Washington Conveyance of Deed to Lender in Lieu of Foreclosure

Description

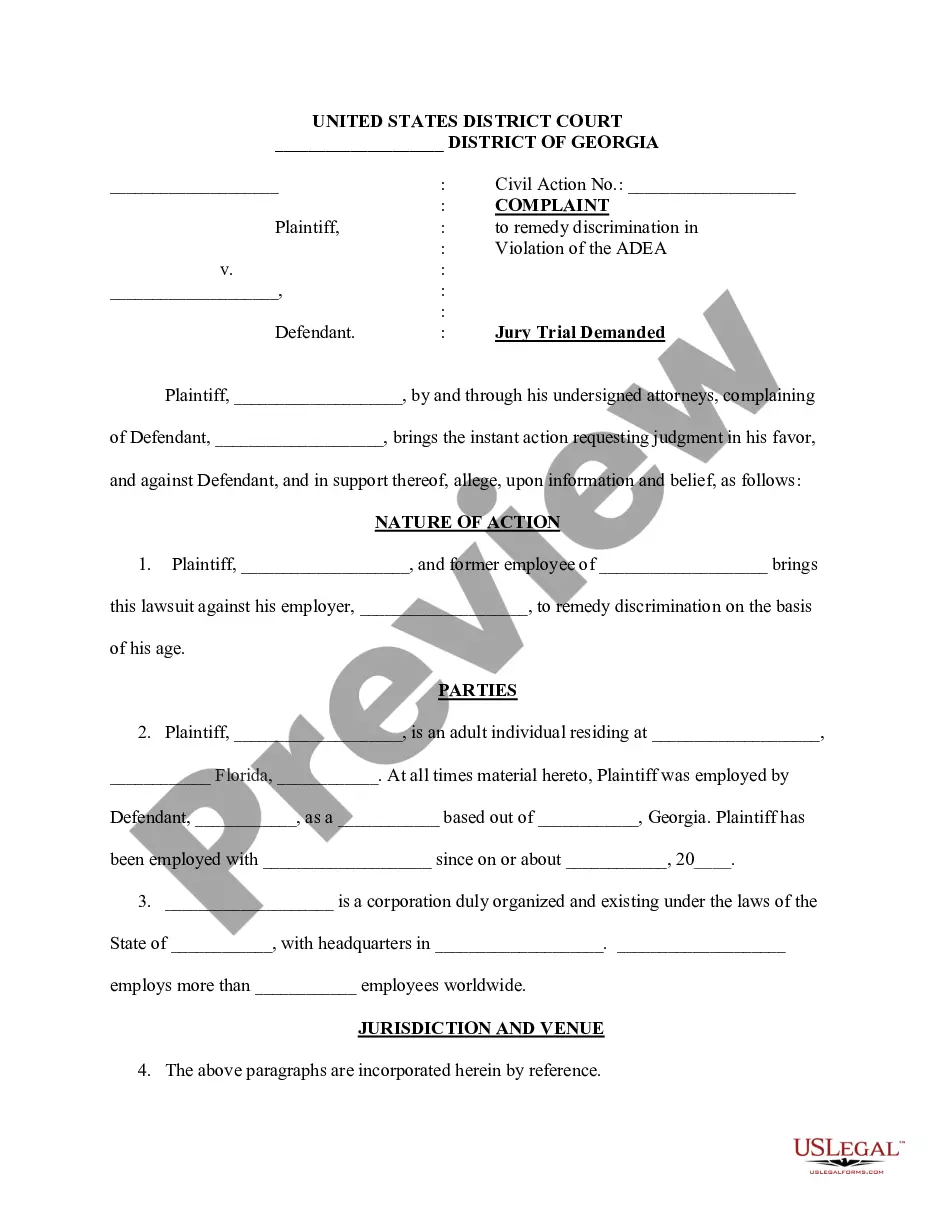

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

US Legal Forms - one of the most significant libraries of legal forms in the United States - gives an array of legal file layouts you can download or printing. While using website, you can find 1000s of forms for organization and specific uses, sorted by types, suggests, or keywords.You can find the newest types of forms much like the Washington Conveyance of Deed to Lender in Lieu of Foreclosure within minutes.

If you already have a monthly subscription, log in and download Washington Conveyance of Deed to Lender in Lieu of Foreclosure through the US Legal Forms collection. The Acquire option can look on each and every form you view. You get access to all previously downloaded forms in the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, listed below are straightforward recommendations to help you began:

- Be sure to have selected the right form to your town/area. Go through the Review option to check the form`s content. Read the form outline to actually have chosen the right form.

- In case the form does not suit your specifications, use the Search field at the top of the display screen to find the the one that does.

- Should you be content with the shape, validate your choice by simply clicking the Purchase now option. Then, select the costs program you like and offer your qualifications to sign up for an accounts.

- Procedure the deal. Use your bank card or PayPal accounts to finish the deal.

- Choose the format and download the shape on your device.

