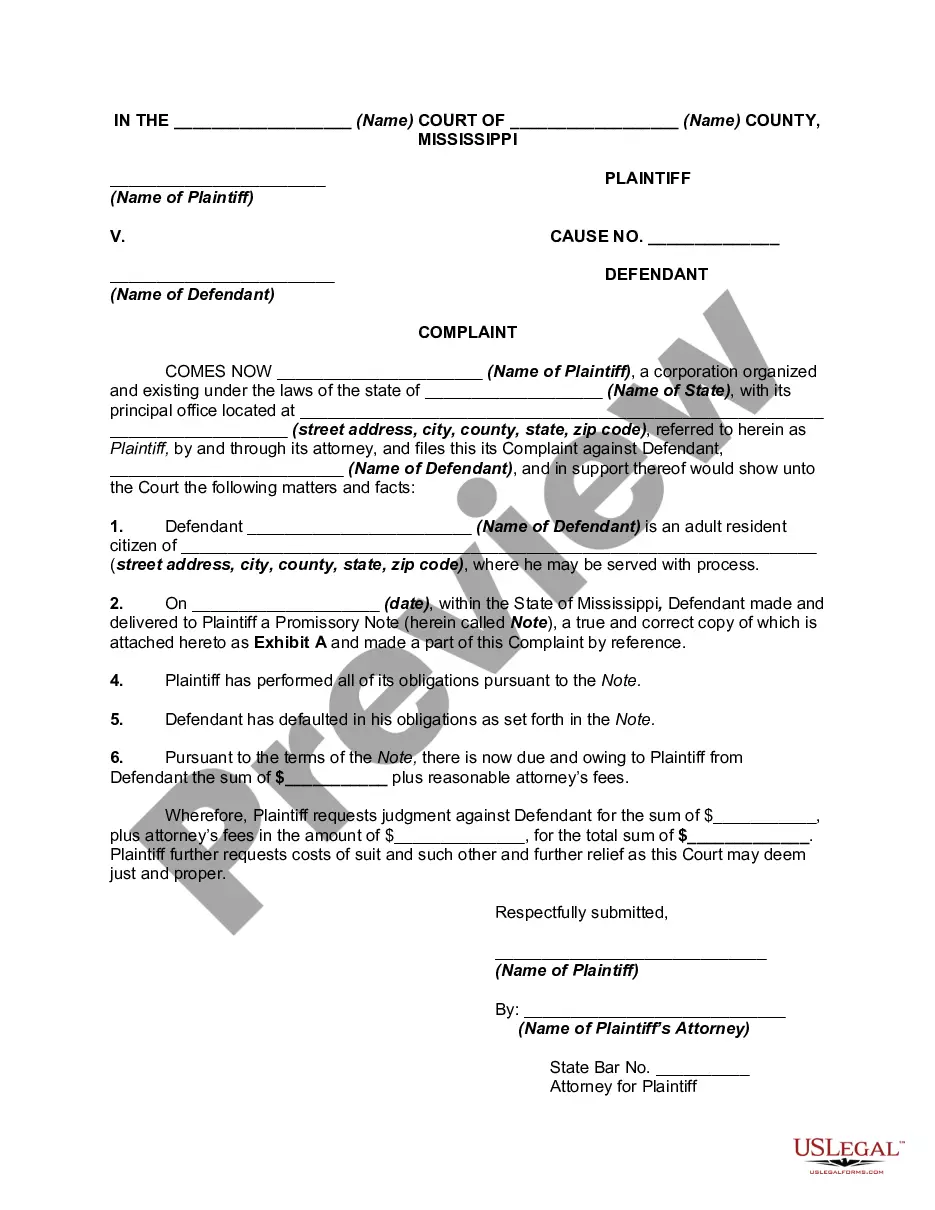

Are you currently inside a position where you will need papers for sometimes business or person purposes virtually every working day? There are plenty of lawful file layouts accessible on the Internet, but discovering versions you can depend on isn`t simple. US Legal Forms gives 1000s of type layouts, such as the Wisconsin Complaint for Past Due Promissory Note, which can be written to fulfill federal and state requirements.

In case you are presently informed about US Legal Forms internet site and possess a free account, simply log in. Next, it is possible to acquire the Wisconsin Complaint for Past Due Promissory Note design.

Unless you offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is for your proper town/area.

- Utilize the Review switch to check the form.

- Look at the explanation to ensure that you have selected the proper type.

- In case the type isn`t what you are seeking, utilize the Research area to discover the type that fits your needs and requirements.

- If you get the proper type, click Acquire now.

- Choose the prices plan you need, complete the specified information and facts to produce your bank account, and buy an order with your PayPal or bank card.

- Pick a practical paper file format and acquire your duplicate.

Get each of the file layouts you possess purchased in the My Forms menus. You can obtain a extra duplicate of Wisconsin Complaint for Past Due Promissory Note any time, if necessary. Just click on the needed type to acquire or printing the file design.

Use US Legal Forms, probably the most extensive variety of lawful forms, to save lots of some time and steer clear of blunders. The service gives skillfully manufactured lawful file layouts which you can use for a variety of purposes. Produce a free account on US Legal Forms and start generating your way of life a little easier.