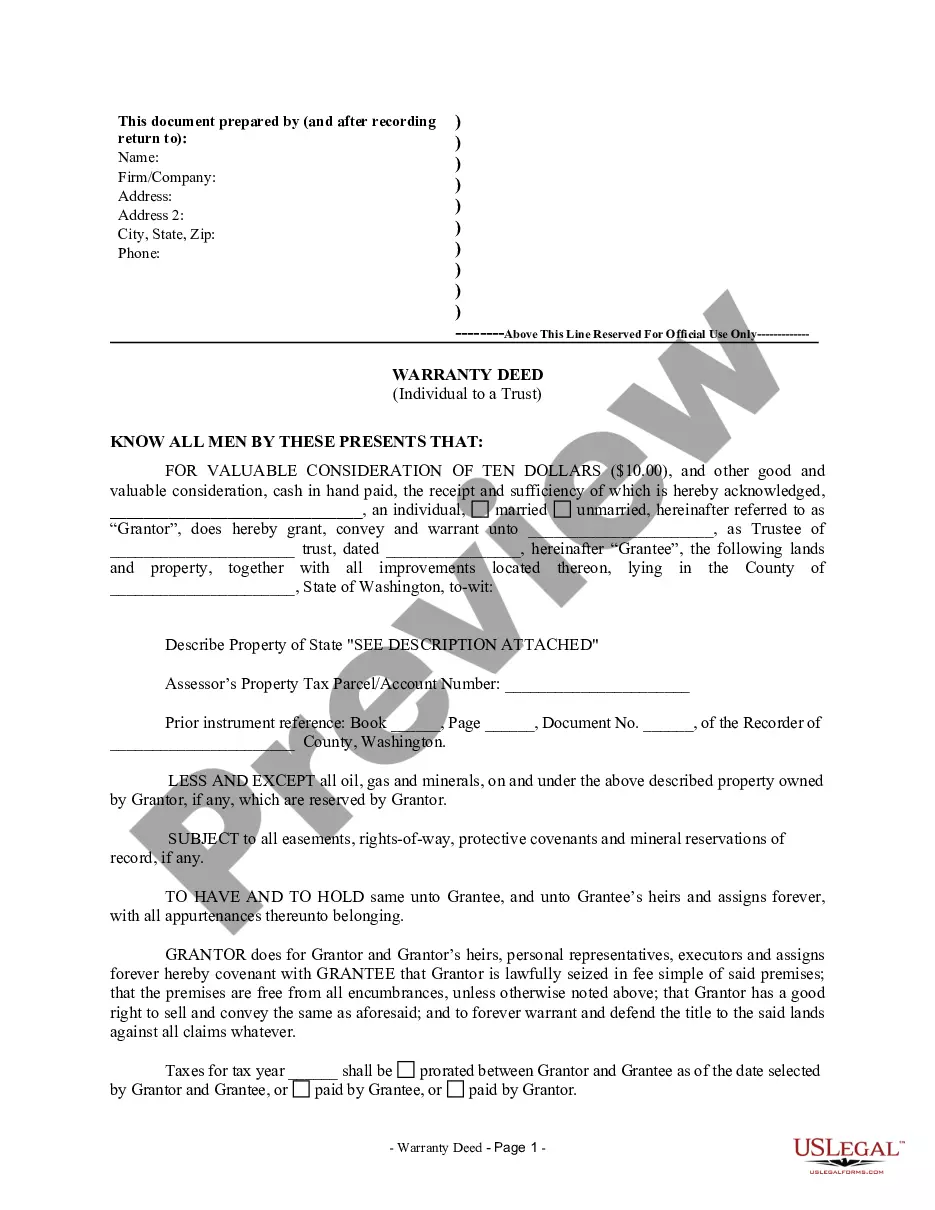

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Washington Warranty Deed from Individual to a Trust

Description

How to fill out Washington Warranty Deed From Individual To A Trust?

Out of the multitude of platforms that offer legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before purchasing them. Its comprehensive catalogue of 85,000 samples is grouped by state and use for efficiency. All of the forms available on the platform have been drafted to meet individual state requirements by certified legal professionals.

If you have a US Legal Forms subscription, just log in, look for the form, click Download and obtain access to your Form name from the My Forms; the My Forms tab holds your downloaded forms.

Follow the tips listed below to obtain the form:

- Once you find a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new template using the Search engine if the one you have already found isn’t appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

When you’ve downloaded your Form name, you are able to edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab can be reused multiple times, or for as long as it remains the most updated version in your state. Our service provides easy and fast access to samples that suit both lawyers and their clients.

Form popularity

FAQ

A trustee deed offers no such warranties about the title.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

A deed conveys ownership; a deed of trust secures a loan.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.