Wisconsin Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

US Legal Forms - one of the largest collections of legal templates in America - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Wisconsin Sample Letter for Withheld Delivery in seconds.

If you currently have a monthly subscription, Log In and download the Wisconsin Sample Letter for Withheld Delivery from the US Legal Forms library. The Download option will display on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the purchase. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Wisconsin Sample Letter for Withheld Delivery. Each template you save to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you need. Access the Wisconsin Sample Letter for Withheld Delivery with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of expert and state-specific templates that meet your business or personal requirements and standards.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

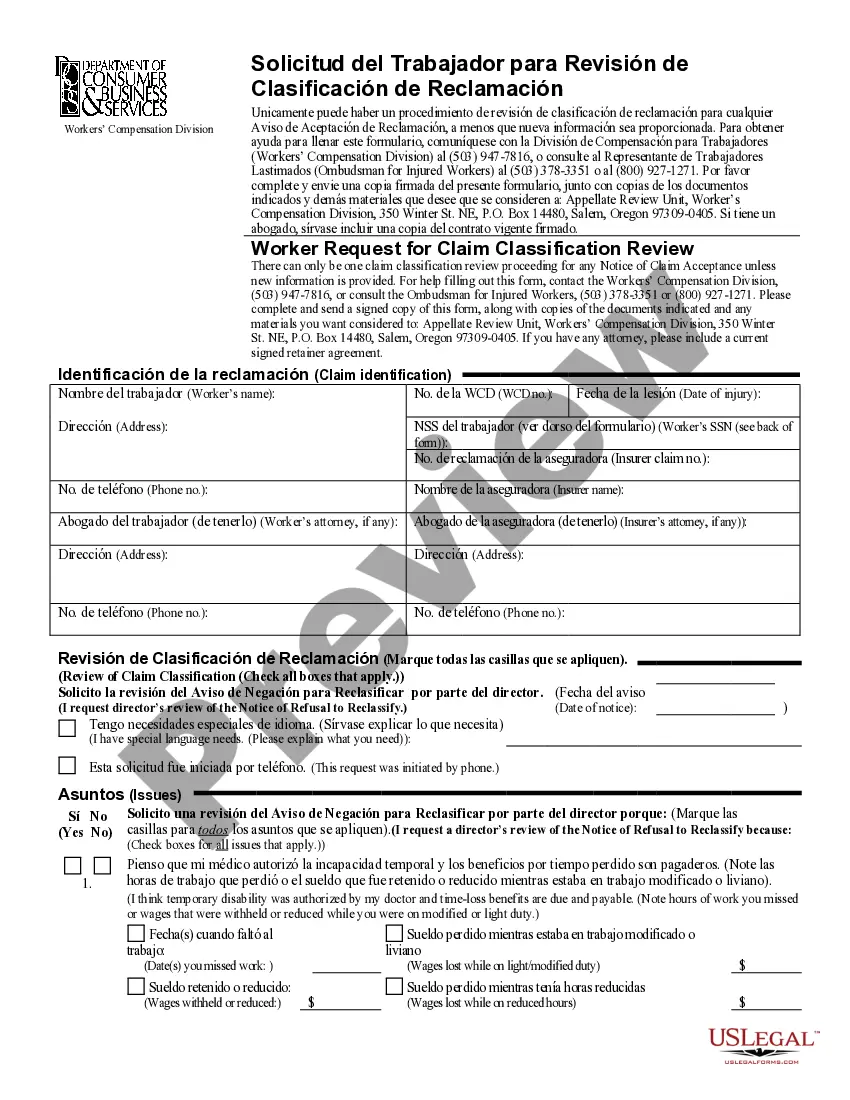

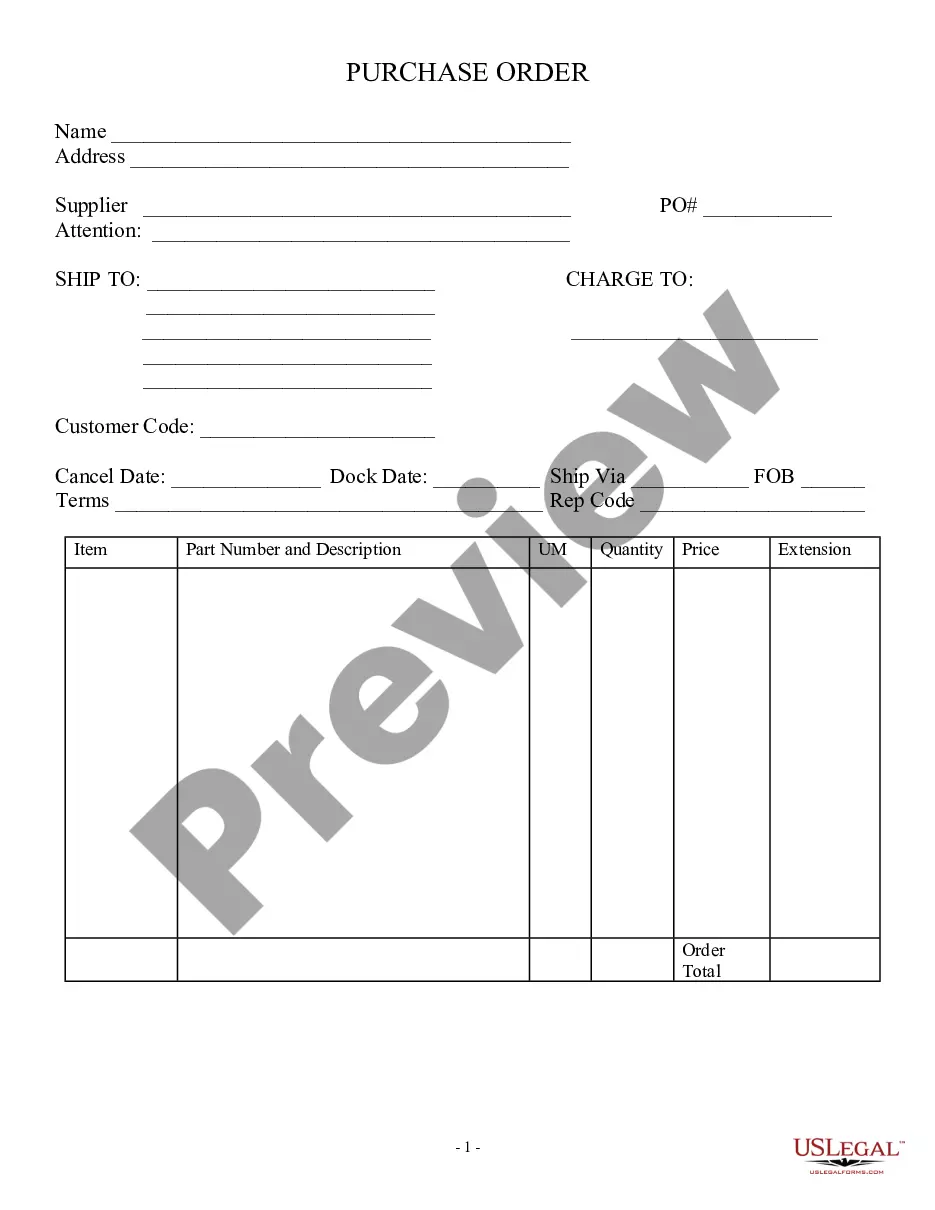

- Make sure you have selected the correct form for your city/region. Click the Preview option to check the form's content.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, utilize the Search bar at the top of the page to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now option.

- Then, select the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

The W6 form is not a standard tax form issued by the IRS, but it may refer to specific state forms related to withholding. In Wisconsin, understanding forms related to withholding is essential for proper tax management. You can utilize a Wisconsin Sample Letter for Withheld Delivery to communicate any questions regarding tax forms or withholding directly with your tax authority.

The AW 6 form is used in Wisconsin to request an individual income tax withholding exemption. It is filed with your employer to prevent excess withholding from your paycheck. To ensure your exemption status is clear, referencing a Wisconsin Sample Letter for Withheld Delivery can be beneficial in your correspondence with employers.

A lock letter, such as an IRS lock-in letter, is a notification requiring your employer to withhold taxes based on certain conditions. This letter is often issued when there are discrepancies in your tax filings or when the IRS needs to ensure proper withholding. If you receive a lock letter, responding with a Wisconsin Sample Letter for Withheld Delivery can clarify your tax obligations.

