Wisconsin Affidavit of Amount Due on Open Account

Description

How to fill out Affidavit Of Amount Due On Open Account?

Have you been inside a place in which you will need documents for possibly organization or personal functions virtually every working day? There are tons of lawful record themes available on the Internet, but finding ones you can rely is not simple. US Legal Forms delivers a large number of develop themes, just like the Wisconsin Affidavit of Amount Due on Open Account, that are written to fulfill state and federal requirements.

In case you are currently familiar with US Legal Forms web site and have your account, basically log in. After that, it is possible to obtain the Wisconsin Affidavit of Amount Due on Open Account design.

Should you not come with an account and would like to start using US Legal Forms, adopt these measures:

- Find the develop you require and make sure it is for the right metropolis/region.

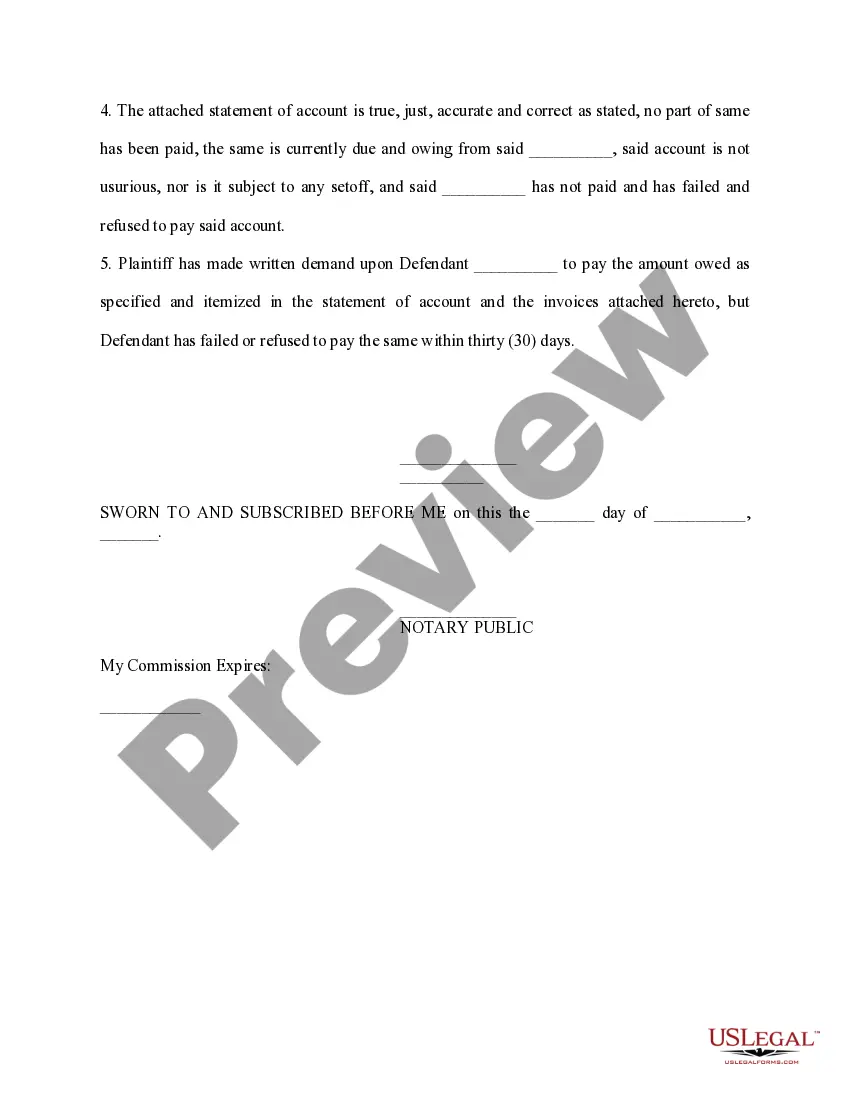

- Use the Preview switch to check the form.

- See the outline to ensure that you have selected the correct develop.

- If the develop is not what you`re trying to find, take advantage of the Look for area to discover the develop that fits your needs and requirements.

- Once you discover the right develop, just click Buy now.

- Opt for the rates program you need, submit the specified information to make your account, and purchase the order utilizing your PayPal or credit card.

- Pick a handy data file structure and obtain your duplicate.

Locate every one of the record themes you may have purchased in the My Forms menu. You can obtain a further duplicate of Wisconsin Affidavit of Amount Due on Open Account anytime, if possible. Just click on the needed develop to obtain or produce the record design.

Use US Legal Forms, the most substantial variety of lawful types, to conserve time and prevent mistakes. The support delivers skillfully manufactured lawful record themes which you can use for a variety of functions. Make your account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

Form PR-1831 - Transfer By Affidavit ($50,000 And Under) is a probate form in Wisconsin. To transfer decedent's assets not exceeding $50,000 (gross) to an heir, trustee of trust created by decedent, or person who was guardian of the decedent at the time of the decedent's death for distribution.

Wisconsin's Small Estate Affidavit statute allows estates under $50,000 to avoid probate and instead be transferred via affidavit. See Wis Stat. §867.03. It can be used by an heir, a trustee of a revocable trust, a person named in the decedent's will, or a guardian after the passing of the decedent.

(12) Gross Value Of Wisconsin Decedent Estate. Currently, if the value of the Wisconsin Decedent's estate is less than $50,000.00 then it may be considered a small estate. If it is greater than fifty thousand dollars then such a value will disqualify the estate from this status.

The Transfer by Affidavit process may be used to close a person's estate when the deceased had $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.

The Affidavit Lack of Probate (or ?No Probate?) is a factual confirmation which supports that the rightful heirs are entitled to their interest in the property after the passing of the Decedent. It is recognized in many Washington Counties as a way to clear the Decedent's name off title as an alternative to a probate.

Order for Financial Disclosure State Law provides that if a person obtains a judgment for money, he or she is entitled to receive information regarding the financial status of the unsuccessful party within 15 days after entry of the judgment.