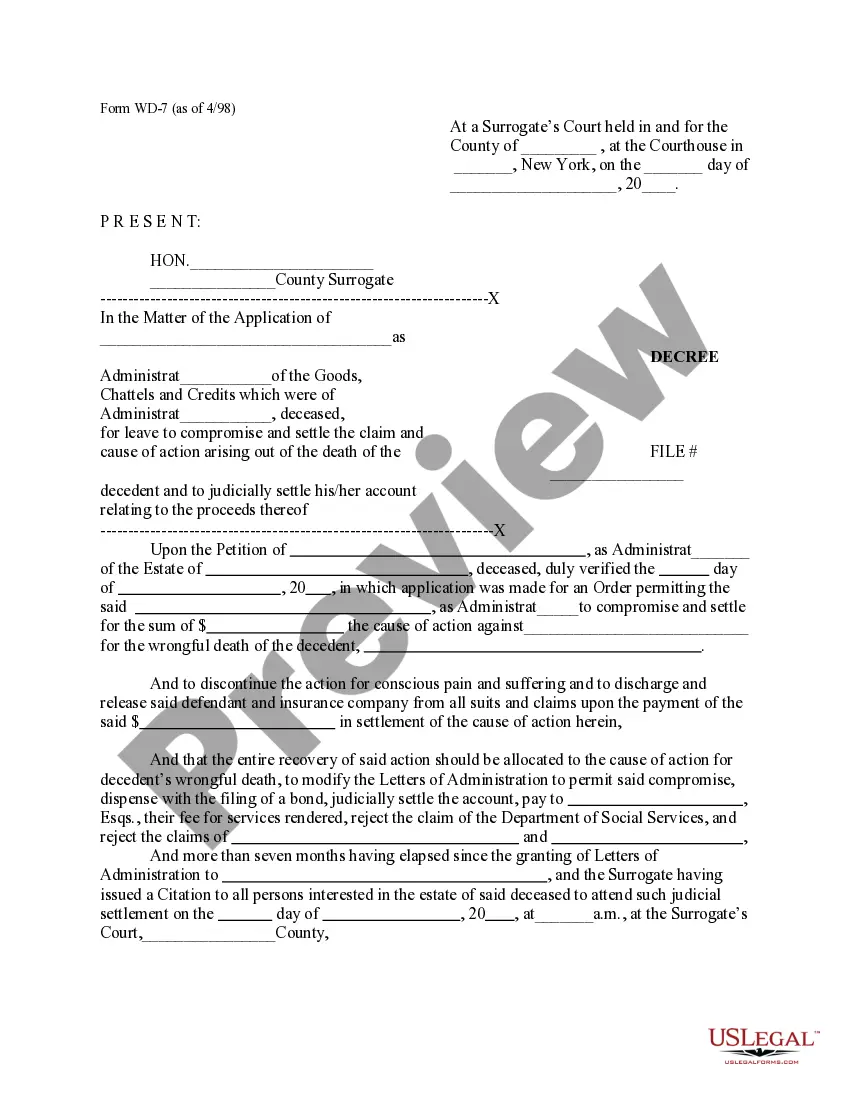

This form is a Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums

Description

How to fill out Complaint For Declaratory Judgment For Return Of Improperly Waived Insurance Premiums?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums in just moments.

If you already possess a subscription, Log In and download the Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have chosen the correct form for your city/county. Click the Preview button to review the form's content. Check the form details to confirm you have selected the right form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking on the Get now button. Then, choose the payment plan you desire and provide your credentials to register for an account. Complete the purchase. Use a Visa or Mastercard or PayPal account to finalize the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums. Every form you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you need.

US Legal Forms is your go-to resource for comprehensive legal documentation.

Leverage a vast library of templates tailored to suit a wide range of legal situations.

- Access the Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure accuracy in your selections by reviewing form details before proceeding.

- Easily manage your forms through the My documents section of your profile.

- Benefit from a user-friendly platform for all your legal document needs.

- Enjoy indefinite access to the forms you download or purchase.

Form popularity

FAQ

A declaratory judgment in insurance is a court ruling that clarifies the rights and obligations of the parties involved in a dispute over an insurance policy. This legal tool helps determine whether coverage exists for a specific claim or situation. It can prevent future disputes and provide peace of mind for policyholders. If you're dealing with improperly waived insurance premiums, consider using a Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums to resolve your concerns effectively.

An insurance company may request a declaratory judgment from a court when there is uncertainty about the coverage of a policy or the obligations of the parties involved. This often occurs in complex situations, such as disputes over claims or interpretations of policy language. By seeking a declaratory judgment, the insurer aims to clarify its position, which can help prevent further litigation. If you face such a situation, consider filing a Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums to protect your interests.

To file a complaint against an insurance company in Wisconsin, you first need to gather all relevant documentation related to your case. This includes your policy details, any correspondence with the insurer, and evidence supporting your claim. Next, visit the Wisconsin Department of Insurance website to access their complaint form. Submitting a Wisconsin Complaint For Declaratory Judgment for Return of Improperly Waived Insurance Premiums can also be a crucial step if you seek a legal resolution.

To establish federal jurisdiction in a declaratory judgment action, two conditions must be satisfied. First, is the constitutional inquiry - the case must be a 'case or controversy' pursuant to Article III of the US Constitution. Second is the prudential inquiry ? declaratory relief must be appropriate.

Thus, a declaratory judgment action that is nothing more than an anticipatory defense to a breach of contract claim may be an inappropriate use of the declaratory judgment mechanism. Given that courts have discretion whether to entertain a declaratory judgment action, they may decline to do so under such circumstances.

An example of this in a case involving contracts would be a party seeking an interpretation of the contract to determine their rights. Another example would be an insured individual seeking a specific determination of their rights and surrounding circumstances regarding insurance coverage under a specific policy.

So what is a "declaratory judgment" lawsuit? This answer is this: It's a lawsuit that a plaintiff files in which the plaintiff asks the court to "declare" through issuance of a "declaratory judgment" what the respective rights of the parties are.

For example, a policyholder believes that their denied claim is unjust. As a result, they inform the insurer that they are considering a lawsuit to recover losses. The insurer seeks a declaratory judgment to clarify its rights and obligations with hopes of preventing the lawsuit.

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.

Declaratory judgment is appropriate if: 1) there is a controversy in which a claim is asserted against a party with an interest in contesting it; 2) the controversy is between adverse parties; 3) the party seeking relief has a legally protectible interest; and 4) the issue in controversy is ripe for determination.