Vermont Qualified Investor Certification Application

Description

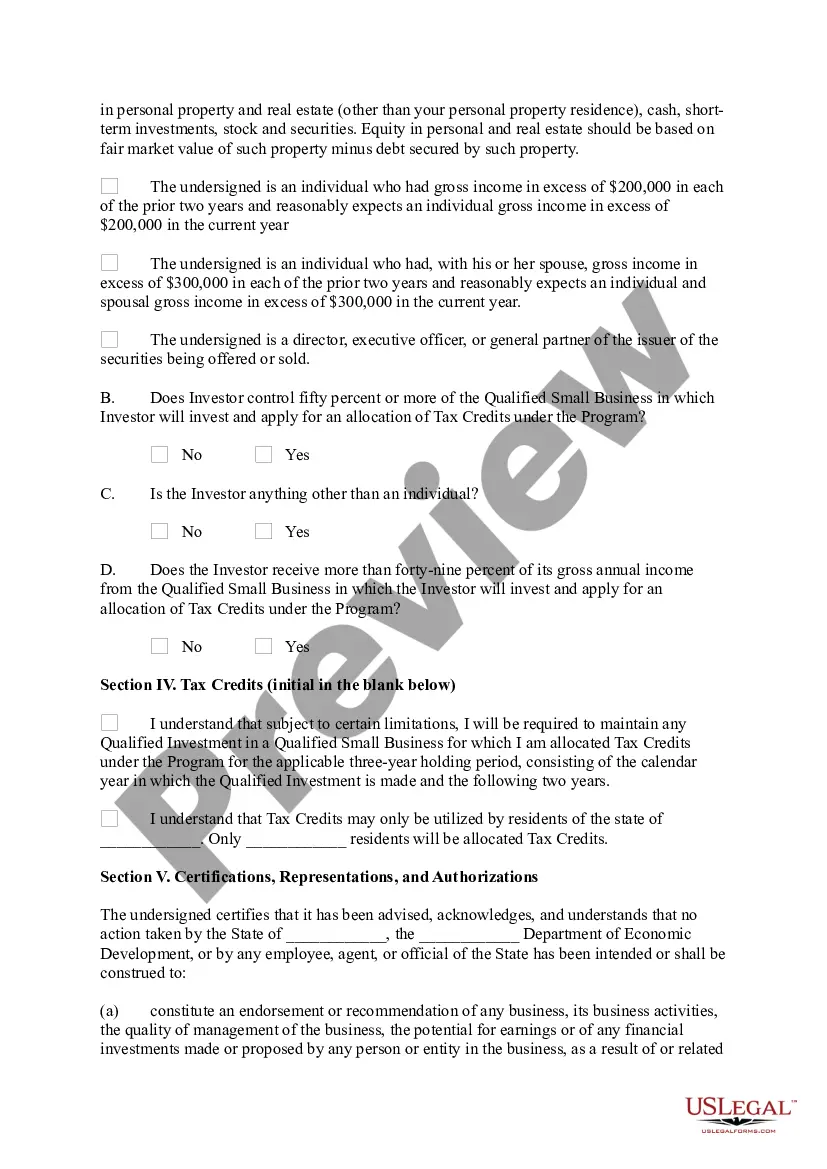

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

US Legal Forms - one of the greatest libraries of lawful types in the States - offers an array of lawful document templates you are able to obtain or printing. Utilizing the website, you will get a huge number of types for business and personal purposes, categorized by types, suggests, or keywords.You can get the most up-to-date types of types much like the Vermont Qualified Investor Certification Application within minutes.

If you currently have a registration, log in and obtain Vermont Qualified Investor Certification Application through the US Legal Forms catalogue. The Down load switch can look on each type you view. You have accessibility to all formerly delivered electronically types in the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, listed below are basic guidelines to get you started out:

- Ensure you have selected the best type for your town/area. Click on the Preview switch to check the form`s information. Read the type outline to ensure that you have chosen the appropriate type.

- In case the type does not fit your specifications, take advantage of the Search area at the top of the display to discover the one that does.

- Should you be happy with the shape, validate your decision by visiting the Buy now switch. Then, opt for the prices program you like and offer your accreditations to register on an bank account.

- Process the purchase. Make use of credit card or PayPal bank account to complete the purchase.

- Find the format and obtain the shape in your gadget.

