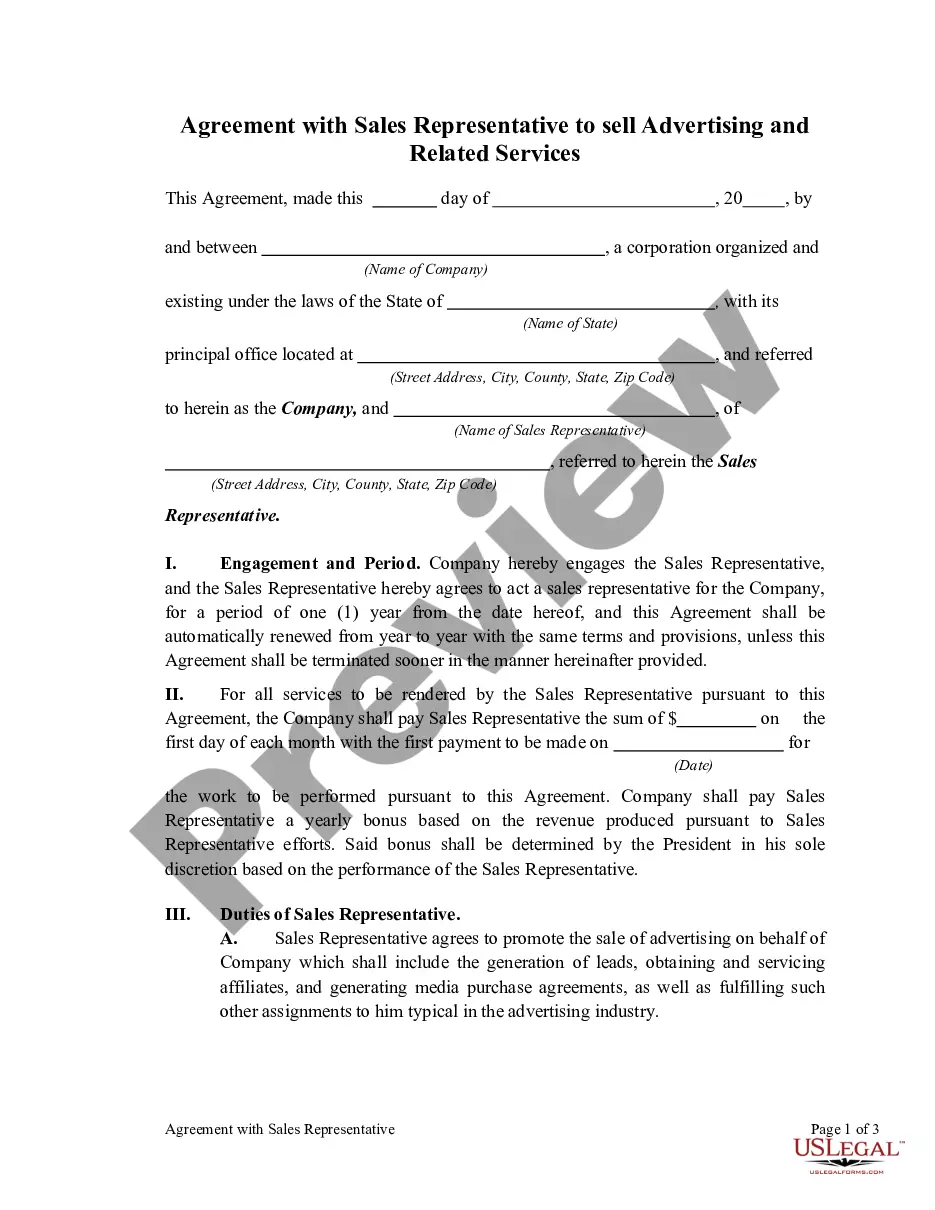

Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services

Description

Form popularity

FAQ

Publication 240 in Wisconsin details the tax treatment for non-resident partners in partnerships and limited liability companies. This guide explains how income is taxed at both the state and federal levels. Understanding these tax intricacies is essential when forming or managing agreements like the Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services.

