Washington Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form

Description

How to fill out Order Discharging Debtor Before Completion Of Chapter 12 Plan - Updated 2005 Act Form?

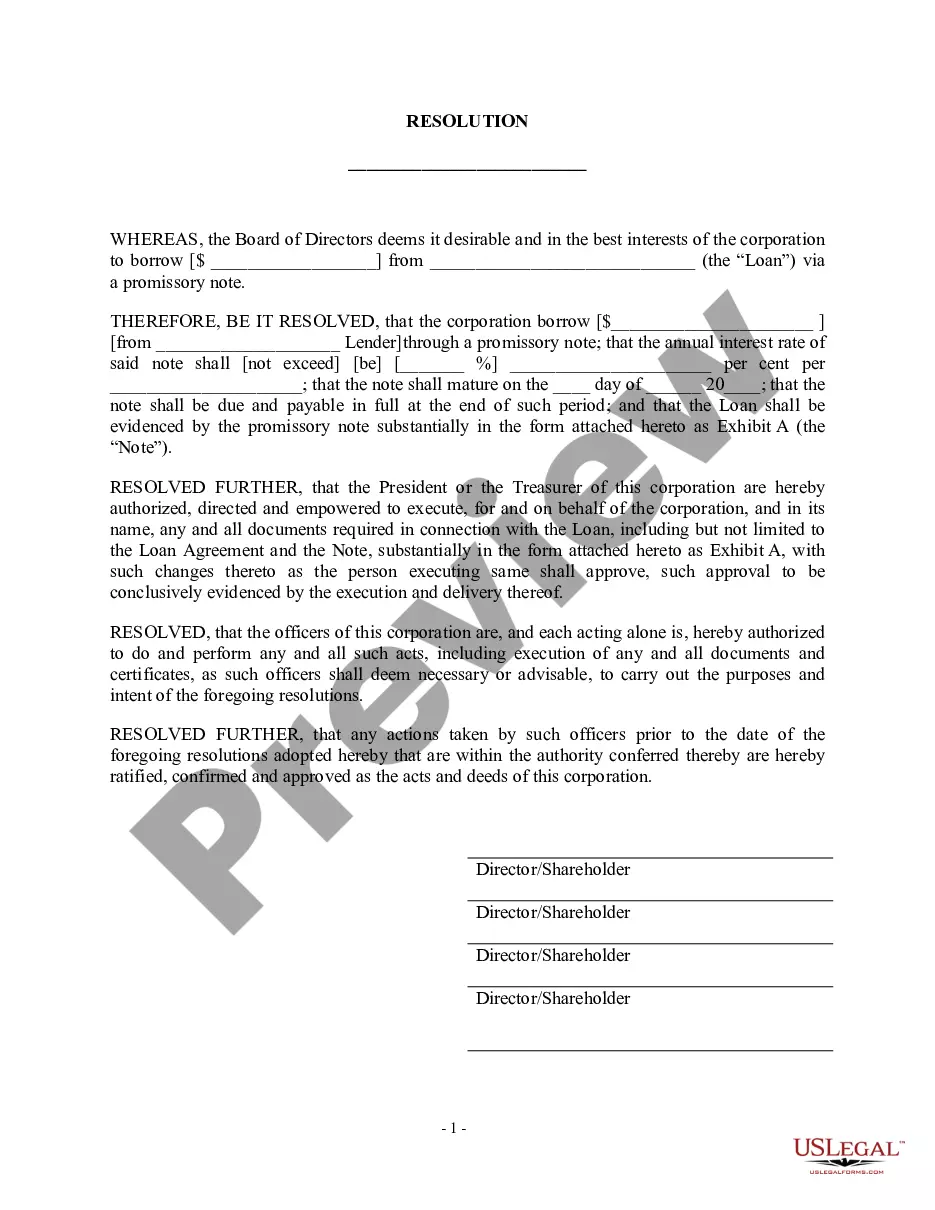

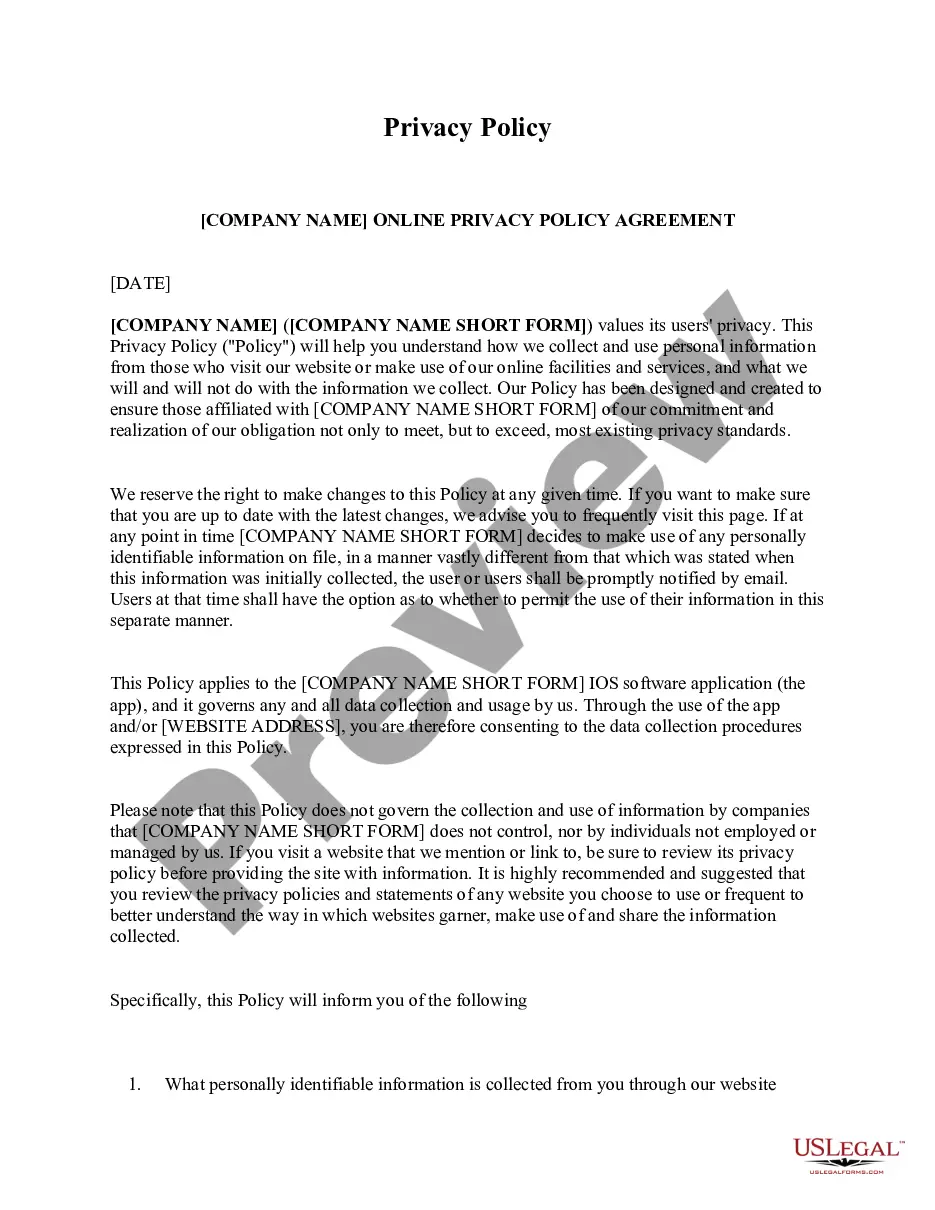

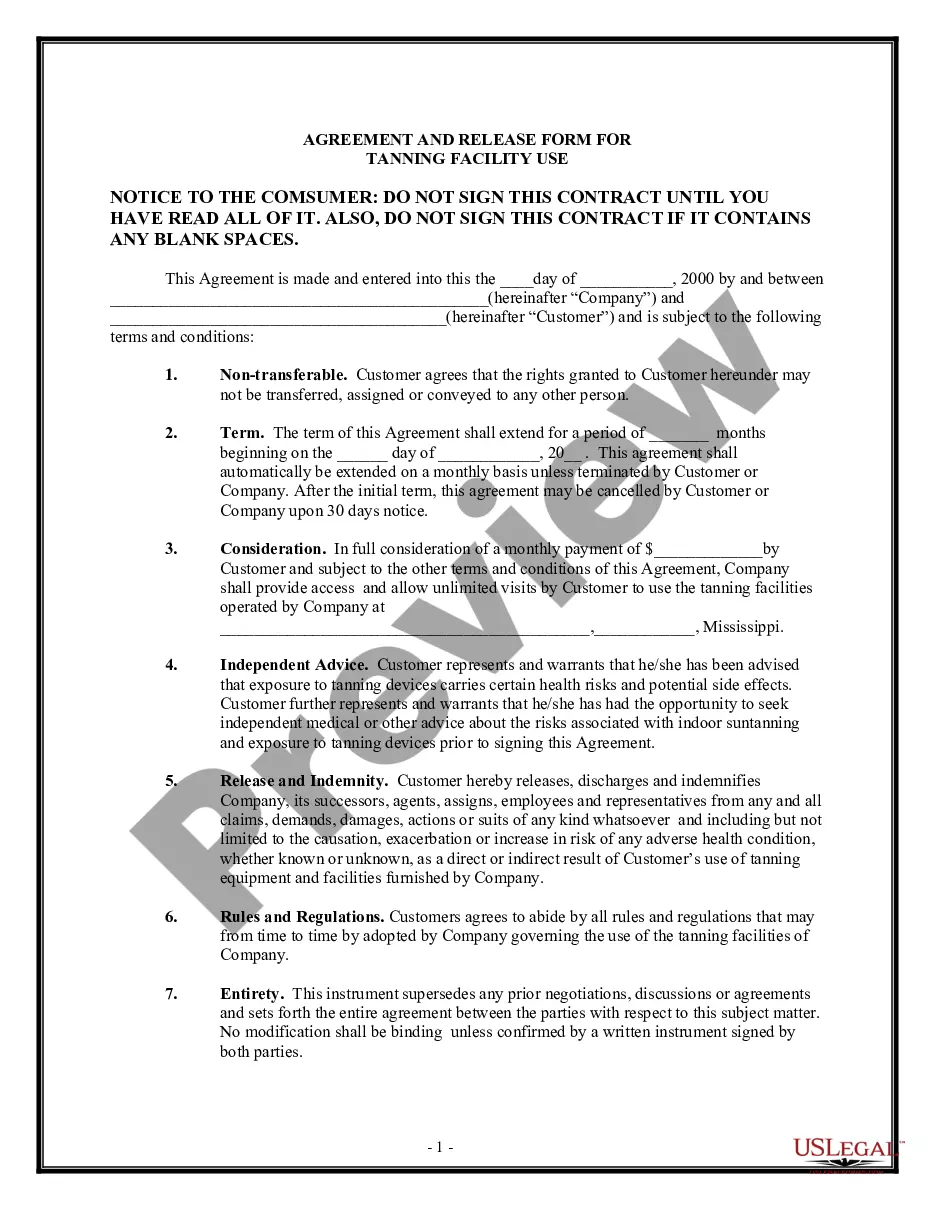

Discovering the right authorized file format might be a have a problem. Naturally, there are plenty of layouts available on the Internet, but how will you discover the authorized type you need? Utilize the US Legal Forms site. The services gives thousands of layouts, for example the Washington Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form, which you can use for enterprise and personal requirements. All the varieties are examined by experts and meet up with state and federal specifications.

If you are already authorized, log in for your accounts and then click the Down load option to have the Washington Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form. Make use of accounts to look throughout the authorized varieties you may have purchased previously. Check out the My Forms tab of your accounts and get one more duplicate of the file you need.

