Vermont Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

If you need to thorough, obtain, or generate authentic document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Different templates for commercial and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to locate the Vermont Self-Employed Utility Services Contract with just a few clicks.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Vermont Self-Employed Utility Services Contract. Each legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Vermont Self-Employed Utility Services Contract with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to access the Vermont Self-Employed Utility Services Contract.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

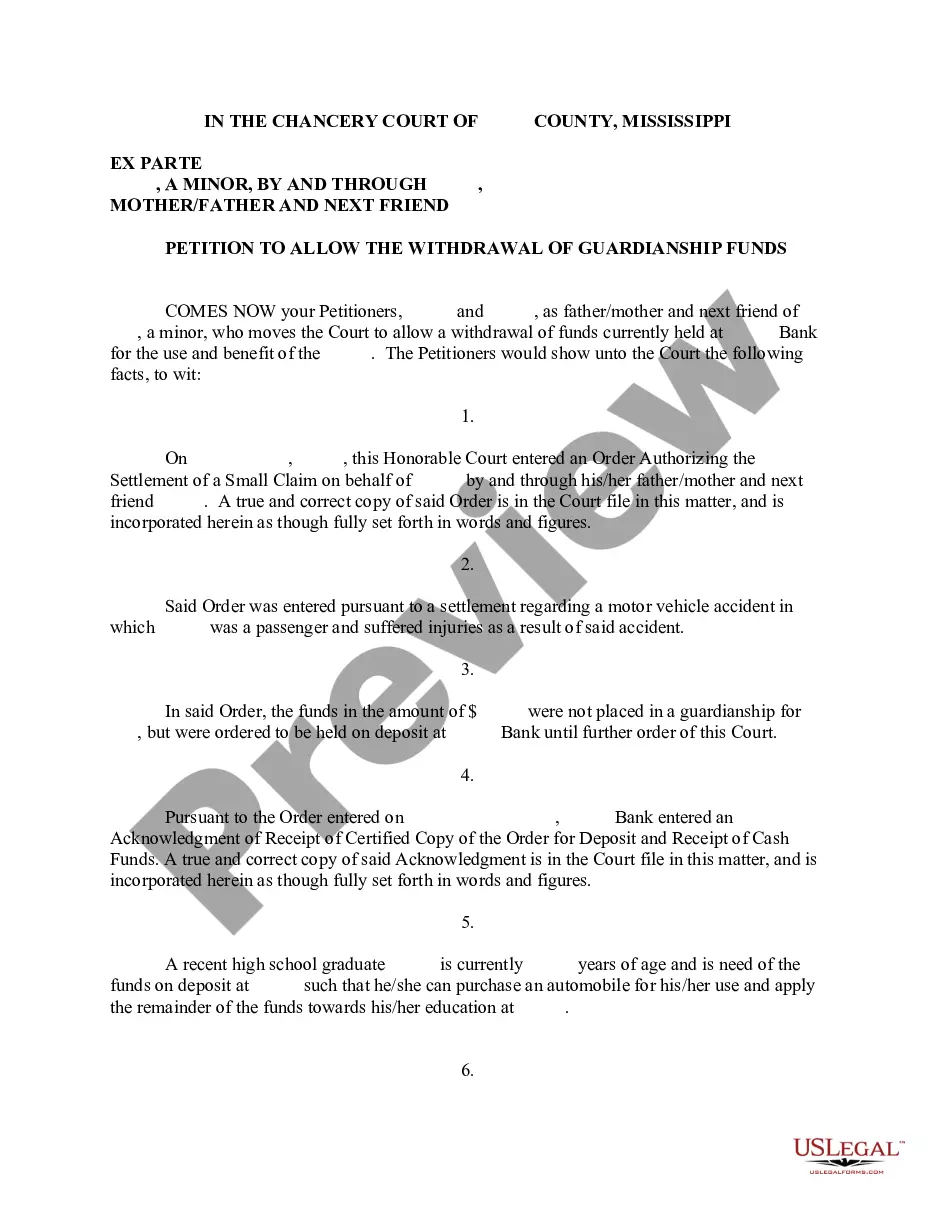

- Step 2. Utilize the Preview function to review the form’s details. Don’t forget to read the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to explore other models in the legal form library.

- Step 4. Once you have located the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Independent contractors in Vermont must adhere to specific legal requirements, including obtaining necessary licenses and permits. If you are considering a Vermont Self-Employed Utility Services Contract, familiarize yourself with these regulations to ensure compliance. Using platforms like US Legal Forms can guide you through the legalities, helping you create valid contracts and understand your rights and obligations.

In Vermont, contract labor is generally not subject to sales tax unless it involves taxable services. If you are working under a Vermont Self-Employed Utility Services Contract, it is crucial to determine if your work falls under any taxable categories. This understanding can prevent unexpected tax burdens and help you organize your financial responsibilities.

Yes, service contracts can be taxable in Vermont depending on the nature of the services provided. When engaging in a Vermont Self-Employed Utility Services Contract, you should evaluate whether the contract includes taxable services. Consulting with a tax professional can help clarify your obligations and ensure you manage your tax liabilities effectively.

In Vermont, most services are not subject to sales tax, but there are exceptions. For instance, specific services, such as utility services, are taxable under Vermont law. If you are entering into a Vermont Self-Employed Utility Services Contract, it is essential to understand the tax implications associated with these services to ensure compliance.

Writing a contract agreement for services, like a Vermont Self-Employed Utility Services Contract, involves several key steps. First, clearly outline the terms of service, including the scope of work, payment terms, and deadlines. Next, both parties should review the agreement to ensure understanding and agreement on all terms. Finally, consider using a platform like US Legal Forms to access templates that simplify the process and ensure legal compliance.

In Vermont, whether contractors need a license depends on the type of work they perform. Generally, certain trades may require licensing, while others do not. For self-employed utility services, it is advisable to check local regulations and ensure compliance. Having a Vermont Self-Employed Utility Services Contract can also help clarify any licensing requirements related to your specific services.

To set up a service contract, begin by outlining the services you will provide and any specific terms related to payment and deadlines. You can use a Vermont Self-Employed Utility Services Contract template to guide you through the process. Clearly stating the roles and responsibilities of both parties is essential for avoiding future disputes. This structured approach helps ensure that both you and your client are on the same page.

Yes, having a contract is highly recommended when you are self-employed. A Vermont Self-Employed Utility Services Contract can help clarify your services, payment terms, and deadlines. It protects both you and your clients by ensuring everyone understands their responsibilities. This clarity can lead to smoother working relationships and fewer misunderstandings.

Yes, it is legal to work without a signed contract, but it is risky. A Vermont Self-Employed Utility Services Contract provides a framework for your working relationship and serves as a reference in case of disputes. Without a contract, you might face challenges regarding payment, deadlines, and responsibilities. To protect yourself, consider using a contract for all your self-employed work.

The legal requirements for being self-employed vary by state, but generally include registering your business and obtaining necessary licenses. In Vermont, a Vermont Self-Employed Utility Services Contract may also be required to formalize your services. Additionally, you should keep accurate financial records and fulfill tax obligations. Meeting these requirements helps you operate legally and efficiently.