28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

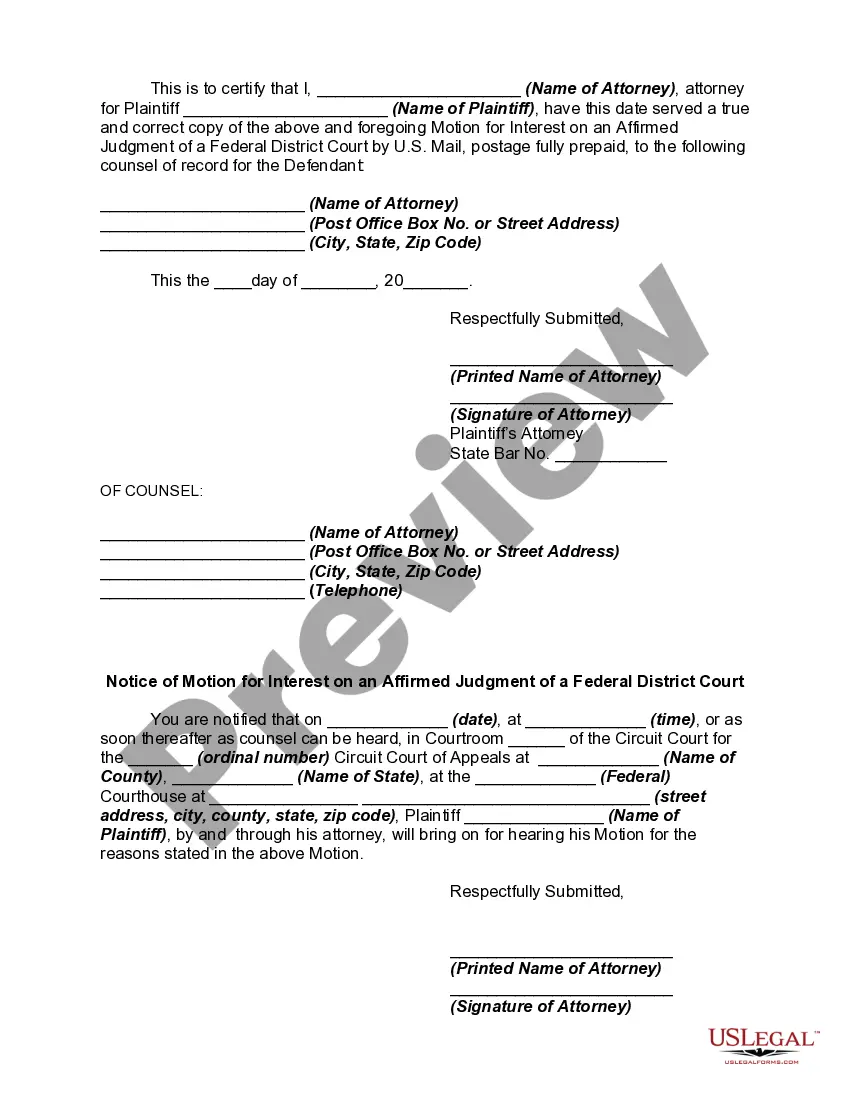

Washington Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

You may devote several hours on the Internet searching for the lawful papers web template that fits the federal and state demands you want. US Legal Forms offers a huge number of lawful varieties which can be analyzed by experts. You can actually acquire or print out the Washington Motion for Interest on an Affirmed Judgment of a Federal District Court from our services.

If you already have a US Legal Forms account, you can log in and click on the Acquire switch. Following that, you can total, modify, print out, or sign the Washington Motion for Interest on an Affirmed Judgment of a Federal District Court. Every single lawful papers web template you get is yours permanently. To obtain yet another backup of the obtained form, go to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms web site for the first time, adhere to the easy directions listed below:

- First, ensure that you have selected the best papers web template for the region/city of your choosing. Browse the form information to make sure you have chosen the correct form. If readily available, utilize the Review switch to check from the papers web template also.

- If you would like locate yet another variation of your form, utilize the Search discipline to obtain the web template that meets your requirements and demands.

- After you have identified the web template you would like, click on Purchase now to continue.

- Find the prices plan you would like, key in your references, and register for your account on US Legal Forms.

- Full the purchase. You may use your credit card or PayPal account to purchase the lawful form.

- Find the format of your papers and acquire it for your system.

- Make adjustments for your papers if required. You may total, modify and sign and print out Washington Motion for Interest on an Affirmed Judgment of a Federal District Court.

Acquire and print out a huge number of papers themes making use of the US Legal Forms site, which offers the greatest selection of lawful varieties. Use specialist and condition-certain themes to take on your organization or personal requirements.

Form popularity

FAQ

Post-judgment interest rate: 10.10% (the amount of post judgment interest is set by Rule 36.7 of the Uniform Civil Procedure Rules 2005).

If the party has appeared before the motion is filed, the party may respond to the pleading or otherwise defend at any time before the hearing on the motion. If the party has not appeared before the motion is filed the party may not respond to the pleading nor otherwise defend without leave of court.

Interest accrues on an unpaid judgment amount at the legal rate of 10% per year (7% if the judgment debtor is a state or local government entity) generally from the date of entry of the judgment.

HOW TO CALCULATE POST JUDGMENT INTEREST Take your judgment amount and multiply it by your post judgment rate (%). Take the total and divide it by 365 (the number of days in a year). You will end up with the amount of post judgment interest per day.

The rate of interest used in calculating the amount of post-judgment interest is the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System each Monday for the preceding week (unless that day is a holiday in which case the rate is published on the next business day) ...

ABA, Calculation of Prejudgment Interest on Past Losses in Business Litigation. For example, the California Constitution applies a general the rate of interest at 7% per annum, and in Palomar Grading & Paving, Inc.

Example: Judgment of $2000; interest rate of 6% per year; 280 days since the date the small claims petition was filed. $2000 x .06 = $120 annual interest. $120/365 = $.329 per day. $. 329 x 280 days = $92.05 interest owed.

(5) Except as provided under subsection (1) of this section, judgments for unpaid consumer debt, as defined in RCW 6.01. 060, shall bear interest from the date of entry at a rate of nine percent.