An IRS lock-in letter isn’t inherently bad but can indicate that there may be inconsistencies in your tax information. It mandates specific withholding instructions that your employer must follow. Addressing it promptly, possibly with a Wisconsin Sample Letter for Withheld Delivery, can help to resolve any misunderstandings effectively.

Yes, Wisconsin has several state tax withholding forms, including the Form WT-4 for employees. These forms assist in determining the appropriate amount of state income tax to withhold from your paycheck. Familiarity with these forms and knowing how to address any concerns through a Wisconsin Sample Letter for Withheld Delivery can streamline your tax management.

Wisconsin form WT 7 is the Employee’s Wisconsin Withholding Exemption Certificate. It allows employees to declare their legal exemption from state withholding. Providing accurate information on this form can help avoid unnecessary withholding, and creating a Wisconsin Sample Letter for Withheld Delivery may further clarify your exemption to your employer.

Wisconsin pass-through withholding refers to the tax withholding process applied to pass-through entities like partnerships and S corporations. This allows income to be reported at the individual owner's level, reflecting their share of income on their personal tax returns. If you're involved in such entities, understanding how withholding works can be enhanced by utilizing a Wisconsin Sample Letter for Withheld Delivery.

The WT 6 form is used in Wisconsin for reporting income that requires state income tax withholding. This form helps employers determine the correct amount of withholding based on employee tax information. If you face challenges related to withholding, utilizing a Wisconsin Sample Letter for Withheld Delivery might simplify the process of addressing any issues.

No, state withholding and federal withholding are not the same. Federal withholding is based on your earnings and is sent to the IRS, while state withholding goes to your state's tax authority. Understanding the differences between these two is crucial, especially when managing your tax deductions effectively with a Wisconsin Sample Letter for Withheld Delivery.

To resolve an IRS lock-in letter, you generally need to provide the IRS with updated information regarding your tax situation. This can involve submitting a completed Form W-4 or a clarification letter. Using a Wisconsin Sample Letter for Withheld Delivery can facilitate communication and help you explain your circumstances effectively.