Washington Indemnification Agreement for a Trust

Description

How to fill out Indemnification Agreement For A Trust?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest forms like the Washington Indemnification Agreement for a Trust within moments.

If you already have a monthly membership, Log In to download the Washington Indemnification Agreement for a Trust from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Each form you add to your account has no expiration date and is yours permanently. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Washington Indemnification Agreement for a Trust through US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

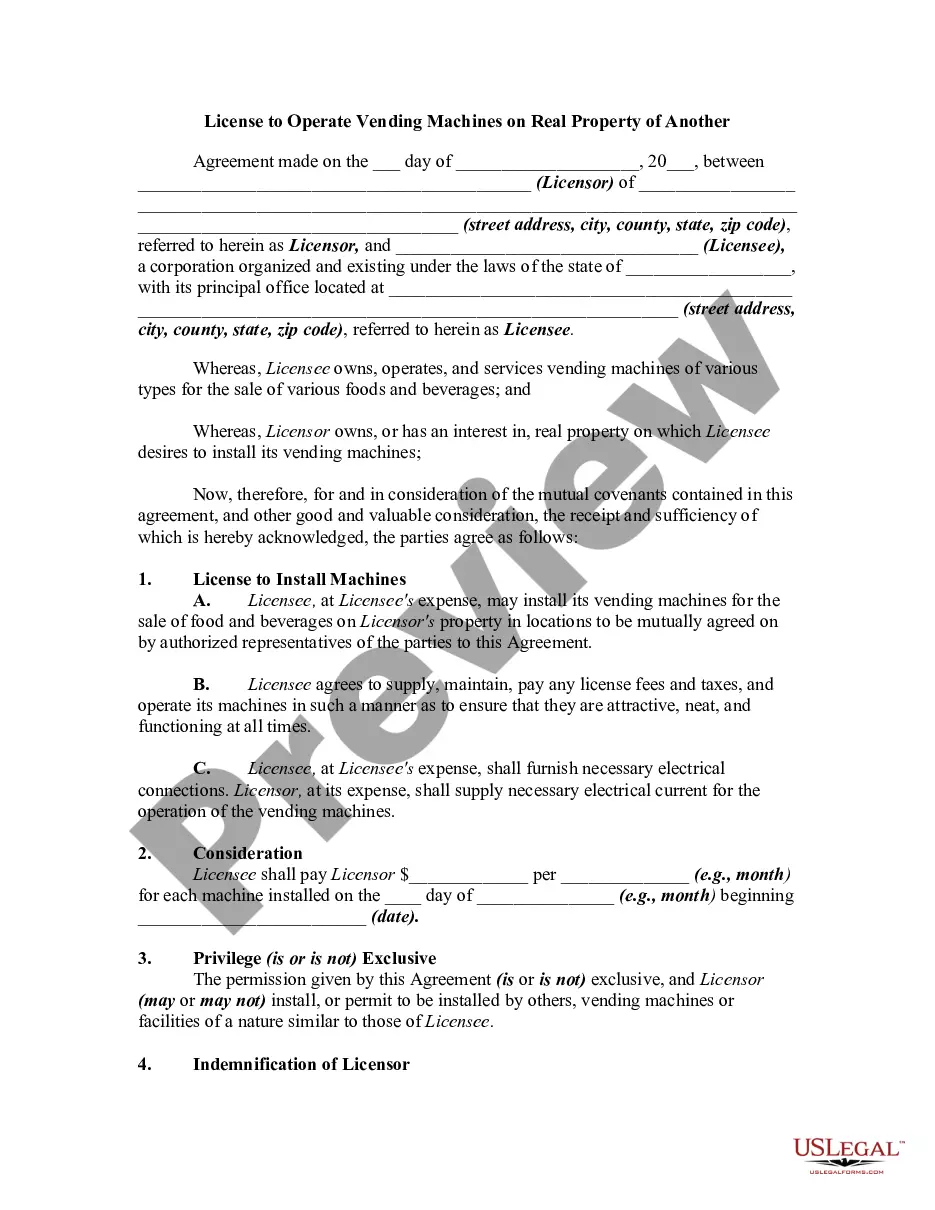

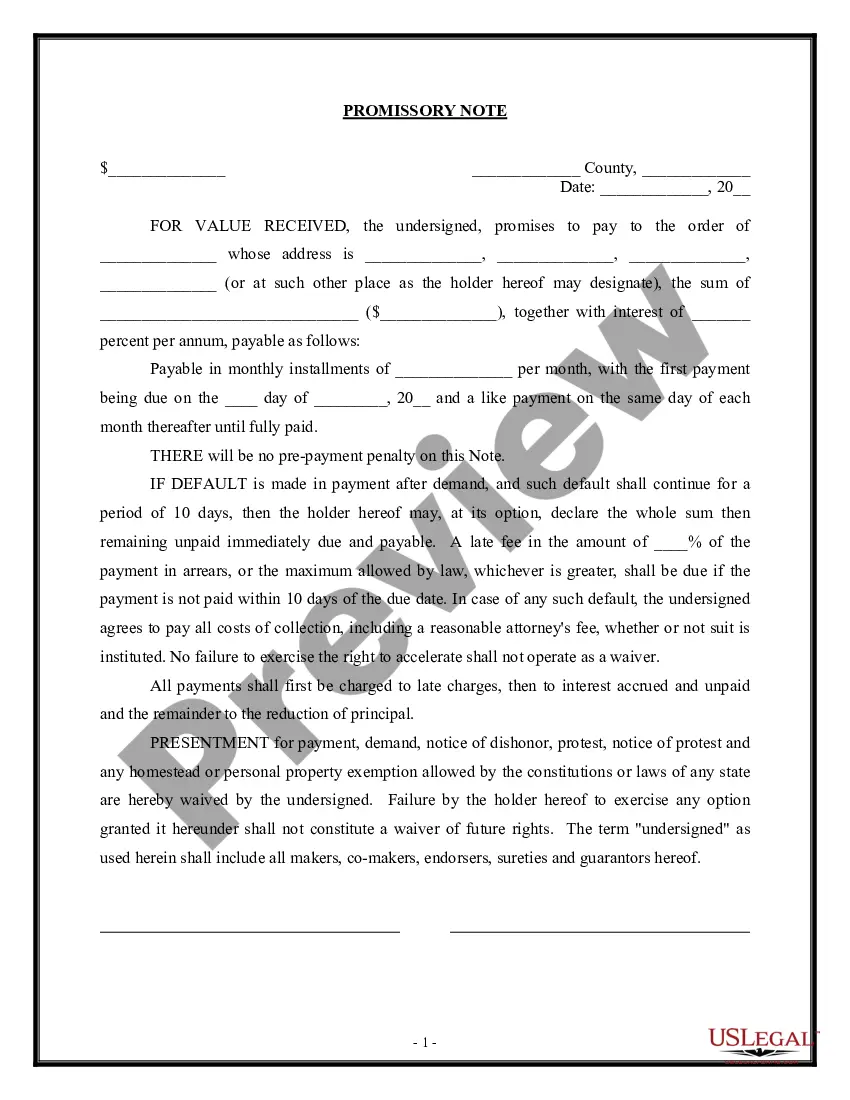

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Check the form description to ensure you have chosen the right document.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, choose the payment plan you prefer and provide your details to create an account.

- Process the transaction. Use your Visa, Mastercard, or PayPal account to complete the payment.

- Select the format and download the form to your device.

- Make edits. Complete, modify, print, and sign the downloaded Washington Indemnification Agreement for a Trust.

Form popularity

FAQ

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement.

A trustee may ask a beneficiary to sign a piece of paper indemnifying the trustee prior to making a distribution of trust assets. First, let's talk about what indemnification means? Indemnification is a legal term. It literally means that one person is going to pay for any loss or harm suffered by another person.

$20/Month. The cost of professional indemnity insurance varies considerably. While these policies are extremely common, and typically inexpensive for most industries, the cost can increase significantly for specialized services with much higher risks.

The sole purpose of the Trust is to provide assurance to the Beneficiaries of the availability of amounts to which the Beneficiaries would be entitled according to the Grantor's Indemnification Obligations to the Beneficiaries.

A common example of indemnification happens with reagrd to insurance transactions. This often happens when an insurance company, as part of an individual's insurance policy, agrees to indemnify the insured person for losses that the insured person incurred as the result of accident or property damage.

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

Indemnification clauses are clauses in contracts that set out to protect one party from liability if a third-party or third entity is harmed in any way. It's a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

To indemnify means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.