Washington Retail Internet Site Agreement

Description

How to fill out Retail Internet Site Agreement?

If you wish to comprehensive, obtain, or print out lawful file themes, use US Legal Forms, the most important assortment of lawful types, which can be found on-line. Utilize the site`s simple and easy handy research to discover the papers you want. Numerous themes for company and personal functions are categorized by classes and claims, or keywords. Use US Legal Forms to discover the Washington Retail Internet Site Agreement in a number of mouse clicks.

Should you be presently a US Legal Forms consumer, log in to the bank account and click on the Down load switch to obtain the Washington Retail Internet Site Agreement. You may also accessibility types you previously delivered electronically in the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for the right metropolis/country.

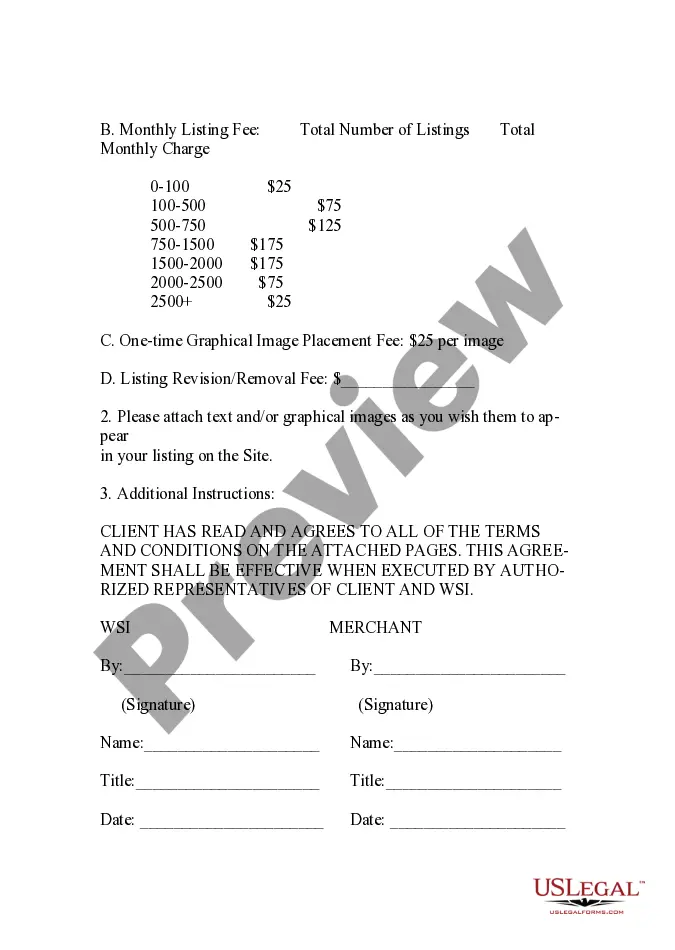

- Step 2. Take advantage of the Review option to examine the form`s content material. Never forget to read through the explanation.

- Step 3. Should you be unsatisfied with the form, use the Lookup area towards the top of the display to discover other variations in the lawful form design.

- Step 4. After you have located the form you want, go through the Purchase now switch. Pick the prices plan you like and include your credentials to register to have an bank account.

- Step 5. Procedure the purchase. You may use your charge card or PayPal bank account to finish the purchase.

- Step 6. Select the structure in the lawful form and obtain it in your product.

- Step 7. Full, revise and print out or sign the Washington Retail Internet Site Agreement.

Every single lawful file design you buy is yours forever. You might have acces to every single form you delivered electronically inside your acccount. Go through the My Forms portion and select a form to print out or obtain once more.

Remain competitive and obtain, and print out the Washington Retail Internet Site Agreement with US Legal Forms. There are millions of expert and state-distinct types you can use to your company or personal requirements.

Form popularity

FAQ

Washington is a destination-based sales tax state. So if you sell an item to a customer through your online store, collect sales tax at the tax rate where your product is delivered. (I.e. the Buyer's ship to address.) The state sales tax rate for Washington is 6.5%.

Which States Do Not Levy an Internet Sales Tax? Only five states in the U.S. do not collect sales tax from internet purchases as of 2022. These include: Alaska, Delaware, New Hampshire, Montana, and Oregon.

Charges for digital storage, hosting and back-up services are subject to B&O tax under the service and other activities classification (sales tax does not apply).

You must collect retail sales tax from all of your nonresident customers, unless the customer or sale qualifies for another exemption. See our list of common nonresident exemptions for more information and related documentation requirements.

Washington law exempts most grocery type food from retail sales tax. However, the law does not exempt ?prepared food,? ?soft drinks,? or ?dietary supplements.? Businesses that sell these ?foods? must collect sales tax. In addition, all alcoholic items are subject to retail sales tax.

For products manufactured and sold in Washington, a business owner is subject to both the Manufacturing B&O Tax and the Wholesaling or Retailing B&O Tax. However, you may be entitled to the Multiple Activities Tax Credit (MATC).

The State of Washington imposes a 6.5% sales tax on all retail sales as defined by statute (RCW 82.08. 020). Cities, towns, counties, transit districts, and public facilities districts may impose additional local sales taxes as described below.

The threshold in Washington is $100,000 in annual sales. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.