Washington Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

Selecting the appropriate sanctioned document template can be quite a challenge. Naturally, there are numerous templates accessible online, but how will you locate the sanctioned form you need.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Washington Accounts Receivable - Guaranty, which you can apply for both business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Washington Accounts Receivable - Guaranty. Use your account to review the legal forms you have purchased previously. Visit the My documents tab of your account to retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Washington Accounts Receivable - Guaranty. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Utilize the service to download professionally crafted papers that adhere to state requirements.

- First, ensure you have selected the correct form for your city/state.

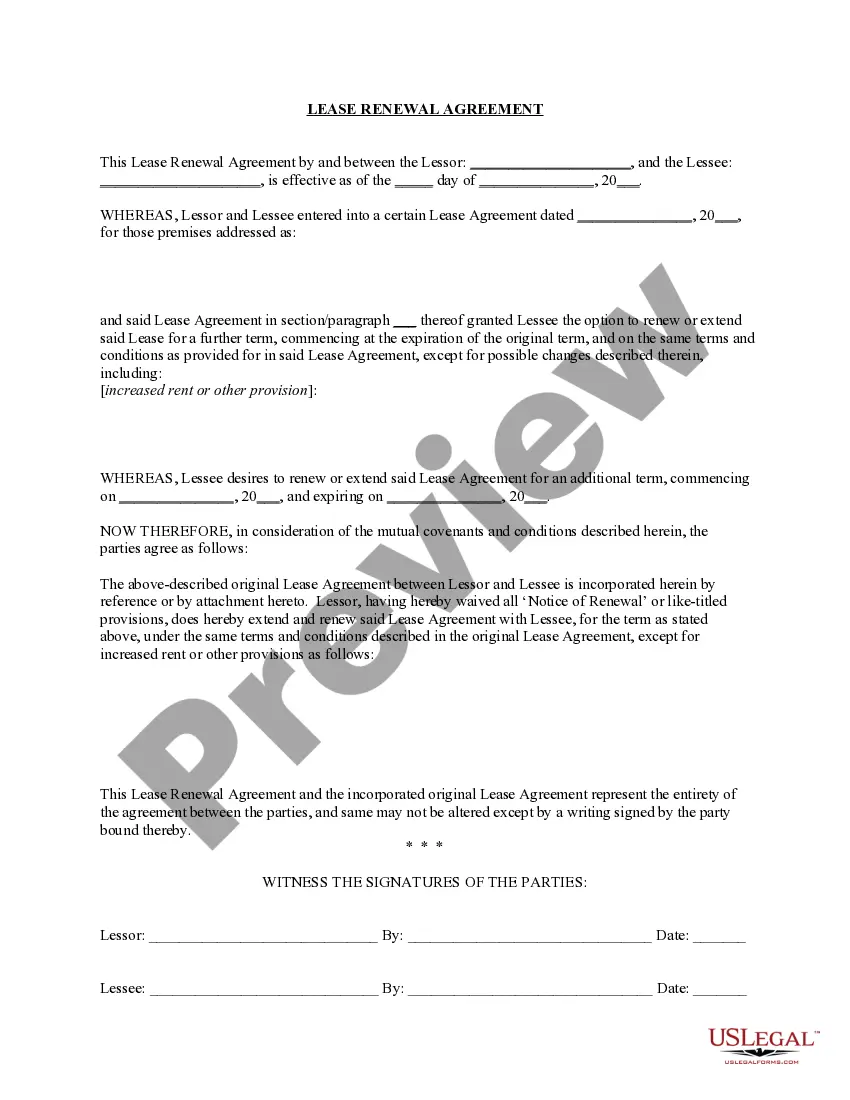

- You can view the form using the Preview button and examine the form outline to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident that the form is appropriate, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Filling out a guarantee form for Washington Accounts Receivable - Guaranty requires careful attention to detail. First, gather all necessary information about the parties involved, including names, addresses, and contact details. Next, clearly specify the amount being guaranteed and the terms of the guarantee. Finally, review the form for accuracy before submitting, as this ensures the validity of the Washington Accounts Receivable - Guaranty.

Is accounts receivable a hard job? Accounts receivable can be challenging at times because it requires a great deal of accuracy, organization, and attention to detail. However, with proper training and experience, it can become easier over time.

The key role of an employee who works as an Accounts Receivable is to ensure their company receives payments for goods and services, and records these transactions ingly. An Accounts Receivable job description will include securing revenue by verifying and posting receipts, and resolving any discrepancies.

An accounts receivable processor is an important part of any company. They are responsible for handling the money that comes in from customers. Their Salary can vary depending on their experience, but it is typically a good-paying job, and they get paid $35,000+ a year.

Accounts receivable measures the money that customers owe to a business for goods or services already provided. Analyzing a company's accounts receivable will help investors gain a better sense of a company's overall financial stability and liquidity.

Accounts receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable are listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.