- Make modifications. Fill up, edit and printing and indication the downloaded Washington Conveyance of Deed to Lender in Lieu of Foreclosure.

Every single design you included in your money lacks an expiry particular date and is also your own property permanently. So, in order to download or printing one more version, just visit the My Forms segment and then click about the form you want.

Gain access to the Washington Conveyance of Deed to Lender in Lieu of Foreclosure with US Legal Forms, the most considerable collection of legal file layouts. Use 1000s of specialist and condition-particular layouts that meet up with your business or specific requires and specifications.

Form popularity

FAQ

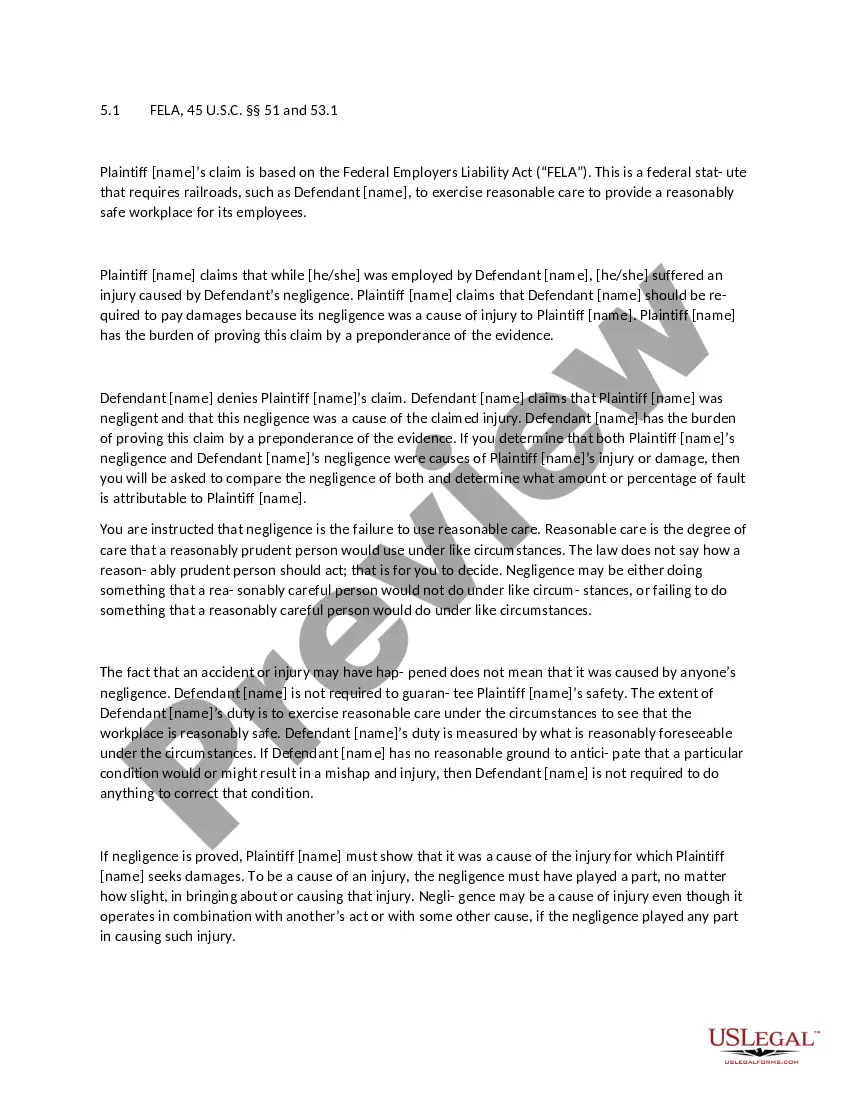

A "deed in lieu" is a transaction in which the homeowner voluntarily transfers title to the property to the bank in exchange for releasing the mortgage (or deed of trust) securing the loan. Unlike with a short sale, one benefit to a deed in lieu is that you don't have to take responsibility for selling your house.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

A deed in lieu means you and your lender reach a mutual understanding that you're no longer able to make your mortgage loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably. In exchange, the lender releases you from your obligations under the mortgage.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

A "deed in lieu of foreclosure" occurs when a lender agrees to accept a deed (title) to the property instead of foreclosing. With a deed in lieu of foreclosure, the deficiency amount is the difference between the total mortgage debt and the property's fair market value.

Understanding Deed in Lieu of Foreclosure In this process, the mortgagor deeds the collateral property, which is typically the home, back to the lender serving as the mortgagee in exchange for the release of all obligations under the mortgage.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

Deed in lieu of foreclosure. A deed given by the mort-gagor to the mortgagee when the mortgagor is in default under the terms of the mortgage. This avoids foreclosure but does not remove liens from the property; "friendly foreclosure."

There's less negative impact on your credit score. As with any negative event impacting your credit, the higher your score is before the negative impact, the bigger the drop will be. With a deed in lieu of foreclosure, the drop might be anywhere from 50 to 125 points or higher.