Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

Identifying the correct legal document format can present challenges. Clearly, there are numerous templates accessible online, but how can you find the legal document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, which can be utilized for both commercial and personal purposes. Each template is reviewed by experts and meets state and federal requirements.

If you are already registered, sign in to your account and then click the Download button to obtain the Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Use your account to browse through the legal documents you may have previously purchased. Visit the My documents section of your account to download an additional copy of the document you need.

US Legal Forms is the largest repository of legal documents where you can find a variety of file templates. Utilize this service to download professionally crafted paperwork that adheres to state regulations.

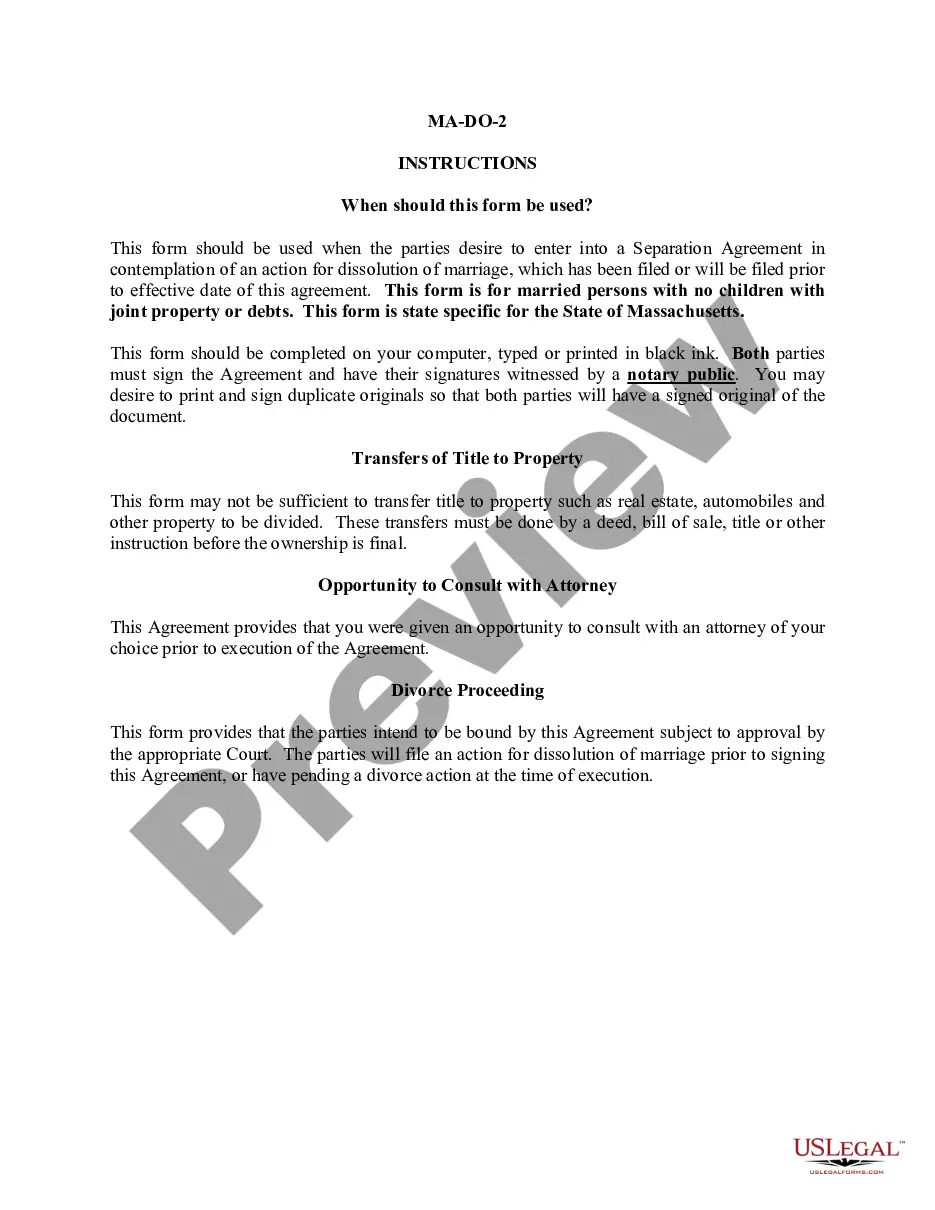

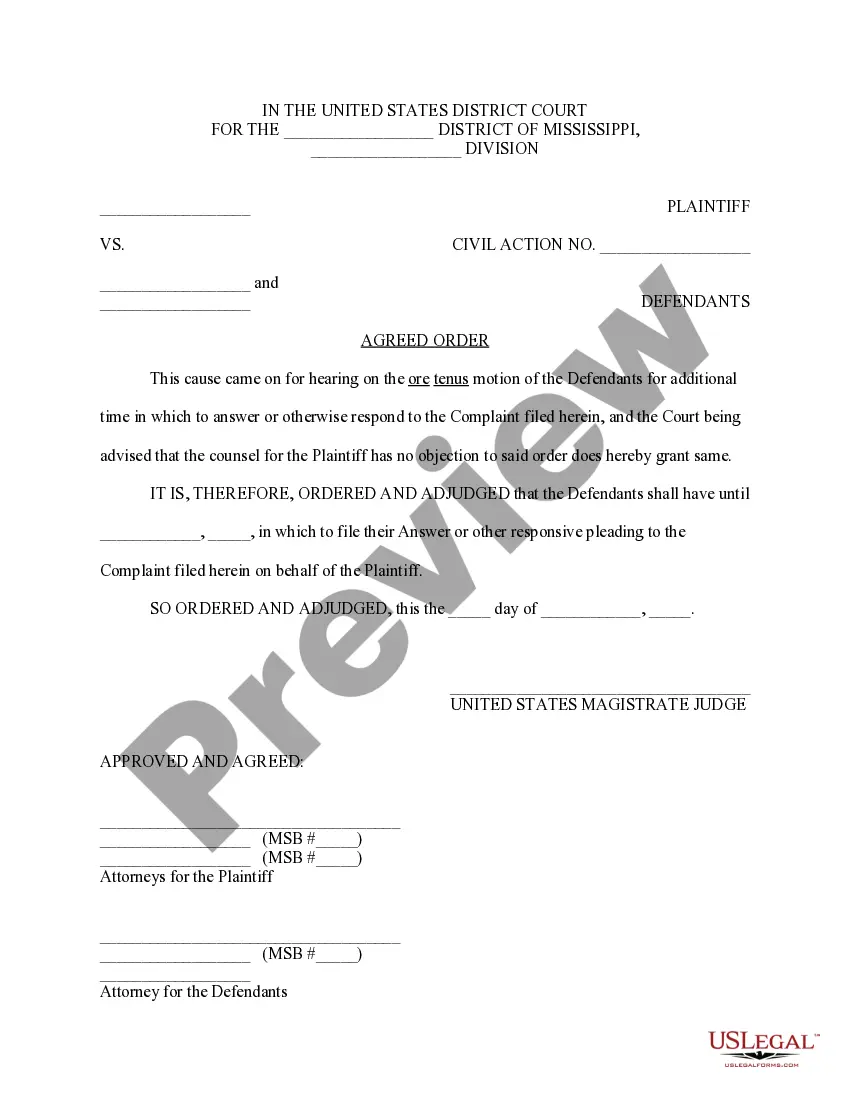

- First, ensure you have chosen the correct template for your city/state. You can review the document using the Review option and read the document summary to confirm it is indeed the one for you.

- If the document does not meet your requirements, utilize the Search field to find the appropriate template.

- Once you are confident that the document is suitable, select the Acquire now button to receive the template.

- Choose the payment plan you desire and input the necessary details. Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

- Complete, edit, print, and sign the downloaded Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

Form popularity

FAQ

In Washington, most employers must provide workers' compensation insurance for their employees, which covers workplace injuries and illnesses. Independent contractors, however, may not be required to carry this insurance unless they employ others or fall into a specific category outlined by the state. As an independent contractor, you should consider including insurance recommendations in your Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to ensure appropriate coverage and compliance.

The key difference between an employee and an independent contractor in Washington state lies in the level of control and independence. Employees typically work under an employer's direction, following set hours and receiving benefits, while independent contractors operate their own business and have more flexibility in how they complete their work. Understanding these differences is crucial when drafting a Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, as it impacts tax responsibilities and liability issues.

To become an independent contractor in Washington state, you must first be clear about your business structure and register your entity with the state, if necessary. You will also need to obtain a business license and any required permits that pertain to your industry. Alongside this, creating a clear Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause will help protect your rights and outline your relationship with clients.

