Vermont Masonry Services Contract - Self-Employed

Description

How to fill out Masonry Services Contract - Self-Employed?

You can spend multiple hours online trying to locate the official document template that meets the local and national requirements you require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

It's easy to obtain or print the Vermont Masonry Services Contract - Self-Employed from the service.

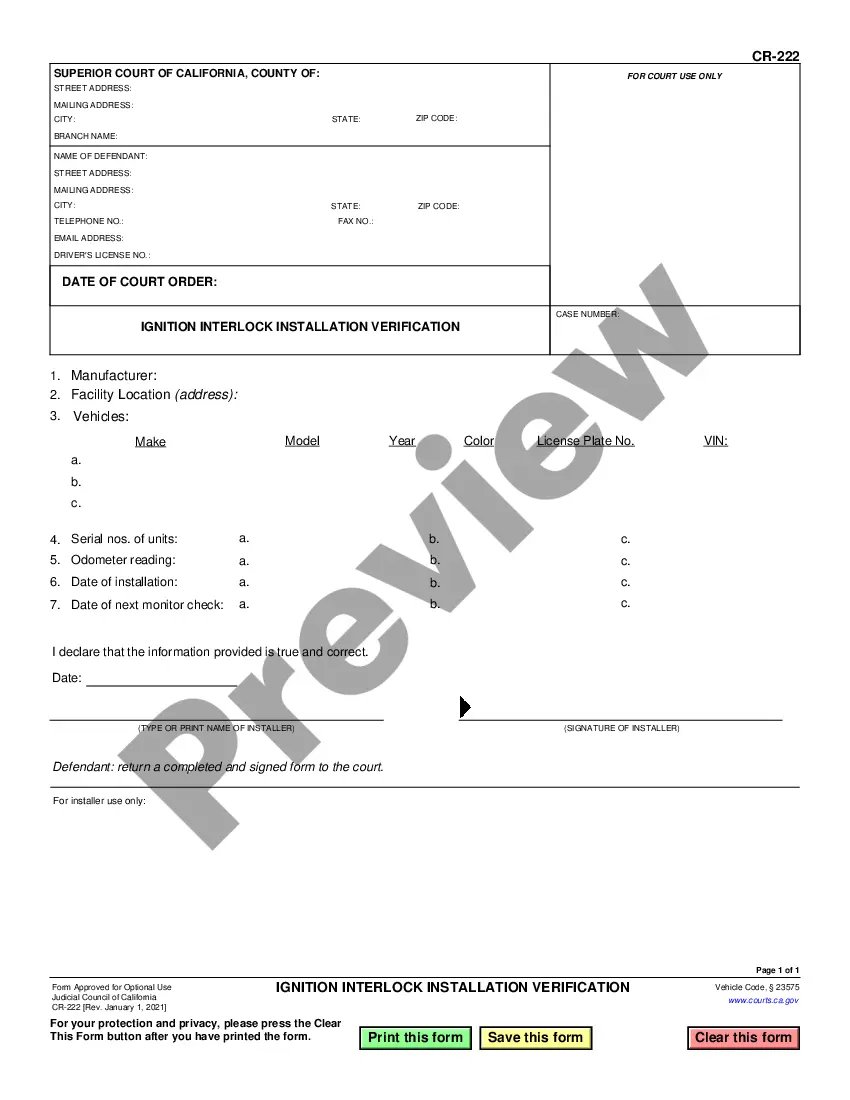

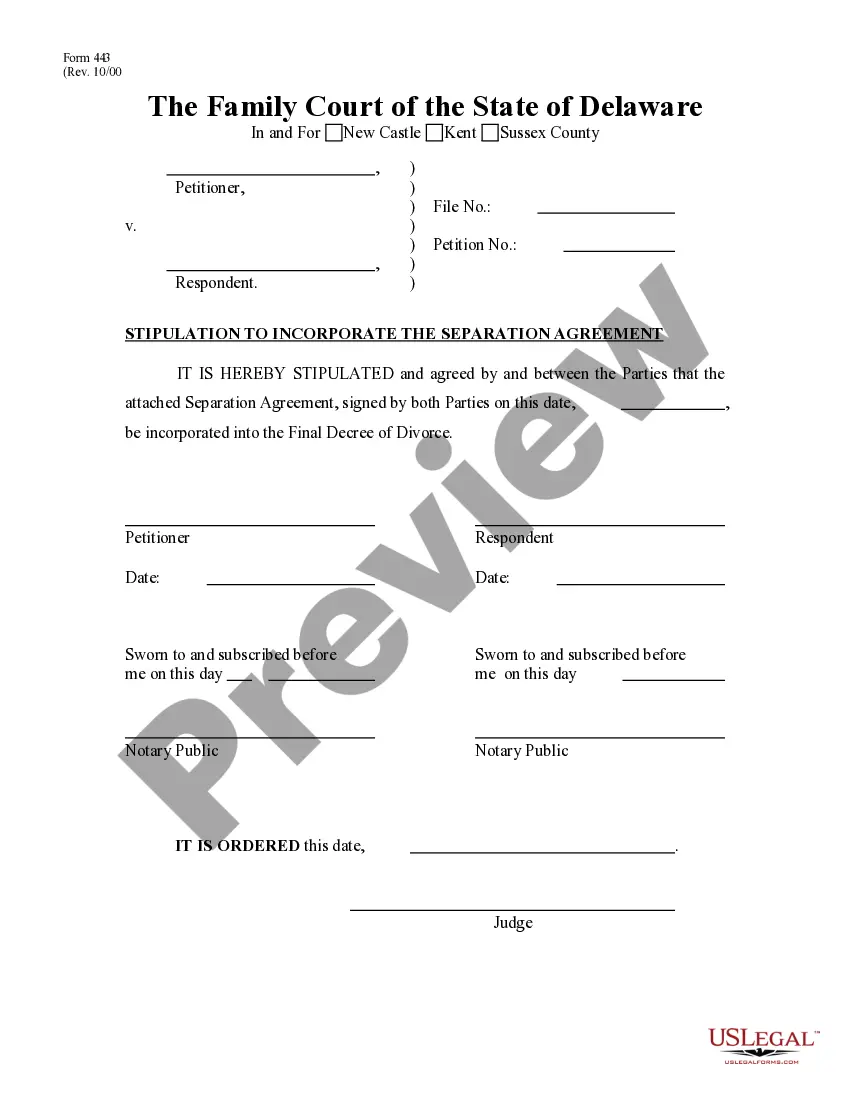

Check the form description to confirm that you've chosen the right document. If available, utilize the Review button to preview the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Vermont Masonry Services Contract - Self-Employed.

- Each legal document template you purchase is yours permanently.

- To get an additional copy of a purchased form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/region.

Form popularity

FAQ

Recent changes in regulations for self-employed individuals may affect tax obligations and benefits. It's vital to stay updated on these rules, as transitional clauses can often impact your approach to creating a Vermont Masonry Services Contract - Self-Employed. Consulting resources like US Legal Forms can help you navigate these changes and ensure your contract complies with current laws.

In Vermont, whether contractors need to be licensed depends on the type of work they perform. While some specialized trades may require a license, many general contracting jobs do not. However, obtaining a Vermont Masonry Services Contract - Self-Employed is a smart way to ensure you meet all local regulations while formalizing your offerings to clients.

Absolutely, you can be self-employed and maintain a contract. A Vermont Masonry Services Contract - Self-Employed serves as a formal agreement between you and your clients, establishing the expectations for your work. This arrangement helps you clarify scope, timelines, and payment terms, creating a foundation for successful professional relationships.

To set yourself up as an independent contractor, start by registering your business and obtaining any necessary permits or licenses. You will also want to create a Vermont Masonry Services Contract - Self-Employed that clearly defines your services and payment terms. Additionally, consider opening a separate bank account for your business transactions to manage your finances effectively, ensuring a smooth operation.

