Washington Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

You can dedicate hours online looking for the appropriate legal document template that meets the local and federal requirements you need. US Legal Forms offers countless legal forms that are vetted by professionals.

You can obtain or print the Washington Certificate of Heir for the Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) using our service.

If you possess a US Legal Forms account, you can sign in and hit the Download button. Then, you can fill out, modify, print, or sign the Washington Certificate of Heir for the Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Each legal document template you obtain is yours indefinitely. To retrieve another copy of a purchased form, navigate to the My documents section and click the corresponding button.

Make adjustments to your document if necessary. You can fill out, modify, sign, and print the Washington Certificate of Heir for the Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

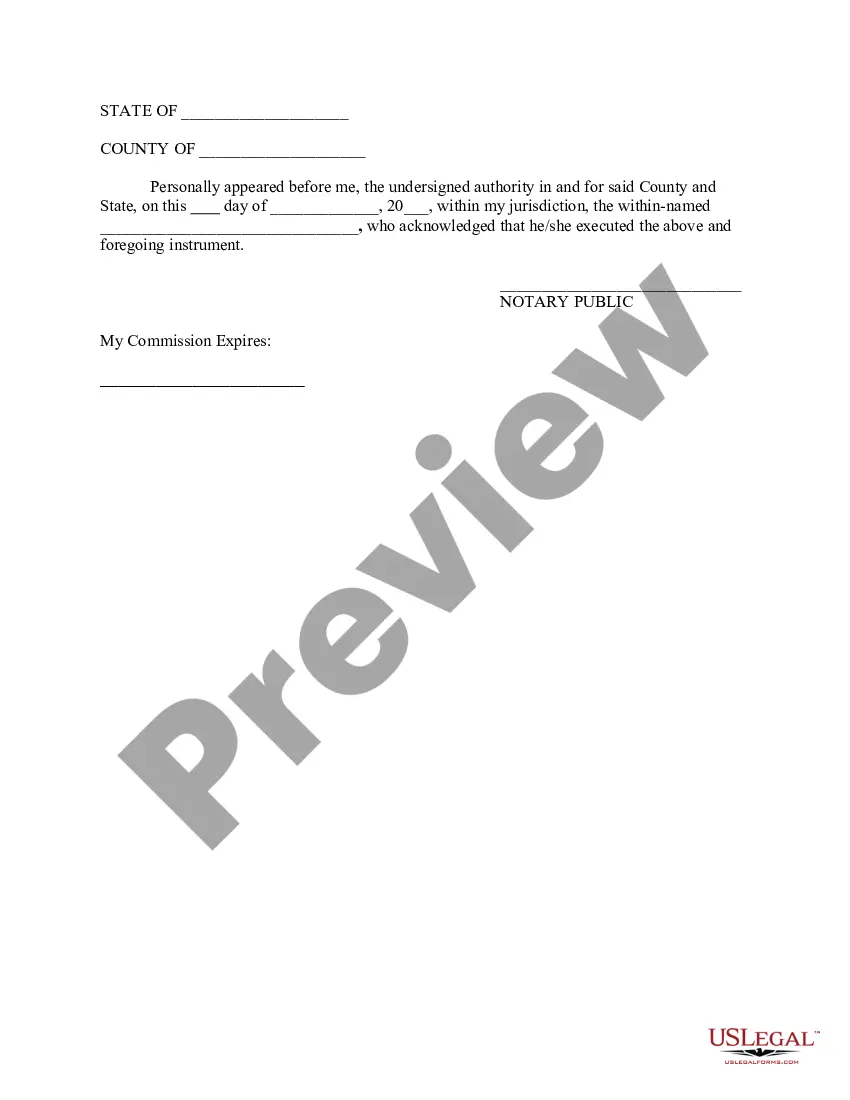

- First, ensure you have selected the correct document template for the area/city of your choice. Check the form description to confirm you have chosen the right one. If available, use the Review button to view the document template simultaneously.

- If you wish to find another version of the form, utilize the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Purchase now to move forward.

- Select the pricing plan you prefer, input your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

Form popularity

FAQ

How do I normally get proof of vehicle ownership? A vehicle's buyer and seller must both turn paperwork in to the Washington Department of Licensing (DOL) within five days of the vehicle's sale. The seller signs over the title to you. The DOL then issues you a new title.

If you happen to be the joint-owner, administrator, or beneficiary, you may only be required to provide the death certificate and the vehicle's title to your local WA title office. The title office agent will retitle the vehicle for you without an attorney or court order.

Giving the car to a family member You must complete a Bill of Sale and put the sale price as zero since it's a gift. Sign and hand over the title and submit a Vehicle Report of Sale to finalize the process and pay $13.25 ing to the Washington State Licensing Department.

If the decedent died without a Will, a petition is filed to appoint a personal representative to administer the estate and the assets of the decedent pass by way of the intestate succession laws of the State of Washington. The court issues letters of administration in the case of a probate without a Will.

Washington-titled vehicles / vessels Proof of payment in Washington may be required. A statement of gift is required from the donor and does not need to be notarized. "Gift" written on the title as the purchase price is acceptable as the statement of gift.

Methods allowing tax exemption Trip Permit - The vehicle or trailer must leave the dealer's premises under the authority of a trip permit. An affidavit must be used when this method is used. If the vehicle or trailer has valid Washington plates, the plates must be removed prior to final delivery.

Gifting a Car 101: Make Sure You Can Afford the Gift Tax Depending on where you live and who you're giving the car to, you may be responsible for paying a gift tax. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

While some car owners consider selling the car for a dollar instead of gifting it, the DMV gift car process is the recommended, not to mention more legitimate, way to go.