- Make changes. Fill out, change and printing and indicator the delivered electronically Vermont Qualified Investor Certification Application.

Each web template you added to your account does not have an expiry date which is your own forever. So, if you want to obtain or printing yet another version, just proceed to the My Forms area and then click on the type you want.

Gain access to the Vermont Qualified Investor Certification Application with US Legal Forms, probably the most considerable catalogue of lawful document templates. Use a huge number of specialist and condition-distinct templates that meet up with your organization or personal needs and specifications.

Form popularity

FAQ

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

To dually register an individual as an AG (Broker-Dealer Agent) and RA (Investment Adviser Representative) when the employing firms are affiliates, both Form BD and Form ADV must designate the other firm as an affiliate.

An investment vehicle, such as a fund, would have to determine that you qualify as an accredited investor. To do this, they would ask you to fill out a questionnaire and possibly provide certain documents, such as financial statements, credit reports, or tax returns.

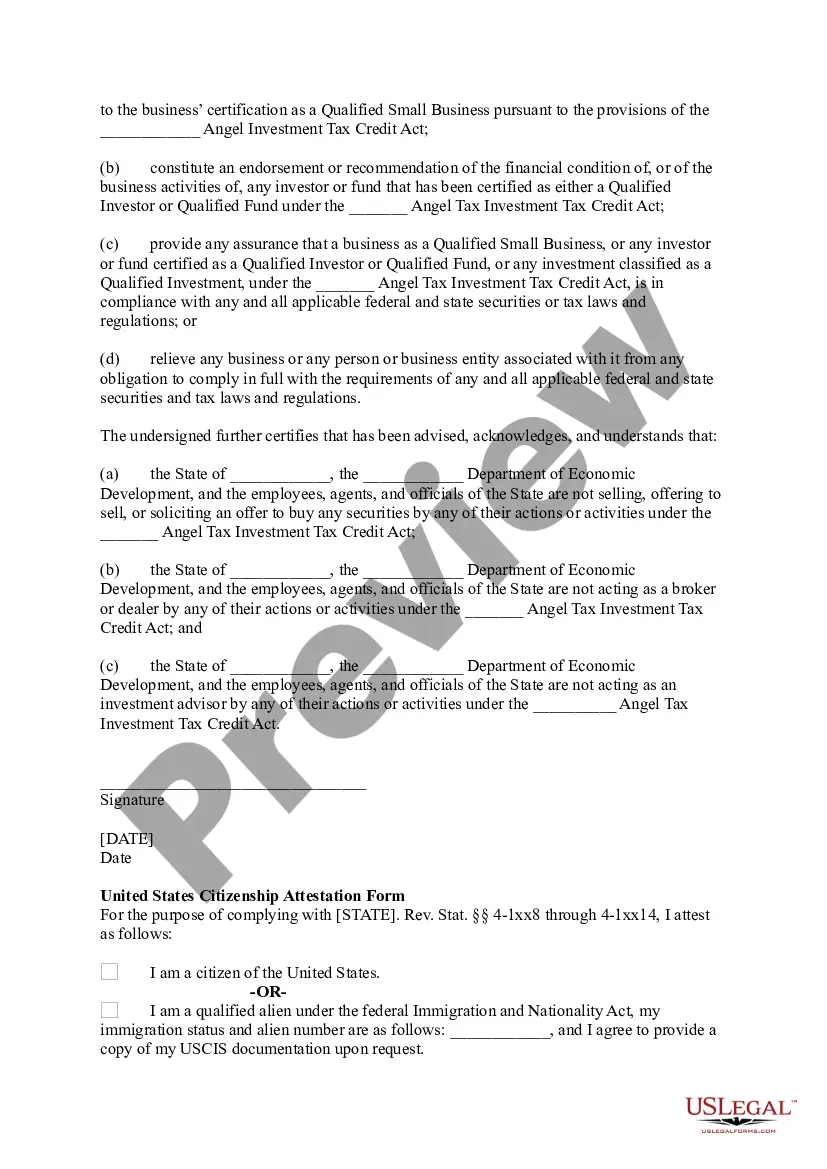

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

A statement of net worth will include balance sheets, income statements and cash flow statements. Balance sheets : Balance sheets provide detailed accounting of a company or individual's assets, liabilities and shareholders' equity.