Washington Petition for Creation of Historic District

Description

How to fill out Petition For Creation Of Historic District?

Discovering the right authorized record web template can be quite a have a problem. Of course, there are tons of layouts available online, but how would you discover the authorized develop you want? Make use of the US Legal Forms website. The support gives 1000s of layouts, such as the Washington Petition for Creation of Historic District, which can be used for enterprise and private demands. Each of the varieties are checked out by pros and meet federal and state specifications.

In case you are already listed, log in to your account and then click the Down load option to find the Washington Petition for Creation of Historic District. Utilize your account to appear from the authorized varieties you might have acquired formerly. Check out the My Forms tab of your respective account and have one more version in the record you want.

In case you are a whole new end user of US Legal Forms, allow me to share straightforward directions for you to comply with:

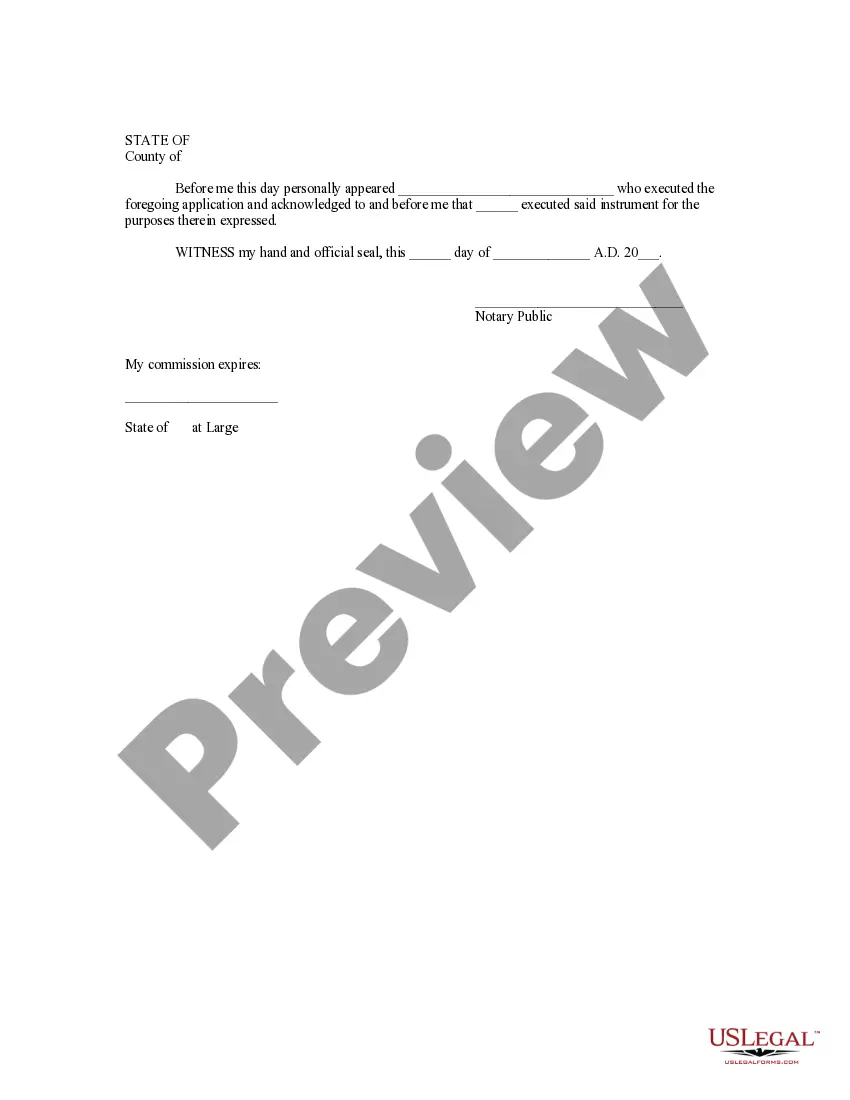

- Initially, make sure you have selected the appropriate develop for your metropolis/state. It is possible to check out the shape using the Preview option and study the shape description to make sure it will be the best for you.

- If the develop is not going to meet your expectations, make use of the Seach field to get the correct develop.

- When you are positive that the shape would work, click on the Buy now option to find the develop.

- Opt for the rates strategy you want and enter in the required information. Build your account and pay for your order making use of your PayPal account or charge card.

- Opt for the submit formatting and obtain the authorized record web template to your gadget.

- Complete, revise and printing and sign the acquired Washington Petition for Creation of Historic District.

US Legal Forms is definitely the greatest library of authorized varieties for which you can discover a variety of record layouts. Make use of the company to obtain skillfully-created files that comply with express specifications.

Form popularity

FAQ

A 20% Federal income tax credit on the qualified amount of private investment spent on certified rehabilitation of a National Register listed historic building. The National Park Service (NPS) is the agency that administers the program at the federal level for the Internal Revenue Service.

Federal Tax Credit Program ? 20% program, Existing Federal Benefit: The Oregon State Historic Preservation Office administers a federal tax credit program that can save building owners twenty percent of the cost of rehabilitating their National Register-listed commercial, industrial, or rental residential building.

The Tax Exemption freezes the taxable ceiling of the land and improvements at the pre-renovation values for the purpose of assessing City of Fort Worth taxes. The exemption period is ten (10) years. Application to the Tarrant Appraisal District must be made by the property owner each year of the exemption.

The Federal Historic Preservation Tax Incentives program encourages private sector investment in the rehabilitation and re-use of historic buildings. It creates jobs and is one of the nation's most successful and cost-effective community revitalization programs.

Electric Vehicle Incentives As a Washington resident, your new or used electric vehicle purchase may be eligible for a range of incentives, including rebates and tax credits. Individuals who purchase qualified residential fueling equipment after January 1, 2023, may receive a tax credit of up to $1,000.