The FOIA law, known as the Wisconsin Public Records Law, grants individuals the right to access public records held by government bodies. This transparency ensures that citizens can request and obtain information related to governmental operations. For businesses negotiating a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, knowing how this law impacts your operations can promote a culture of compliance and integrity.

The standard deduction for Wisconsin in 2024 is set to provide taxpayers with a basic allowance, reducing taxable income. For most individuals, this deduction varies based on filing status and can significantly impact overall tax liability. If your business is structured around agreements like the Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, staying informed about these deductions can benefit long-term planning.

Serving by publication in Wisconsin requires publishing a summons or notice in a local newspaper that meets specific legal criteria. This method is often used when the defendant's whereabouts are unknown. If your business involves contracts like the Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, ensuring proper service can be crucial for enforceability.

In Wisconsin, various services are taxable, particularly those directly related to tangible personal property. This includes services involving the repair of goods and certain installation services. When working under a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, it's essential to understand these tax guidelines to ensure compliance.

Graphic design services are typically taxable in Wisconsin. If you're offering these services through a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, remember to add sales tax to your invoices. There are instances where certain design services could be exempt, depending on their use. It’s wise to review tax regulations or seek advice from a tax professional to ensure you're compliant.

Wisconsin has specific categories of sales that are exempt from sales tax, including certain agricultural products and manufacturing machinery. Sales made under a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services may also qualify for exemptions if they fall under particular criteria. It's crucial to understand these exemptions to effectively manage your sales and tax obligations. Consulting a tax expert can provide clarity on this matter.

Yes, advertising is taxable in Wisconsin. Activities related to selling advertising, especially under a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, fall under taxable services. Ensure you include the appropriate sales tax when invoicing clients to avoid any future liabilities. Staying informed about tax regulations can help you maintain a compliant business operation.

In Wisconsin, photography services are generally considered taxable. This means that if you provide photography through a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services, you must collect sales tax from your clients. However, there may be exceptions based on the specific nature of the services offered. It is recommended to consult with a tax professional to ensure compliance.

