Vermont Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Are you currently in the placement in which you need to have paperwork for both company or person functions almost every working day? There are tons of lawful document web templates available online, but locating kinds you can trust isn`t effortless. US Legal Forms delivers a large number of kind web templates, just like the Vermont Notice Regarding Introduction of Restricted Share-Based Remuneration Plan, that happen to be created to meet federal and state specifications.

When you are currently informed about US Legal Forms web site and possess a merchant account, just log in. Next, it is possible to download the Vermont Notice Regarding Introduction of Restricted Share-Based Remuneration Plan format.

Unless you provide an bank account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for the correct metropolis/county.

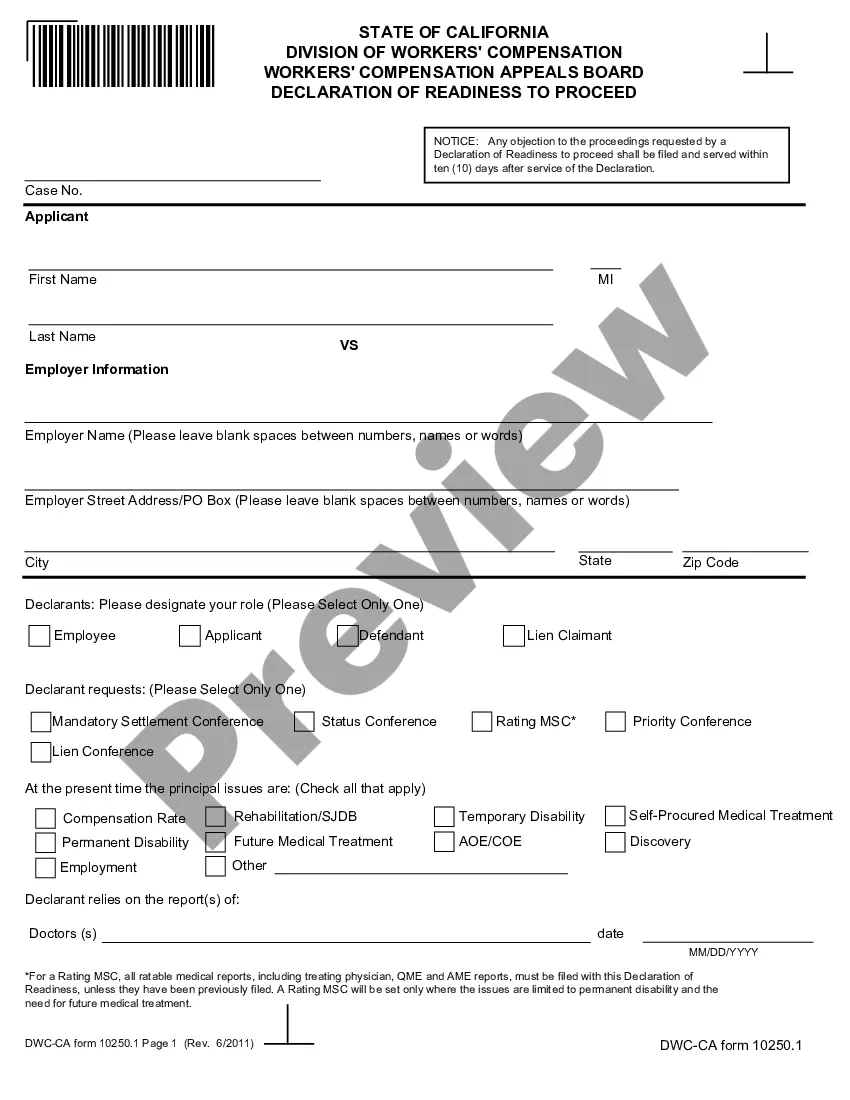

- Make use of the Preview button to check the shape.

- Read the description to actually have chosen the right kind.

- If the kind isn`t what you`re searching for, utilize the Search area to get the kind that meets your needs and specifications.

- If you get the correct kind, click Acquire now.

- Pick the costs plan you desire, submit the necessary information and facts to generate your bank account, and pay for an order with your PayPal or bank card.

- Decide on a hassle-free document formatting and download your backup.

Locate each of the document web templates you have purchased in the My Forms food list. You can aquire a more backup of Vermont Notice Regarding Introduction of Restricted Share-Based Remuneration Plan anytime, if possible. Just go through the essential kind to download or produce the document format.

Use US Legal Forms, the most extensive variety of lawful kinds, in order to save efforts and avoid errors. The assistance delivers expertly manufactured lawful document web templates that can be used for an array of functions. Make a merchant account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

The majority of U.S. states offer unemployment benefits for up to 26 weeks. Benefits range from $235 a week to $823. Policies and benefits vary by state. Mississippi has the lowest maximum unemployment benefits in the U.S. of $235 per week, while Massachusetts has the highest at $823.

If you work 35 hours or more or your earnings exceed your weekly benefit amount plus your disregarded earnings, you will be considered fully employed and will not be entitled to receive benefit for that week.

If an unemployed worker is monetarily eligible for benefits, the weekly benefit amount is computed by dividing the total wages paid in the two highest quarters in the worker's base period by 45. The amount of weekly benefits is capped each year, for the period beginning July 1st through June 30th of the following year.

You are not eligible for unemployment benefits if: You left your job for reasons unrelated to work, unless it was for a reason specified in law. You are unauthorized to work in the U.S. You were fired for willful misconduct.

Qualified dividends are not eligible for capital gains treatment for Vermont tax purposes. Taxpayers may elect either the Flat Exclusion or the Percentage Exclusion. The amount excluded under either method cannot exceed 40% of federal taxable income or $350,000, whichever is less.

Vermont is an at-will employment state. An employee may be discharged at any time with or without cause unless there is a clear and compelling public policy against the reason for the discharge or if the relationship has been modified, such as via an express or implied contract (including employer policies).

Usually you can't get unemployment if you stop working for personal reasons or because you are so sick that you cannot work at all. You may be able to get unemployment if you have to leave your job for a health reason but are still able to do other work.

In the State of Vermont, you have the legal right to refuse access to your property for an inspection by the assessor's office. The assessor is then required to follow State statute and value your property to the best of his/her ability without seeing the grade, condition, updating and other possible improvements.