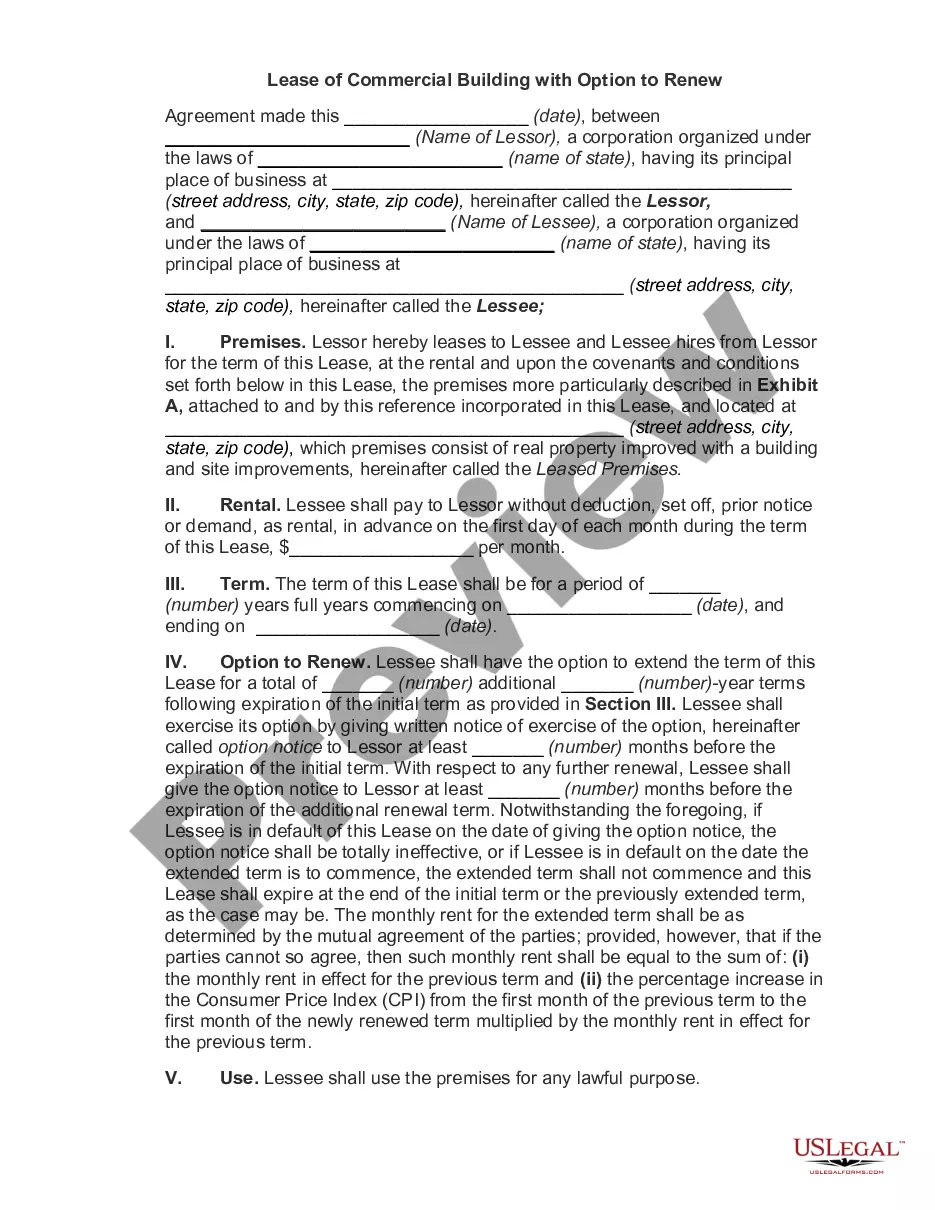

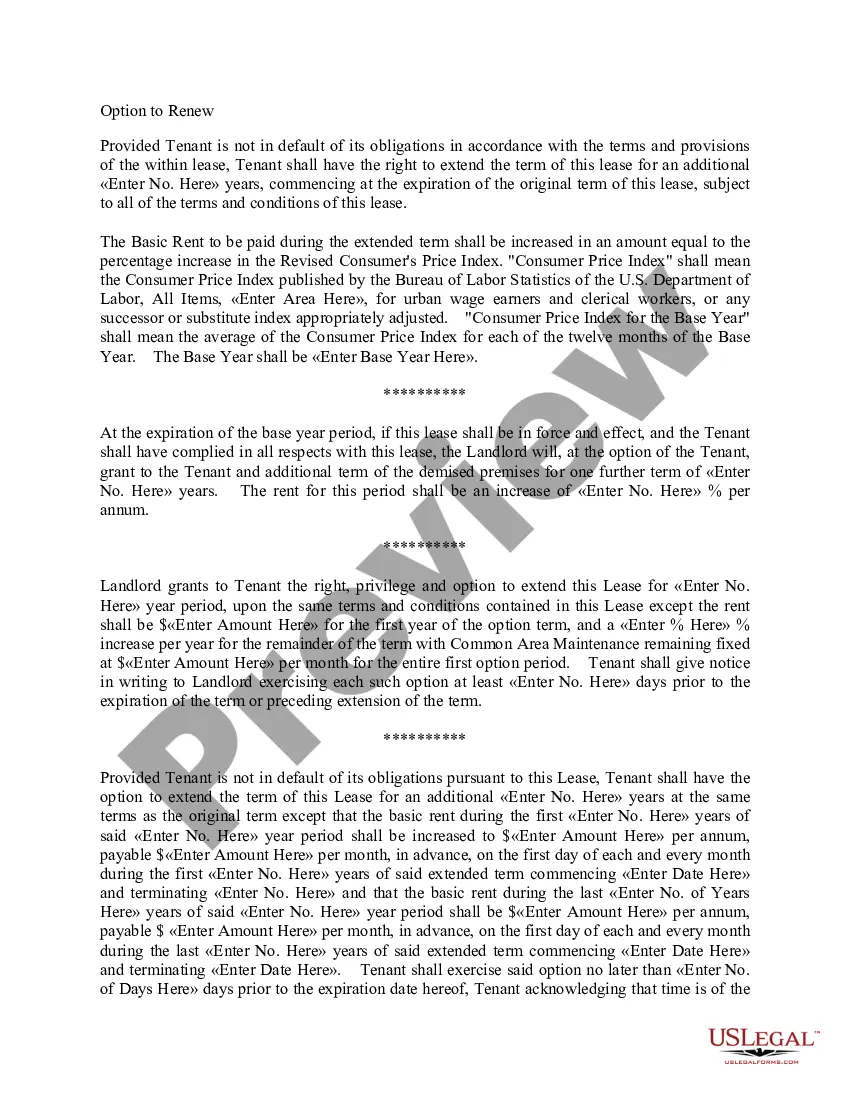

This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Washington Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

US Legal Forms - among the largest libraries of authorized forms in the States - provides a wide range of authorized file templates you may download or print. While using site, you may get 1000s of forms for enterprise and person purposes, categorized by categories, says, or key phrases.You can find the latest versions of forms just like the Washington Option to Renew that Updates the Tenant Operating Expense and Tax Basis in seconds.

If you already have a subscription, log in and download Washington Option to Renew that Updates the Tenant Operating Expense and Tax Basis through the US Legal Forms collection. The Obtain button will appear on each type you see. You gain access to all previously delivered electronically forms in the My Forms tab of the bank account.

In order to use US Legal Forms for the first time, listed here are easy recommendations to help you started out:

- Be sure to have picked the best type for your personal city/state. Click on the Review button to examine the form`s articles. See the type information to ensure that you have selected the appropriate type.

- When the type doesn`t fit your needs, utilize the Look for discipline towards the top of the display to obtain the one which does.

- Should you be pleased with the form, verify your choice by clicking on the Purchase now button. Then, opt for the rates program you want and supply your qualifications to sign up to have an bank account.

- Method the transaction. Make use of your credit card or PayPal bank account to accomplish the transaction.

- Find the structure and download the form on your own gadget.

- Make changes. Fill up, edit and print and sign the delivered electronically Washington Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Every single design you included with your bank account lacks an expiry day which is your own eternally. So, if you would like download or print one more duplicate, just go to the My Forms portion and click about the type you require.