Yes, you can have a contract if you're self-employed. In fact, having a Vermont Masonry Services Contract - Self-Employed is an essential element of your business. This contract outlines the terms of your work, payment, and responsibilities, ensuring clarity between you and your clients. By using a well-structured contract, you can protect your interests and promote professionalism.

employed individual typically uses an independent contractor agreement, which outlines the terms of service, payment structure, and project expectations. This type of agreement allows for flexibility while still protecting both parties' interests. Utilizing a Vermont Masonry Services Contract SelfEmployed can simplify this process and create a solid framework for your business relationships.

To write a contract agreement for services, start by defining the parties involved and detailing the services provided. You should also include payment terms, deadlines, and dispute resolution procedures. Crafting a Vermont Masonry Services Contract - Self-Employed with clear conditions can greatly enhance the trust and collaboration between you and your client.

An employment contract should include the job title, responsibilities, salary, and any benefits offered. Moreover, it should outline the duration of the employment and any conditions for termination. When creating a Vermont Masonry Services Contract - Self-Employed, ensure you specify these terms to foster a clear understanding between you and your client.

To fill out a contractor agreement, you should start by entering the names and contact details of both parties. Next, describe the services to be rendered in detail, along with the payment schedule. It is essential to customize the Vermont Masonry Services Contract - Self-Employed to reflect your specific project needs, making sure both parties sign and date the agreement.

A 1099 contract must clearly outline the scope of work, payment terms, and deadlines for deliverables. Additionally, it should include the contractor's tax information and any relevant legal disclaimers. Always remember, a well-structured Vermont Masonry Services Contract - Self-Employed protects both parties and ensures clarity in the working relationship.