Washington Record of Absence - Self-Certification Form

Description

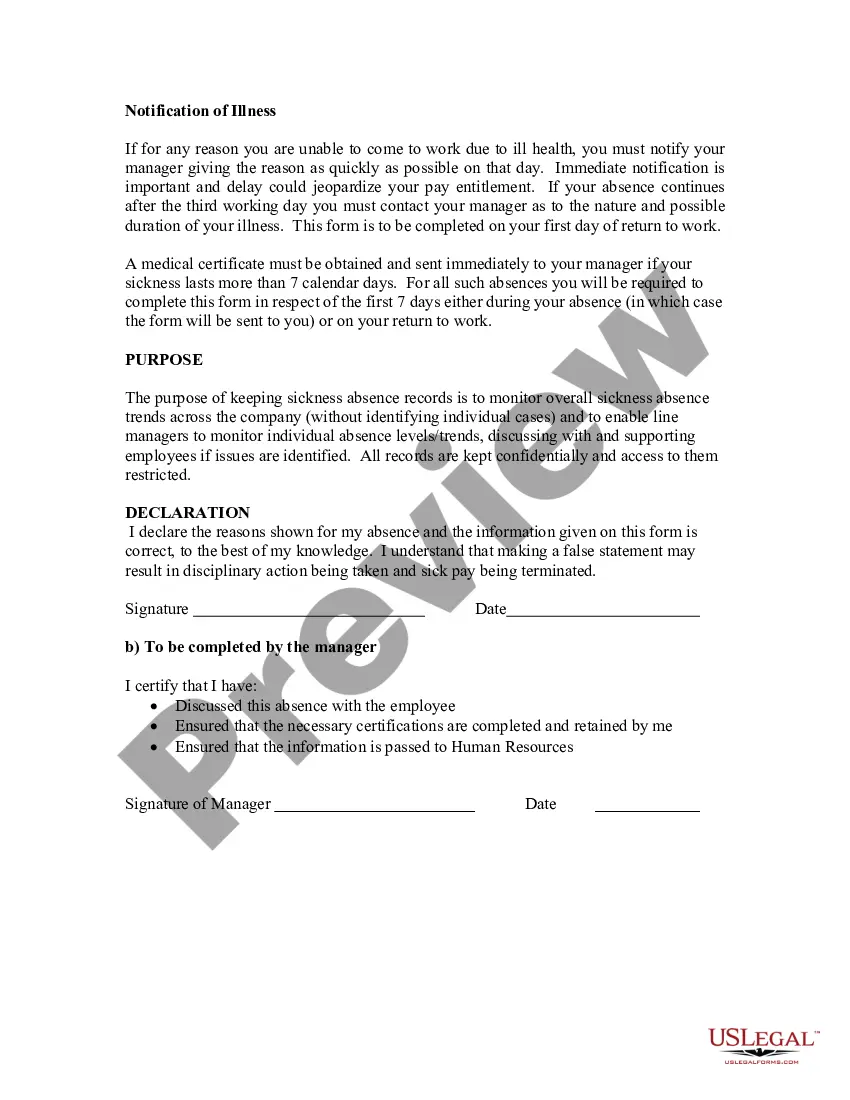

How to fill out Record Of Absence - Self-Certification Form?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a variety of legal template documents that you can download or create.

Using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Washington Absence Record - Self-Certification Form in moments.

If you already have an account, Log In and download the Washington Absence Record - Self-Certification Form from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously purchased forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Washington Absence Record - Self-Certification Form. Each template you add to your account does not expire and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you want. Access the Washington Absence Record - Self-Certification Form with US Legal Forms, one of the largest libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the right form for your city/county.

- Click the Preview button to review the content of the form.

- Read the form information to ensure you have picked the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Nearly every worker can qualify for Paid Leave if they worked a minimum of 820 hours (about 16 hours a week) in Washington during their qualifying period. Log in to your Paid Leave account and submit a Request for Review.

For Paid Leave reporting: 1, 2022, the premium rate is 0.6 percent of each employee's gross wages, not including tips, up to the 2022 Social Security cap ($147,000). Of this, employers with 50+ employees will pay up to 26.78% and employees will pay 73.22%.

PFL isn't included in your employer's regular W-2. Instead, it's reported on a separate 1099-G from the insurer. Amounts labeled as PFL on the W-2 from your employer are taxable both on the federal level and state levels if you are in a state that is not tax-exempt.

Your payment will be processed within two weeks. Remember: You must file every week, even during your waiting week. (People taking bonding leave or military family leave don't have to take a waiting week.) You are not paid during your waiting week, but you can use vacation or sick days from your employer.

Employers who provide paid family and medical leave to their employees may claim a credit for tax years 2018 and 2019. The Employer Credit for Paid Family and Medical Leave is a business credit based on a percentage of wages paid to qualifying employees while they're on family and medical leave.

Are CA PFL benefits taxable? Family leave insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. CA PFL benefits are not subject to California state income tax. Benefits paid directly from the state of California are reported on Form 1099-G.

Are CA PFL benefits taxable? Family leave insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. CA PFL benefits are not subject to California state income tax. Benefits paid directly from the state of California are reported on Form 1099-G.

What are the benefits available? The maximum benefit in 2021 will be $1,206/week; adjusted annually after the first year to 90% of the Washington average weekly wage. An Employee makes 90% of his first $670 in wages and 50% of any wages up to the $1206 maximum.

The daily benefit amount is calculated by dividing your weekly benefit amount by seven. The maximum benefit amount is calculated by multiplying your weekly benefit amount by 8 or adding the total wages subject to State Disability Insurance (SDI) tax paid in your base period.

Benefits provide a percentage of the employee's gross wages between $100-1,000 per week while the employee is on approved leave. To receive benefits under the Paid Family and Medical Leave program, you must have worked a total of at least 820 hours for any Washington employers during the previous 12 months.