If you are a brand new consumer of US Legal Forms, allow me to share basic instructions so that you can stick to:

- Initial, make sure you have selected the proper type to your area/county. You may check out the form making use of the Review option and look at the form outline to ensure it will be the best for you.

- When the type fails to meet up with your needs, take advantage of the Seach industry to discover the correct type.

- When you are certain that the form would work, go through the Purchase now option to have the type.

- Choose the costs strategy you want and enter in the necessary info. Create your accounts and pay for the transaction making use of your PayPal accounts or charge card.

- Pick the document structure and obtain the authorized file format for your gadget.

- Complete, change and print and signal the attained Washington Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form.

US Legal Forms will be the largest collection of authorized varieties that you can find a variety of file layouts. Utilize the service to obtain professionally-produced documents that stick to condition specifications.

Form popularity

FAQ

Hear this out loud PauseGenerally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

Hear this out loud PauseCourts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.

People who file for personal bankruptcy get a discharge ? a court order that says they don't have to repay certain debts. Bankruptcy is generally considered your last option because of its long-term negative impact on your credit.

Debt discharge is the cancellation of a debt due to bankruptcy. When a debt is discharged, the debtor is no longer liable for the debt and the lender is no longer allowed to make attempts to collect the debt. Debt discharge can result in taxable income to the debtor unless certain IRS conditions are met.

Hear this out loud PauseWhat is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Hear this out loud PauseThe correct order of payment of claims from the debtor's estate would be: secured claims, priority claims, unsecured claims.