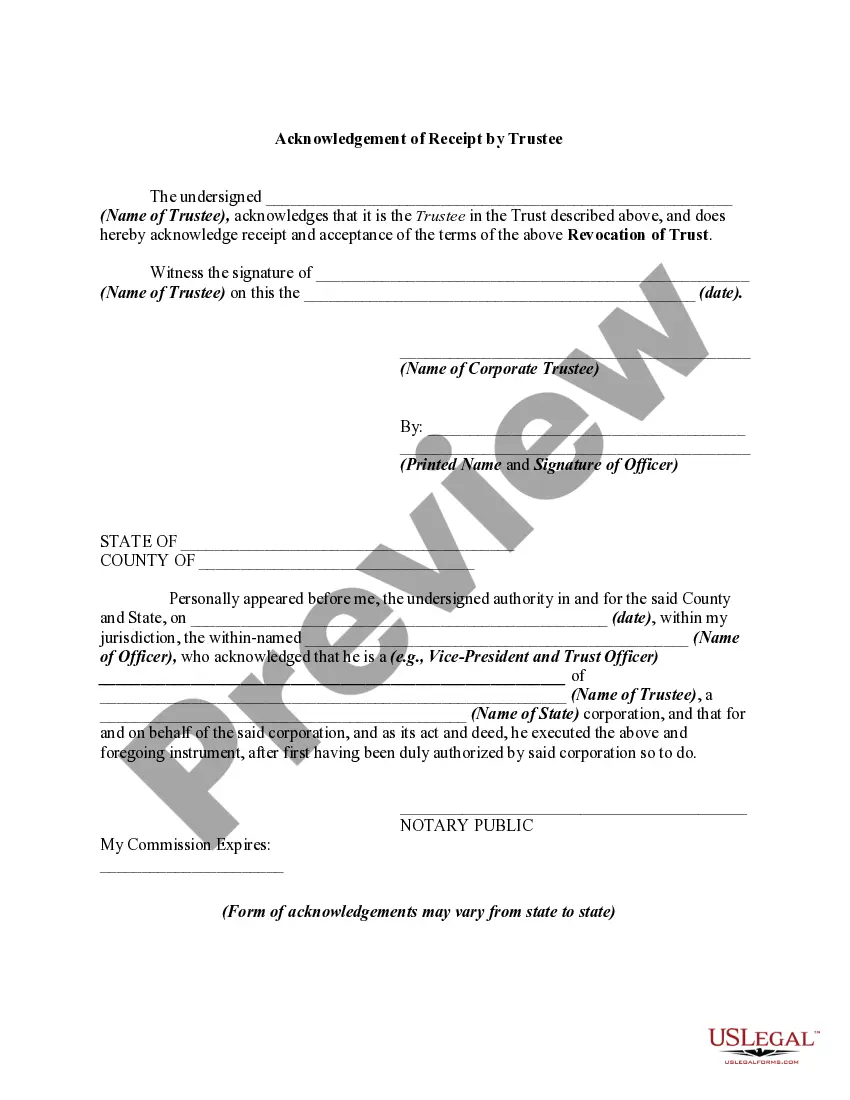

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a revocation of a trust by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee

Description

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a range of legal template documents available for download or creation.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of documents such as the Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee within moments.

Click the Preview button to examine the content of the form.

Review the form description to confirm that you have selected the appropriate one.

- If you have a membership, sign in and download the Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee from the US Legal Forms library.

- The Download option will appear for each document you view.

- You can access all previously downloaded documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

Form popularity

FAQ

A trustee holds significant responsibilities and powers over a trust. They administer the trust according to its terms and act in the best interests of the beneficiaries. This includes managing assets, making distributions, and ensuring compliance with applicable laws, such as those related to the Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. Understanding these powers is essential for both trustees and beneficiaries to ensure smooth trust management.

Revoking a trust can have various tax implications, particularly regarding income and estate taxes. Generally, the assets returned to the grantor are treated as part of their estate, which may affect estate tax calculations. In this context, understanding the Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee is crucial, as it ensures all tax obligations are met and documented correctly. For personalized guidance, consider exploring resources like uslegalforms, which can help navigate the complexities of tax-related matters in trust revocation.

Once a trust is revoked, the assets held in that trust revert back to the grantor or are distributed according to the grantor's instructions. This means that any instructions previously set forth in the trust are no longer binding. In relation to the Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, notifying all parties is essential to prevent any misunderstandings. After revocation, the grantor has full control over the assets and can decide how to manage or distribute them going forward.

When a trust is revoked, it means that the person who created the trust has decided to dissolve it, thus eliminating its legal effect. In the context of Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, this process is formalized by notifying the trustee and other relevant parties. This action typically involves a written declaration, ensuring that all parties are aware of the trust's termination. Understanding this process helps in maintaining clarity regarding asset management and distribution.

The best trust for asset protection often depends on your individual circumstances and goals. Many individuals opt for irrevocable trusts, as they can provide significant protection from creditors and estate taxes. Furthermore, these trusts can help ensure your assets are distributed according to your wishes. Consulting with professionals familiar with Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee can greatly enhance your trust planning.

Yes, you can place a Certificate of Deposit (CD) into an irrevocable trust, thereby safeguarding your assets from creditors while also potentially benefiting from tax advantages. However, you should be aware that once assets are transferred into an irrevocable trust, you cannot regain control over them. For effective management of such transactions, understanding the nuances is essential, particularly regarding Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.

One of the most significant mistakes parents make when setting up a trust fund is failing to update the trust regularly. Life changes, such as the birth of a child or shifts in financial circumstances, necessitate updates to ensure the trust reflects current wishes. Additionally, not clearly communicating the trust's purpose to beneficiaries can lead to confusion and dissatisfaction. Addressing these concerns is crucial, especially when considering Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.

Filling out a revocable living trust involves several straightforward steps. Start by clearly stating your identity as the grantor, followed by naming the trust and listing the assets it will hold. Next, designate a trustee and outline how assets should be managed or distributed. To ease the process, consider using resources like uslegalforms for templates that align with Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.

A trust revocation declaration is a legal document stating your intent to revoke a previously established trust. For instance, you might specify in the declaration that you no longer wish for the trust to hold specific assets. This declaration must include your name, the name of the trust being revoked, and your signature. It's essential to ensure the revocation aligns with lawful practices regarding Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.

In a revocable trust, some assets may be unsuitable due to their unique legal features. For instance, certain retirement accounts and health savings accounts cannot be placed in a revocable trust without tax implications. Moreover, vehicles and real estate can complicate matters if they have existing liens. To navigate these challenges effectively, seek assistance with Washington Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.