Washington Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

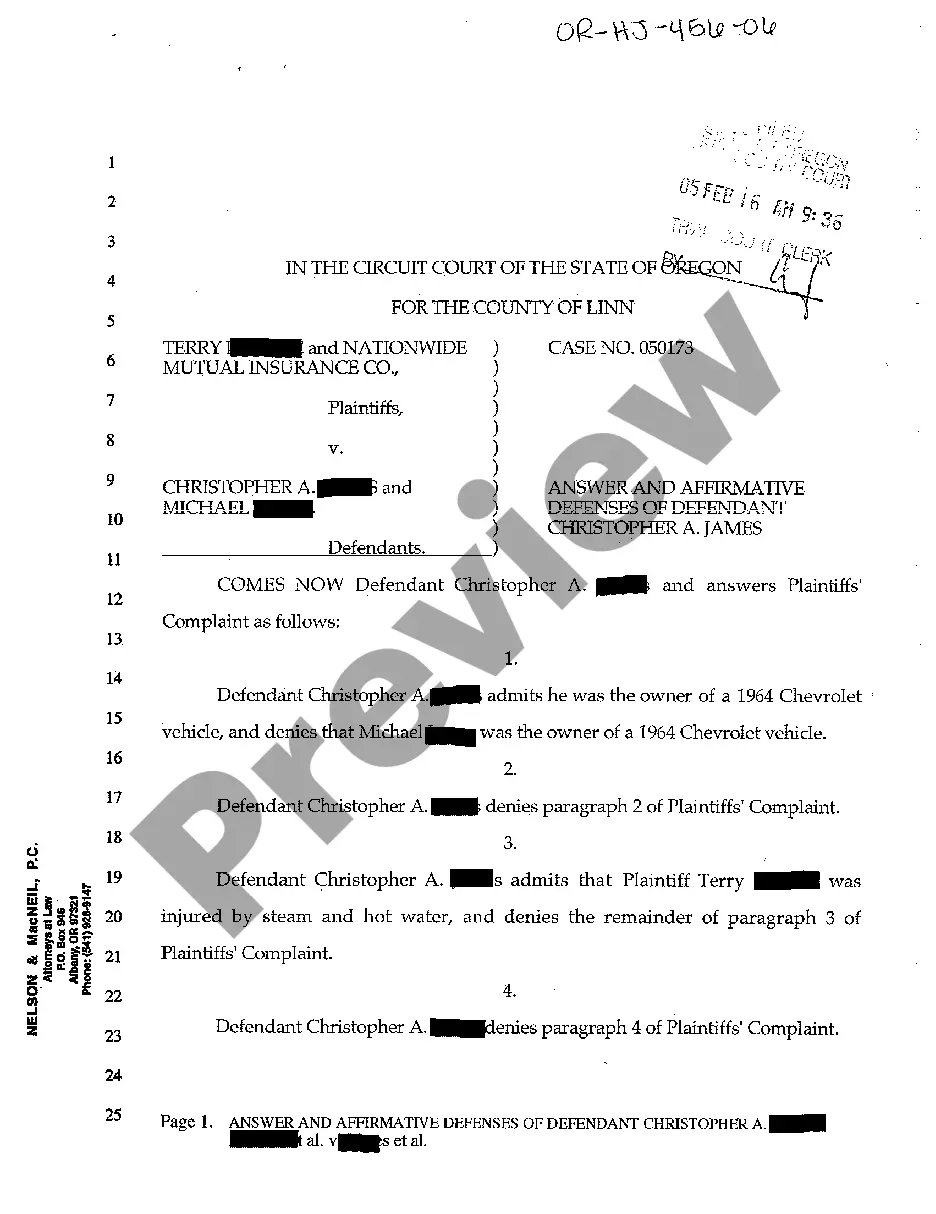

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

US Legal Forms - among the largest libraries of legal forms in the States - delivers a variety of legal file web templates it is possible to acquire or produce. Using the web site, you will get a huge number of forms for enterprise and individual functions, sorted by classes, states, or keywords and phrases.You will discover the newest versions of forms such as the Washington Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent in seconds.

If you already have a membership, log in and acquire Washington Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent from the US Legal Forms catalogue. The Down load key can look on every single type you perspective. You get access to all in the past delivered electronically forms inside the My Forms tab of the profile.

In order to use US Legal Forms initially, listed here are simple guidelines to help you started out:

- Be sure you have selected the correct type for the area/region. Select the Preview key to review the form`s information. Look at the type outline to actually have chosen the appropriate type.

- In the event the type does not suit your specifications, utilize the Search discipline near the top of the display to get the one that does.

- When you are satisfied with the form, verify your decision by clicking on the Buy now key. Then, choose the pricing program you like and provide your credentials to register to have an profile.

- Procedure the deal. Make use of your Visa or Mastercard or PayPal profile to finish the deal.

- Find the formatting and acquire the form on your own product.

- Make changes. Fill out, edit and produce and sign the delivered electronically Washington Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

Every single format you put into your money lacks an expiry time which is your own permanently. So, if you would like acquire or produce yet another version, just check out the My Forms section and then click on the type you require.

Get access to the Washington Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent with US Legal Forms, the most substantial catalogue of legal file web templates. Use a huge number of skilled and state-certain web templates that fulfill your organization or individual requirements and specifications.

Form popularity

FAQ

This security is called collateral, which minimizes the risk for lenders by ensuring that the borrower keeps up with their financial obligation. The borrower has a compelling reason to repay the loan on time because if they default, they stand to lose their home or other assets pledged as collateral.

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.

Mortgages, charges, pledges and liens are all types of security. The main types of quasi-security are guarantees and indemnities, comfort letters, set-off, netting, standby credits, on demand guarantees and bonds and retention of title (ROT) arrangements.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

Collateral and security are two terms that can be confused with one another. People often think the terms are one and the same. While collateral is defined as any property or asset that is given by the borrower to the lender, security refers to a broad set of financial assets used as collateral for a loan.

Several types of collateral can be used for a secured personal loan. Your options may include cash in a savings account, a car or a house. There are two types of loans you can obtain from banks or other financial institutions: secured loans and unsecured loans.