Obtain access to the Washington Option to Renew that Updates the Tenant Operating Expense and Tax Basis with US Legal Forms, the most considerable collection of authorized file templates. Use 1000s of expert and state-distinct templates that fulfill your company or person requirements and needs.

Form popularity

FAQ

Tenant improvements are typically not considered an operating expense.

A base year refers to a type of expense stop in which the landlord pays for all operating expenses in the first year. After that first year, Phelps explained, the tenant is responsible for all operating expenses over and above the first year's established base year expenses.

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

'Base year' is the first calendar year of a tenant's commercial rental period. It is especially important as all future rent payments are calculated using base year. It's additionally important to note that base year is crafted to favor landlords.

When a lease expires, both the lessor and the lessee have a few options available. The lessee can vacate or give up access to the property, or the two parties can agree to a lease renewal. This option may require some renegotiation of the terms of the new lease. The final option is to extend the lease.

The Base Year is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year. In a new lease, the Base Year is most often the year the lease is executed or the year in which the lease commences.

Suppose that a tenant signs a lease in an office building for 5,000 square feet of space. The base rental amount is $10 per square foot. In year one of the lease, the landlord pays for all of the building operating expenses and the total comes out to $10,000. This is the base year expense stop amount.

A gross lease rate consists of a base rent per square foot and additional operating expenses per square foot set during the base year. The base year is typically the year the lease is signed. As such, a gross lease rental rate is inclusive of rent and the first year's operating expenses.