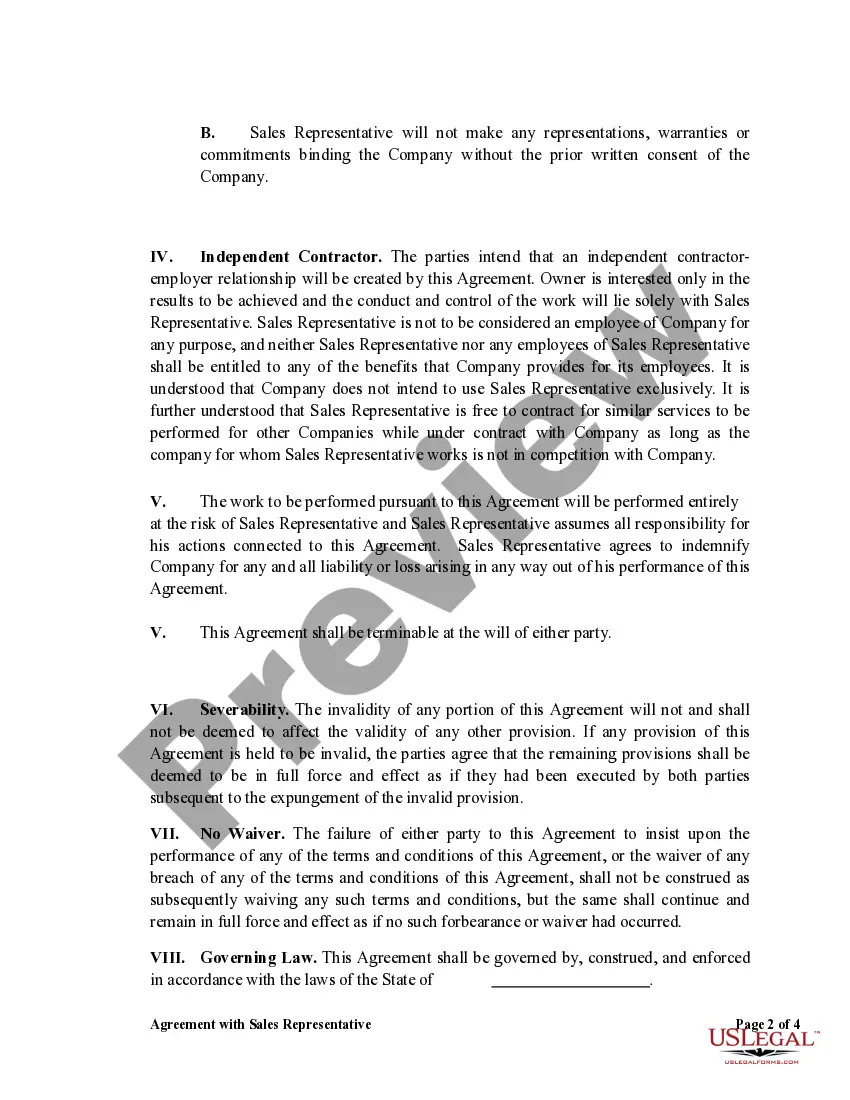

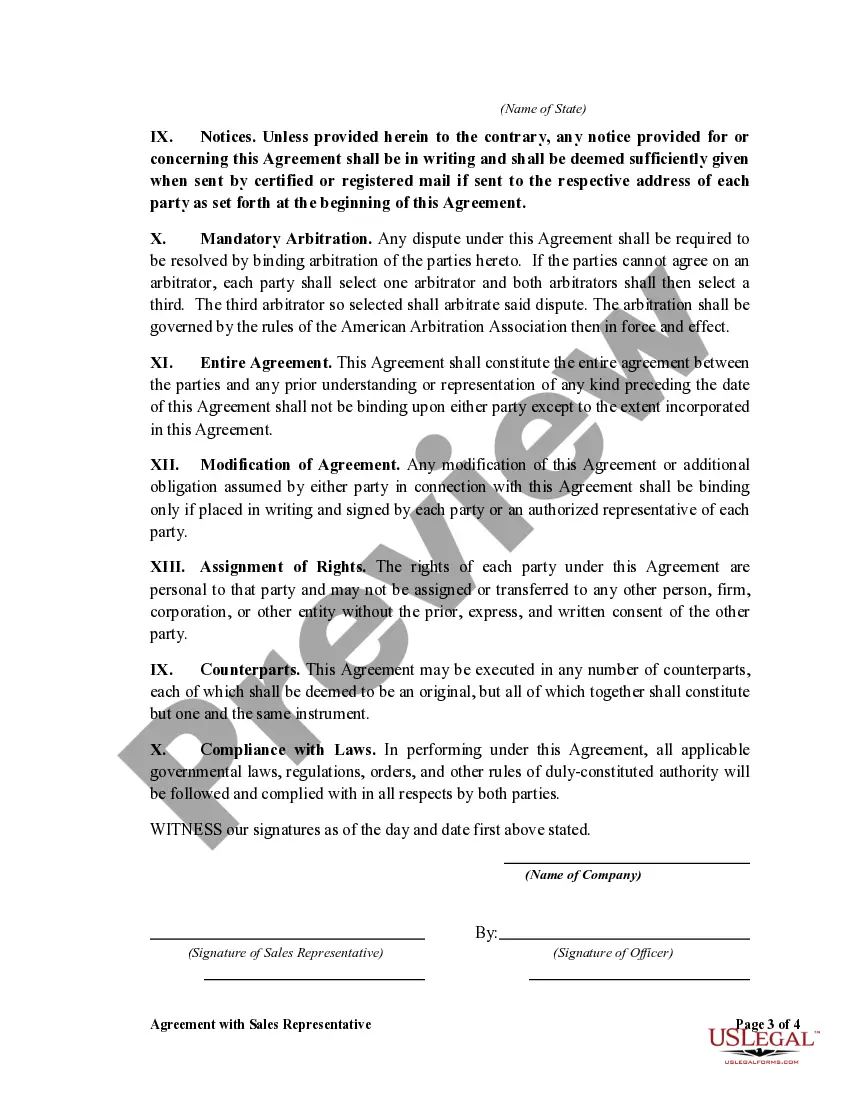

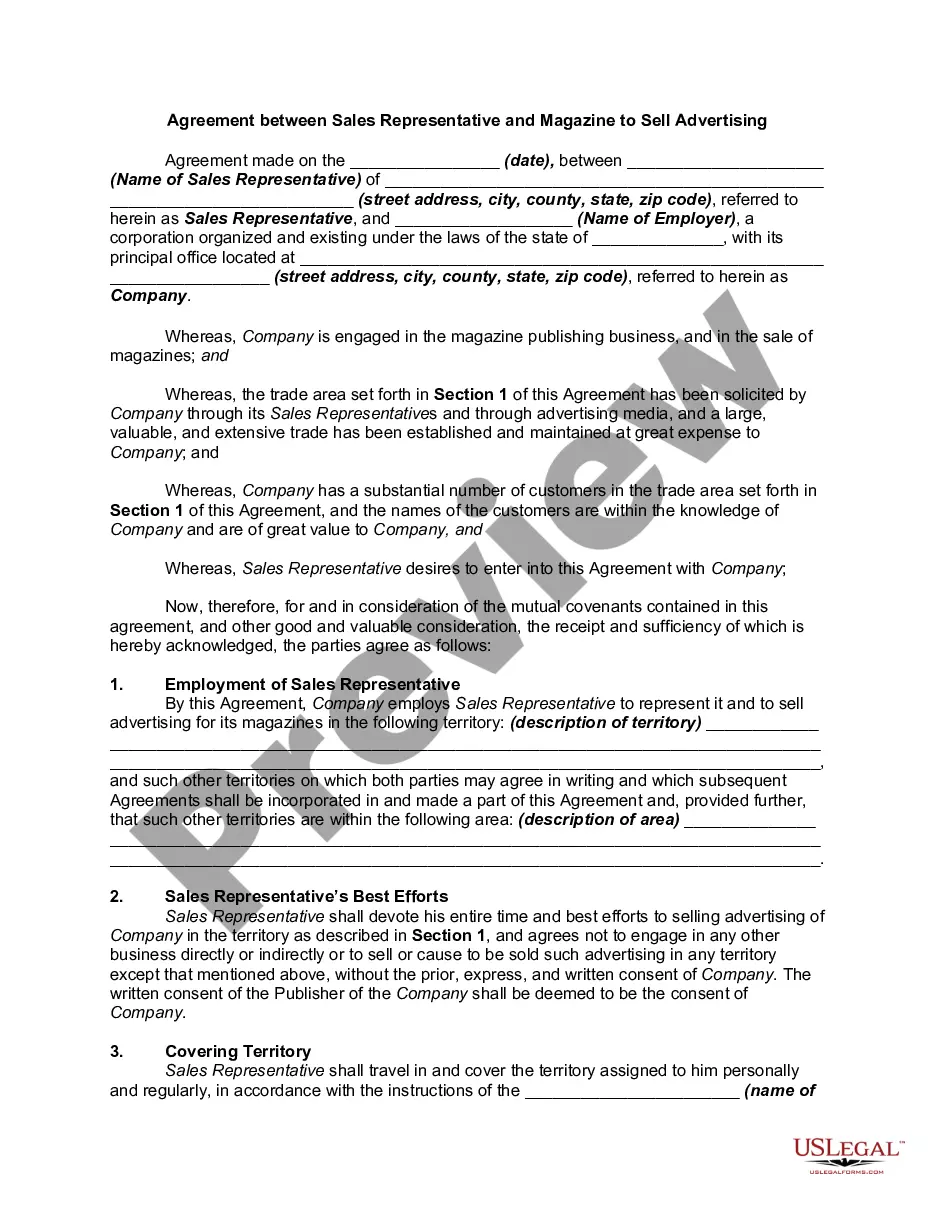

A sales representative agreement is a contract that defines the relationship between a business and a sales representative. This document specifies commission rates, territorial rights, and the types of products or services being sold. For those engaged in advertising, a Wisconsin Agreement with Sales Representative to Sell Advertising and Related Services can facilitate clear communication and efficient sales practices.