Wisconsin Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

Are you presently in the situation that you require papers for both enterprise or personal purposes virtually every day? There are a lot of legal record themes available on the net, but getting kinds you can rely on is not easy. US Legal Forms gives a large number of form themes, much like the Wisconsin Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), that are created to fulfill federal and state needs.

In case you are presently acquainted with US Legal Forms internet site and have a free account, just log in. Next, it is possible to down load the Wisconsin Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) format.

If you do not have an bank account and wish to begin using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is to the proper town/state.

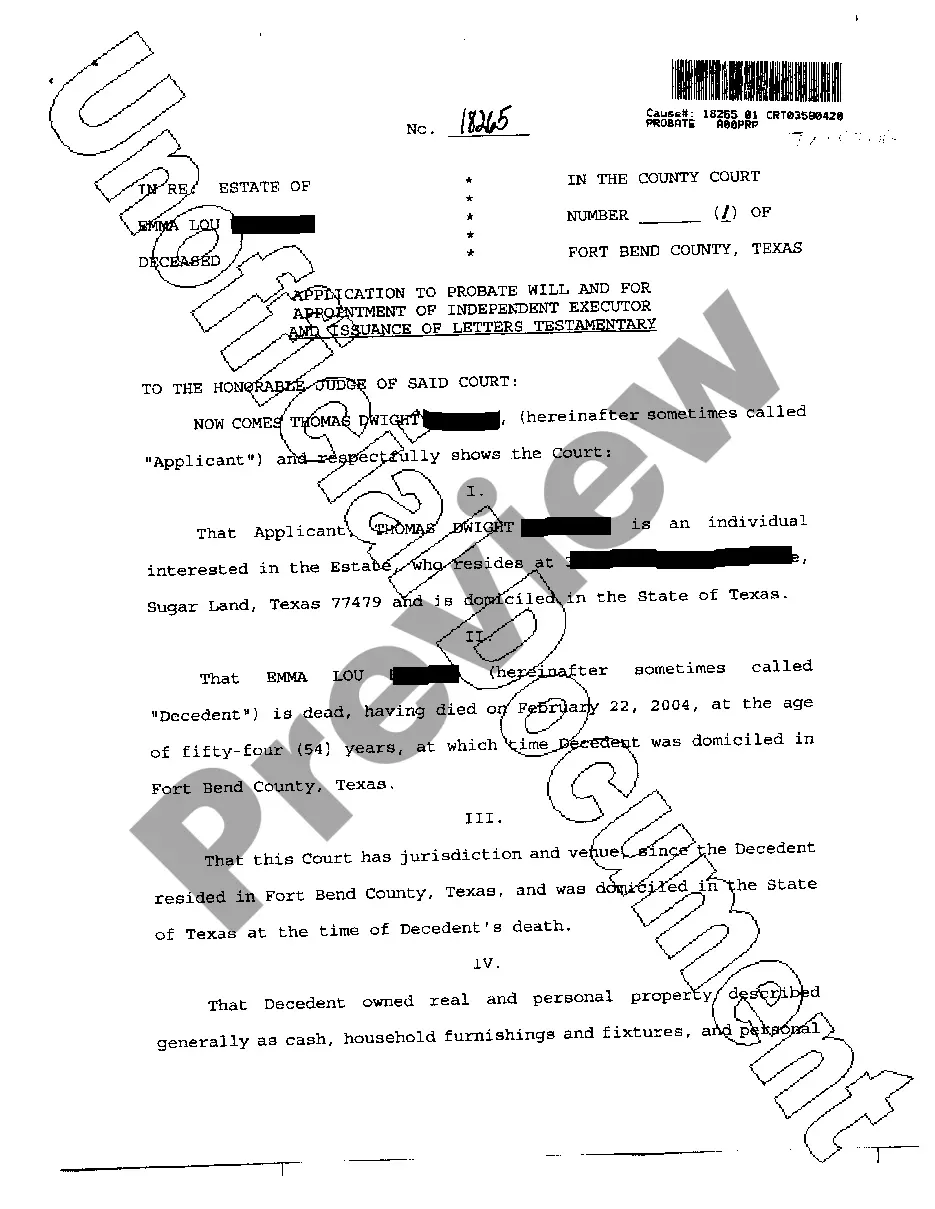

- Use the Preview key to check the shape.

- Browse the description to ensure that you have selected the proper form.

- When the form is not what you are seeking, take advantage of the Lookup field to find the form that meets your needs and needs.

- If you discover the proper form, just click Acquire now.

- Opt for the pricing prepare you desire, submit the required information to produce your money, and buy the order utilizing your PayPal or charge card.

- Decide on a practical document structure and down load your version.

Discover all the record themes you might have purchased in the My Forms menu. You can aquire a more version of Wisconsin Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) at any time, if needed. Just select the needed form to down load or printing the record format.

Use US Legal Forms, the most substantial assortment of legal kinds, to conserve some time and stay away from mistakes. The support gives professionally manufactured legal record themes which can be used for a variety of purposes. Generate a free account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Are There Fees for Bounced Checks? When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft fee.

It is also a crime to forge a check or write a check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

It is also a crime to forge a check or write a check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.

When a check bounces, it will be returned unpaid to your bank, and you'll likely face fees. If a check bounces, it means that there was not enough money in your bank account to fund the check. The person attempting to cash the check won't receive their funds and may even have to deal with additional fees.

After you find out that the check bounced, contact the bank. Even though the check bounced at one time, there might be sufficient funds now. Ask if the bank can try depositing the check again. If there still aren't sufficient funds in the customer's account, ask the bank if they can do an enforced collection.