Certain categories of workers are exempt from workers' compensation in Washington state. For example, sole proprietors, partners in a partnership, and members of limited liability companies (LLCs) may not need coverage. Additionally, those who work as self-employed independent contractors can often opt out of this requirement. It’s important to carefully review your Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to understand your specific obligations.

As a consultant in Washington state, you do need a business license to legally operate. This requirement applies even if you work under a Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Obtaining this license not only enhances your credibility but also addresses potential liability issues when dealing with clients. You can acquire a business license by consulting the Washington Department of Revenue.

Yes, as a sole proprietor in Washington state, obtaining a business license is generally required. This license allows you to operate legally and can help you establish your business identity. When drafting a Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, including your business details will emphasize your professionalism. You can apply for the necessary licenses through the Washington Secretary of State’s office.

In Washington state, you typically need a license to operate as a contractor. The requirements may vary based on the type of contracting work you perform. For those entering into a Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, having the right license can help ensure compliance and protect your business. Make sure to check with the Washington State Department of Labor & Industries for the necessary licenses.

Yes, you can act as an owner-builder in Washington state, allowing you to oversee your construction project without employing a licensed contractor. You must prove adherence to local building codes and regulations. A Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can benefit you by minimizing your liability while maximizing clarity in your building efforts.

In Washington, you can perform a limited amount of work without a contractor license, specifically for minor projects, typically valued under $1,000. However, the rules can vary, depending on the type of work and local codes. To ensure you stay compliant, consider creating a Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause that clearly delineates your scope of work.

You can indeed be your own contractor in Washington state. If you plan to manage your own construction projects, you must adhere to state regulations, such as acquiring any necessary permits. Utilizing a Washington Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help safeguard your responsibilities and liabilities throughout your projects.