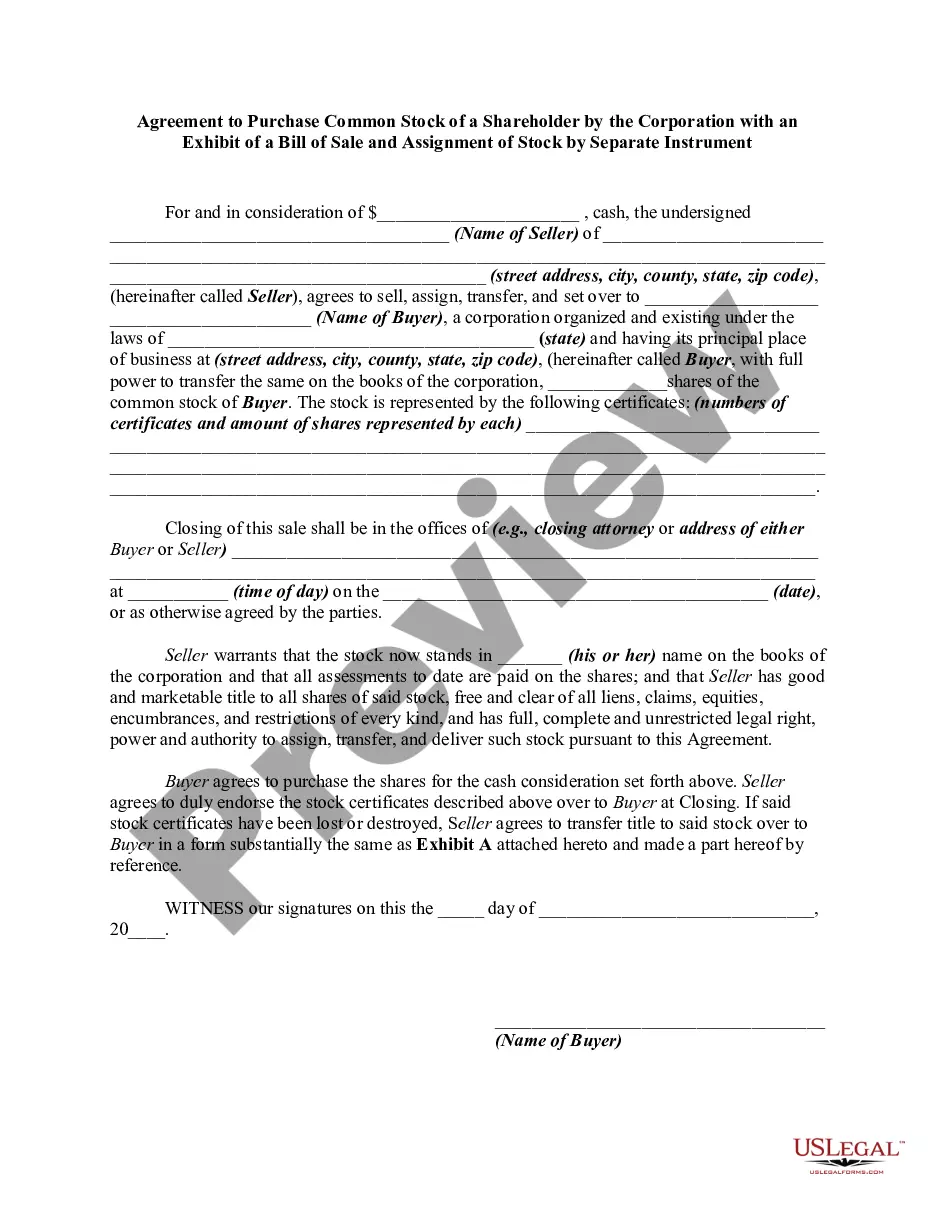

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument

Description

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

If you wish to obtain, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search feature to find the documents you require.

A range of templates for business and personal purposes are categorized by type and state, or by keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you have saved in your account. Click on the My documents section and select a form to print or download again.

Be prompt and acquire, and print the Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Acquire button to get the Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the summary carefully.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find different templates within the legal form library.

- Step 4. Once you have found the form you need, click the Get now button. Choose your pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, amend, and print or sign the Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument.

