the Equipment.You're Paying Interest.Limited Accessibility for New Business Owners.16-Mar-2021

A Capital Lease is treated like a purchase for tax and depreciation purposes. The leased equipment is shown as an asset and/or a liability on the lessee's balance sheet, and the tax benefits of ownership may be realized, including Section 179 deductions.

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

Will the Equipment Need Major Maintenance during the Term of the Lease? If the equipment will require major expenditures for overhaul or repair, the customer may not be able to meet rental payments and pay for the overhaul simultaneously.