If you wish to total, acquire, or produce legal document layouts, use US Legal Forms, the largest collection of legal forms, that can be found on the web. Take advantage of the site`s simple and easy handy research to discover the papers you need. A variety of layouts for company and individual uses are sorted by classes and suggests, or keywords. Use US Legal Forms to discover the Wisconsin Renunciation and Disclaimer of Interest in Life Insurance Proceeds in a few click throughs.

When you are already a US Legal Forms customer, log in to the bank account and click on the Acquire option to get the Wisconsin Renunciation and Disclaimer of Interest in Life Insurance Proceeds. You can also gain access to forms you earlier downloaded from the My Forms tab of your own bank account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that correct town/country.

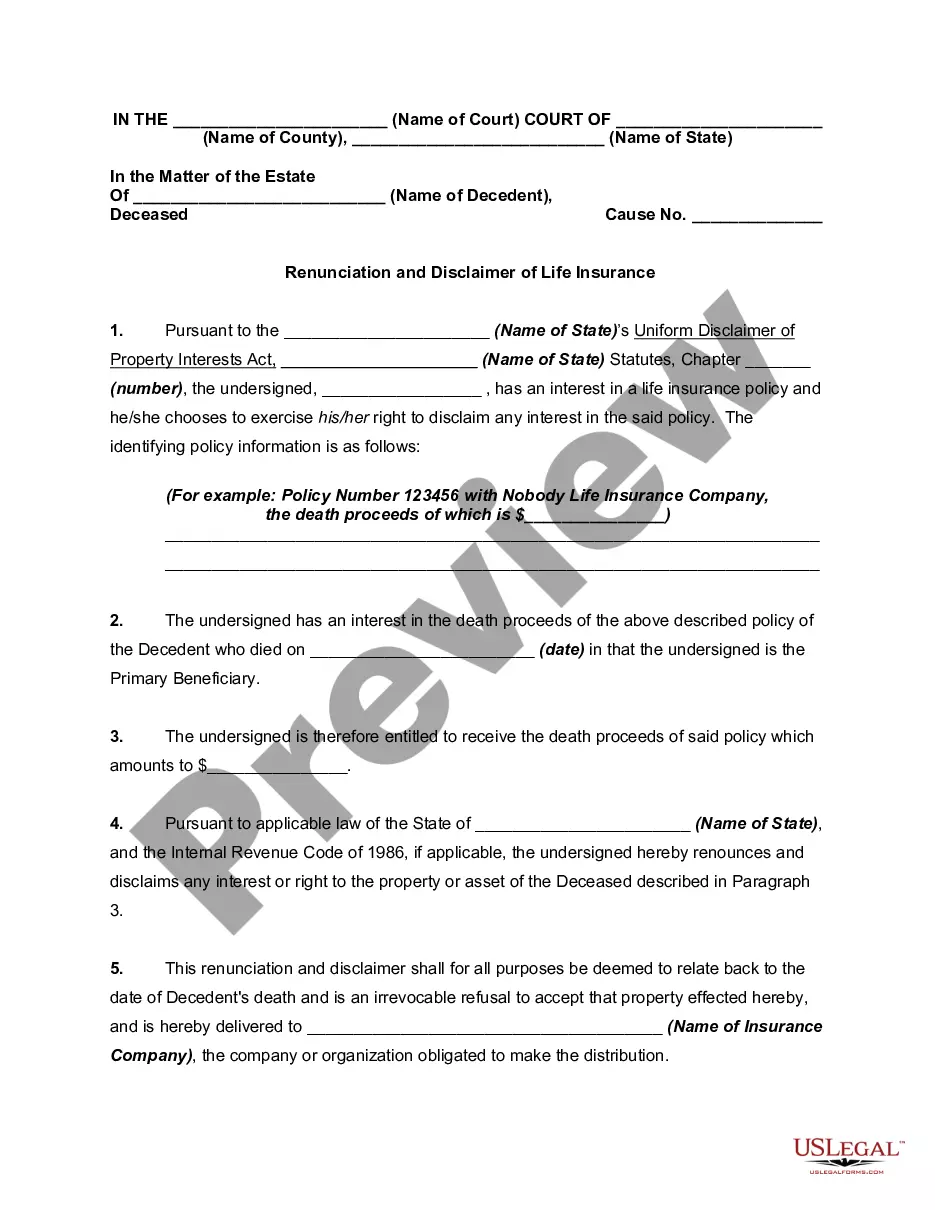

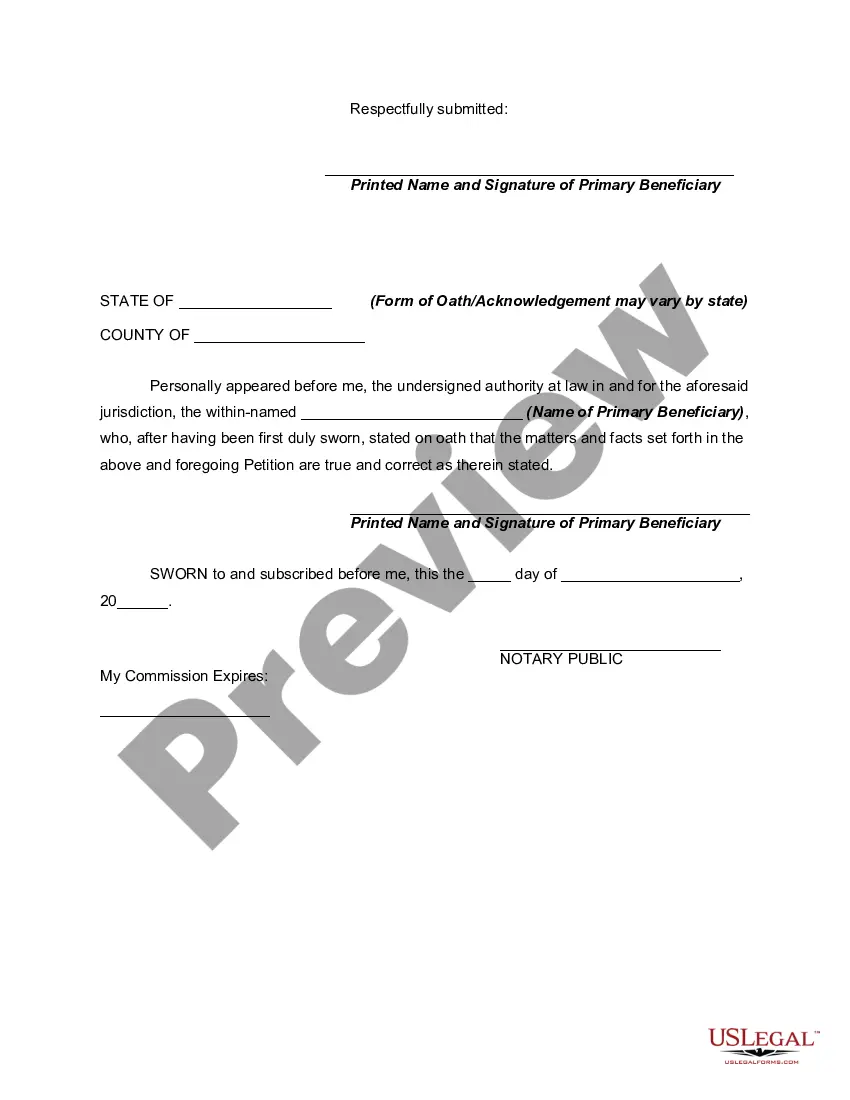

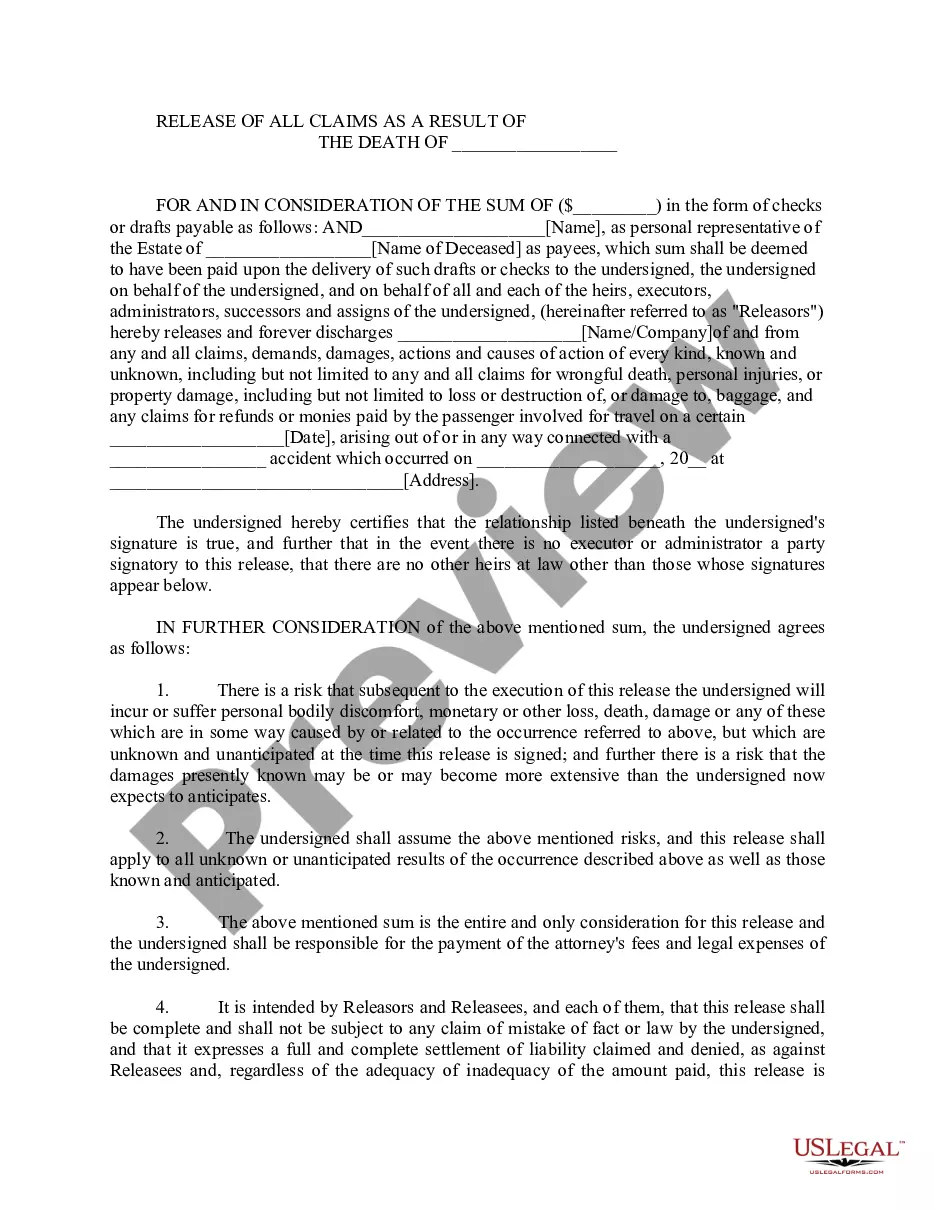

- Step 2. Make use of the Review solution to check out the form`s information. Don`t forget about to see the information.

- Step 3. When you are unsatisfied together with the type, utilize the Search industry near the top of the display screen to locate other variations in the legal type template.

- Step 4. When you have found the shape you need, click on the Get now option. Opt for the costs prepare you choose and add your credentials to register for an bank account.

- Step 5. Procedure the purchase. You can use your bank card or PayPal bank account to finish the purchase.

- Step 6. Choose the format in the legal type and acquire it on your own product.

- Step 7. Total, revise and produce or signal the Wisconsin Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Each and every legal document template you purchase is your own permanently. You might have acces to every type you downloaded in your acccount. Go through the My Forms section and decide on a type to produce or acquire once more.

Remain competitive and acquire, and produce the Wisconsin Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms. There are many professional and condition-particular forms you can use for your company or individual demands.