Form popularity

FAQ

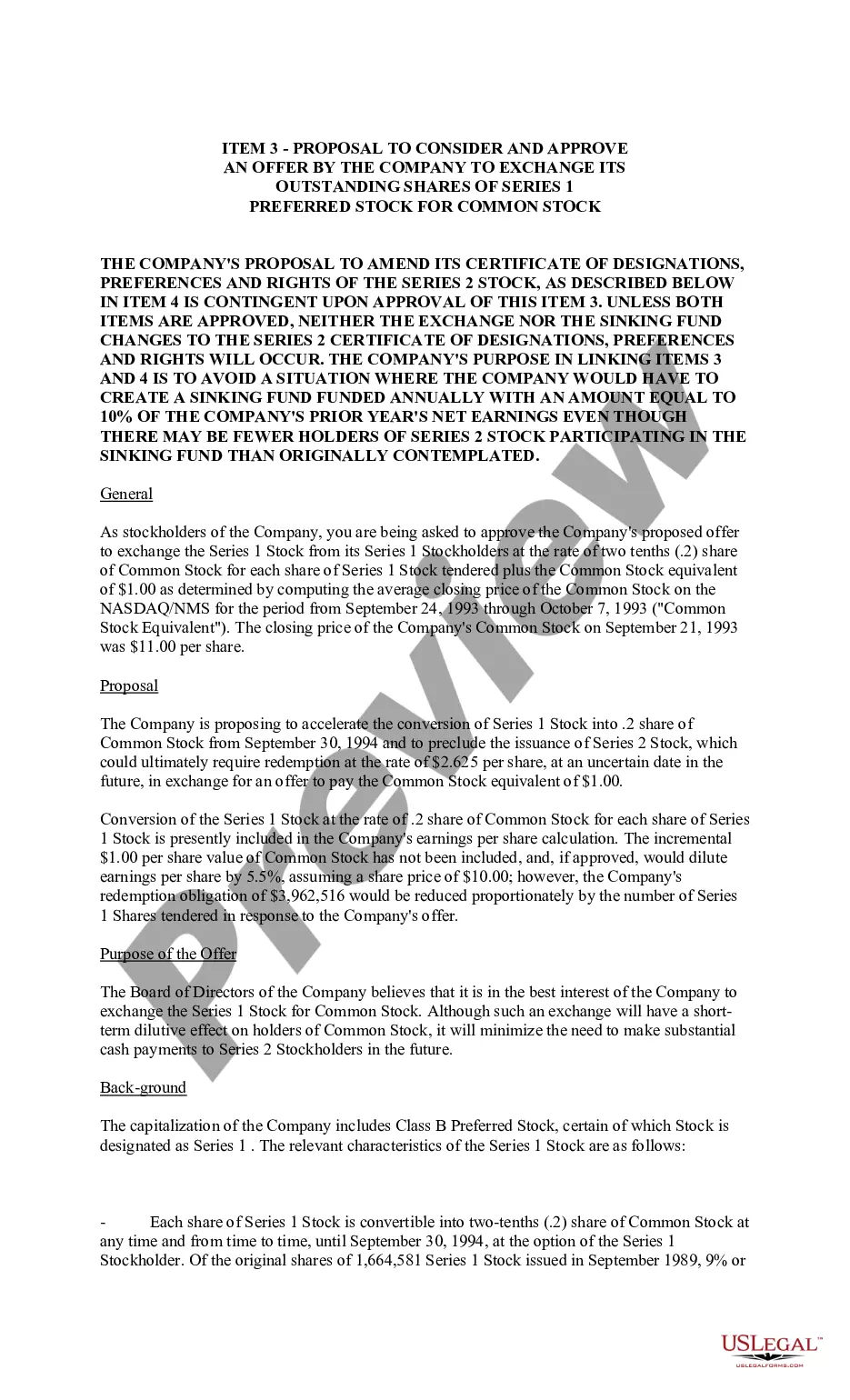

An 'as is' bill of sale in Wisconsin indicates that the buyer accepts the item, including any faults or defects, without any warranties from the seller. This type of sale emphasizes transparency, where both parties agree on the condition of the item at the point of sale. When applied to the Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument, it reinforces the understanding that the buyer accepts the stock in its current condition.

A bill of sale for stock shares is a record of the transfer of ownership of shares from the seller to the buyer. This document includes vital information, such as the names of the parties and the specific shares involved in the transaction. When executed alongside a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument, it helps establish clear ownership and legal title to the stock.

A bill of sale for a business in California is a legal document that transfers ownership of a business’s assets. It clearly outlines what is being sold, what is included in the sale, and the terms of the transaction. In the context of a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument, this document can reflect changes in stock ownership seamlessly when business ownership transfers occur.

In Wisconsin, a bill of sale does not necessarily need to be notarized to be valid. However, notarizing documents can provide an extra layer of authenticity and safeguard against disputes in the future. For decisions regarding asset transfers, including stock assignments, it is beneficial to use a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument to maintain accurate records.

If one owner of a jointly owned property dies in Wisconsin, the surviving owner automatically inherits the deceased owner's share, provided they hold the property as joint tenants with rights of survivorship. This automatic transfer bypasses the probate process, simplifying the transition of ownership. It is wise to document property ownership intentions with a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument to ensure clarity.

In Wisconsin, marital property typically includes all property acquired during the marriage, and it follows joint ownership principles. Upon the death of one spouse, the surviving spouse usually inherits the deceased's share of marital property directly. This arrangement simplifies the inheritance process, reinforcing the importance of clear documentation, such as in a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument.

In Wisconsin, failing to transfer a title within the required 30-day period can result in a fine up to $200. This penalty serves to encourage timely and accurate title transfers, which are crucial for maintaining clear property ownership records. To avoid such complications, consider utilizing a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument to formalize transfers.

In Wisconsin, one owner cannot sell a jointly owned property without the consent of all other joint owners. This restriction aims to ensure that all parties involved have a say in important decisions regarding the property. If an owner wishes to sell, it may be prudent to create a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument to document the sale and responsibilities.

A significant disadvantage of joint ownership in Wisconsin is the potential for disputes over property management and decisions. Each owner has equal rights, which can lead to conflicts if one party wants to sell or make changes. Additionally, joint ownership may complicate estate planning and taxation. Consulting legal documents like a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument can help outline expectations.

In Wisconsin, the right of survivorship is not always automatic. If property is held as joint tenants, the right of survivorship will apply, allowing the surviving owner to inherit the deceased owner's share without going through probate. However, it is essential to confirm the type of ownership on the title or deed. Utilizing a Wisconsin Bill of Sale and Assignment of Stock by Separate Instrument can clarify ownership intentions.