The following form is a Petition that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another.

Wisconsin Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate

Description

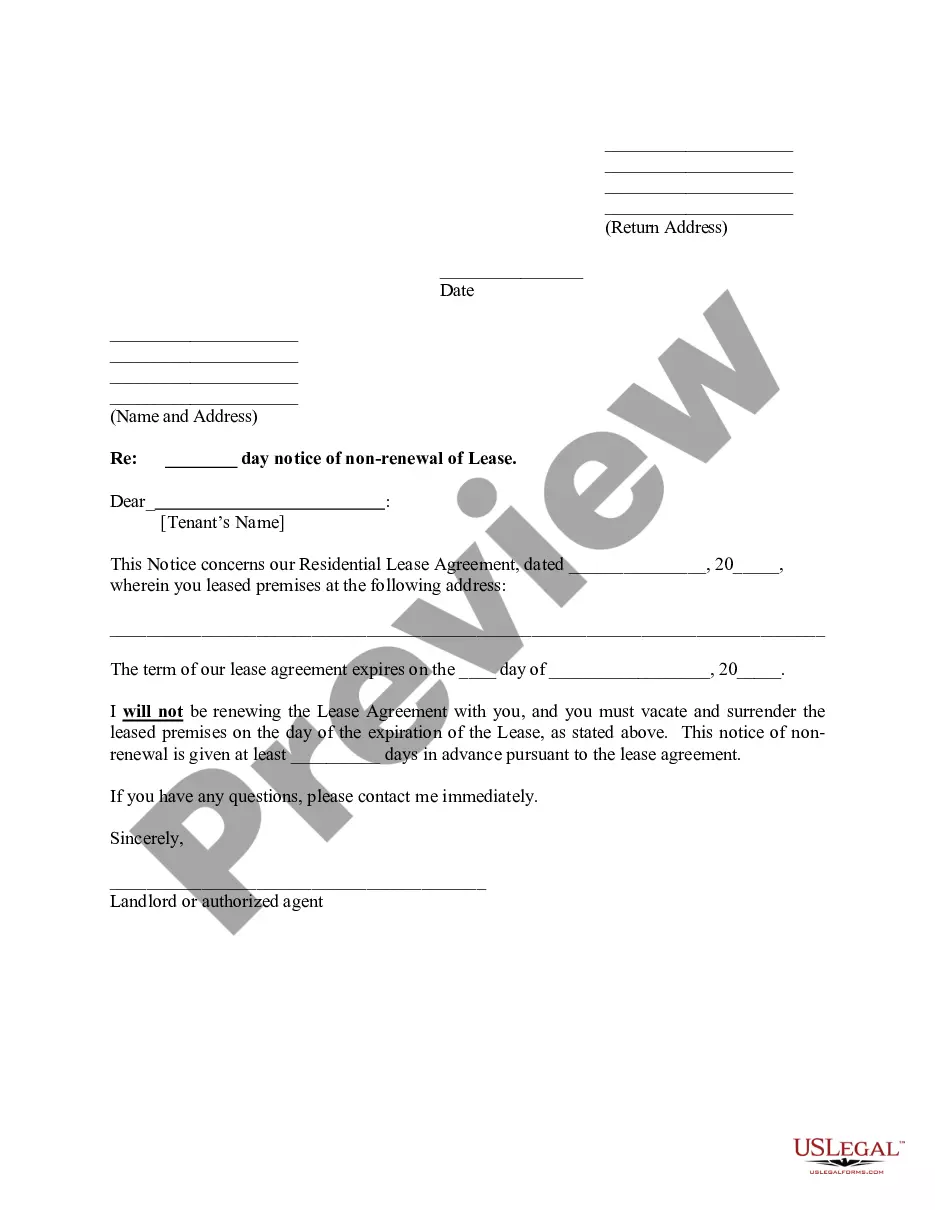

How to fill out Petition Of Creditor Of An Estate Of A Decedent For Distribution Of The Remaining Assets Of The Estate?

Choosing the right authorized papers template can be quite a have difficulties. Needless to say, there are a variety of layouts accessible on the Internet, but how do you get the authorized kind you need? Make use of the US Legal Forms site. The support offers 1000s of layouts, including the Wisconsin Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate, that you can use for organization and personal requirements. Each of the types are inspected by professionals and fulfill federal and state requirements.

When you are previously listed, log in to the bank account and click on the Acquire button to have the Wisconsin Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate. Utilize your bank account to check throughout the authorized types you may have bought previously. Visit the My Forms tab of your bank account and get another backup of your papers you need.

When you are a whole new end user of US Legal Forms, allow me to share basic guidelines for you to follow:

- Initially, ensure you have selected the appropriate kind for your area/region. You can examine the form utilizing the Preview button and look at the form information to guarantee it is the right one for you.

- In the event the kind is not going to fulfill your expectations, use the Seach field to find the proper kind.

- Once you are certain the form is acceptable, click on the Buy now button to have the kind.

- Pick the costs strategy you need and enter the required info. Build your bank account and buy the order using your PayPal bank account or charge card.

- Choose the document file format and down load the authorized papers template to the gadget.

- Comprehensive, edit and produce and sign the received Wisconsin Petition of Creditor of an Estate of a Decedent for Distribution of the Remaining Assets of the Estate.

US Legal Forms is definitely the most significant library of authorized types for which you can see various papers layouts. Make use of the company to down load expertly-manufactured paperwork that follow state requirements.

Form popularity

FAQ

How do I file a claim against an estate? A standard claim form (PR-1819) can be obtained online from Wisconsin Courts. The completed form, along with the statutory $3 filing fee, must be filed with the Register in Probate prior to the expiration of the claims date.

Wisconsin probate laws require an estate to be settled within 18 months. Generally, some counties in Wisconsin request that an executor settle an estate in 12 months. Executors should work toward completing probate within that time.

It is not unusual for the entire process to take 6 months to 18 months (sometime more) to fully complete. If you've been named a beneficiary and are dealing with a trustee or executor who is not properly handling the estate and you have yet to receive your inheritance, please let us know.

It depends. A summary probate proceeding could take as little as four months. In many states, a typical probate and estate administration process may take up to two years. The probate process can take years to settle in an estate with contested issues or lawsuits.

State law requires that an estate be closed within 18 months. However, several counties have adopted a benchmark for completing probate within 12 months.

The executor, also known as a personal representative in some states, has the responsibility of administering the estate of the deceased. This involves gathering and valuing the assets of the estate, paying any debts or taxes, and distributing the remaining assets to the beneficiaries as outlined in the will.

Generally, Wisconsin wants an estate to be probated within 18 months of death but it does vary by county. Some counties in Wisconsin want the estate to be probated within a year. Once the Will and petition are filed creditors have a three month window where they can file claims against the estate.

Form Number: PR-1819 Statutory Reference: Chapter 859, §766.55, Wisconsin Statutes Benchbook Reference: PR 1-13 to 23; PR 7-5 Purpose of Form: To file a claim against an estate. Who Completes It: Claimant or attorney for claimant. Distribution of Form: Court.