Washington Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

It is possible to commit several hours on-line searching for the lawful record template that fits the federal and state specifications you need. US Legal Forms gives thousands of lawful forms that are examined by professionals. It is possible to download or print the Washington Line of Credit Promissory Note from my service.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Download option. Next, you are able to total, change, print, or signal the Washington Line of Credit Promissory Note. Every single lawful record template you buy is the one you have eternally. To acquire yet another backup of any obtained develop, proceed to the My Forms tab and then click the related option.

Should you use the US Legal Forms website for the first time, follow the straightforward recommendations below:

- First, make sure that you have chosen the correct record template for your area/town of your liking. Browse the develop explanation to ensure you have picked the appropriate develop. If accessible, utilize the Preview option to search through the record template at the same time.

- If you wish to get yet another model from the develop, utilize the Research area to find the template that suits you and specifications.

- Once you have located the template you desire, simply click Purchase now to proceed.

- Select the rates plan you desire, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your bank card or PayPal bank account to fund the lawful develop.

- Select the file format from the record and download it to your product.

- Make adjustments to your record if necessary. It is possible to total, change and signal and print Washington Line of Credit Promissory Note.

Download and print thousands of record web templates using the US Legal Forms web site, which provides the biggest collection of lawful forms. Use specialist and status-specific web templates to tackle your company or personal needs.

Form popularity

FAQ

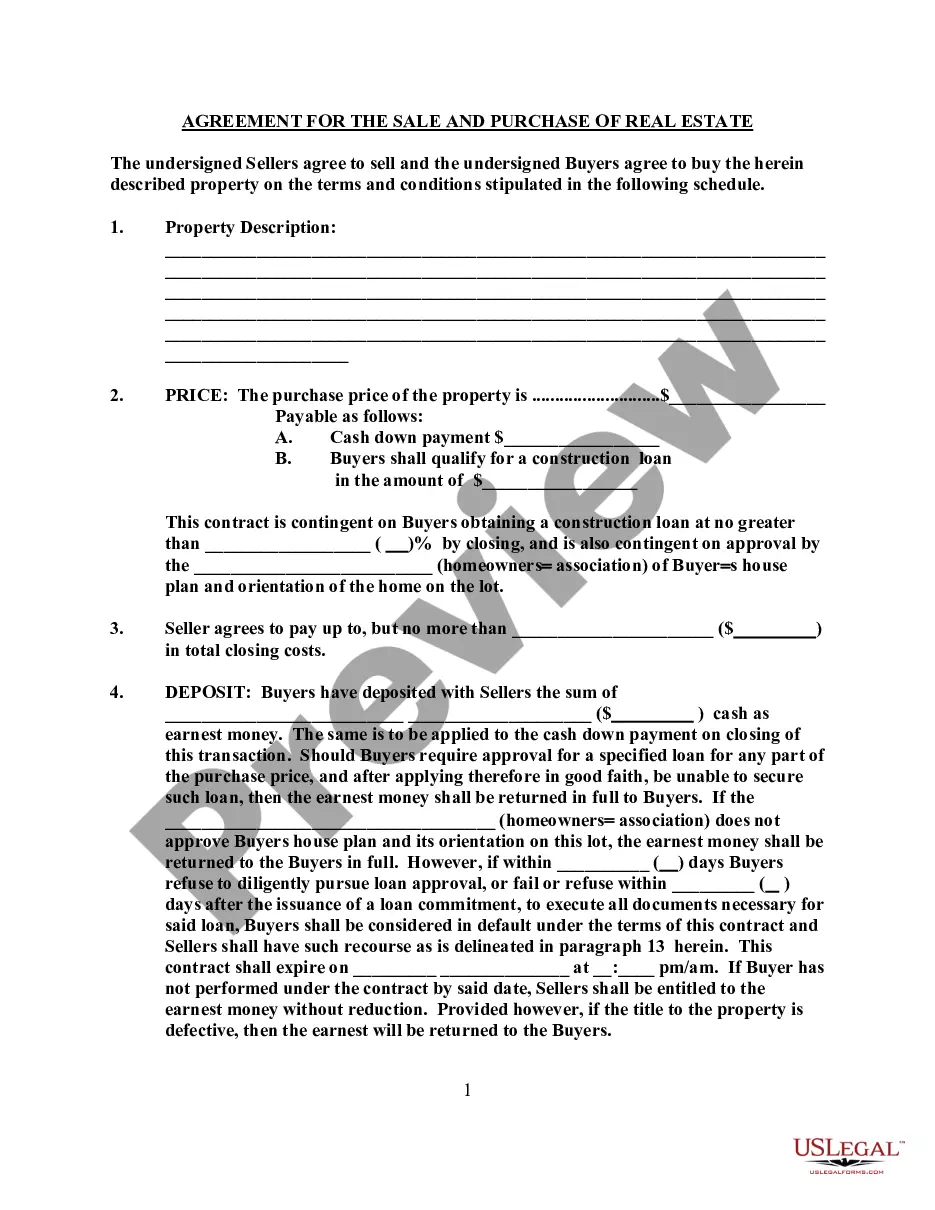

This Note evidences a revolving line of credit. Advances under this Note, as well as directions for payment from Borrower's accounts, may be requested orally or in writing by Borrower or by an authorized person. Lender may, but need not, require that all oral requests be confirmed in writing.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

What is a HELOC note? It's a promissory note, which creates a legal agreement obligating a borrower to repay a debt to a lender. Signing off on a HELOC promissory note conveys responsibilities to you as the borrower and extends rights to the lender. Both are important if you're considering a home equity line of credit.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

In the most sensitive cases, you should notarize your promissory note and any amended versions. This gives your document added authenticity and legal protection. If a borrower defaults or fails to pay, and you need to go to court, a notary signature could do you a solid in the long run.