Vermont Grant Agreement

Description

How to fill out Grant Agreement?

You can spend several hours on the web looking for the legitimate document format that fits the federal and state needs you need. US Legal Forms supplies thousands of legitimate forms which are analyzed by professionals. It is simple to obtain or produce the Vermont Grant Agreement from my support.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Down load key. Afterward, it is possible to total, revise, produce, or sign the Vermont Grant Agreement. Every single legitimate document format you acquire is the one you have eternally. To obtain another version of the acquired type, go to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms web site the very first time, adhere to the easy recommendations under:

- Very first, ensure that you have selected the proper document format to the state/city of your choice. See the type description to make sure you have picked the right type. If offered, use the Preview key to search throughout the document format also.

- If you want to discover another version in the type, use the Look for area to get the format that meets your requirements and needs.

- After you have discovered the format you need, just click Acquire now to carry on.

- Find the pricing strategy you need, type your accreditations, and register for a free account on US Legal Forms.

- Full the purchase. You should use your credit card or PayPal profile to purchase the legitimate type.

- Find the formatting in the document and obtain it to the gadget.

- Make alterations to the document if necessary. You can total, revise and sign and produce Vermont Grant Agreement.

Down load and produce thousands of document templates making use of the US Legal Forms web site, that provides the biggest selection of legitimate forms. Use specialist and express-particular templates to take on your small business or individual needs.

Form popularity

FAQ

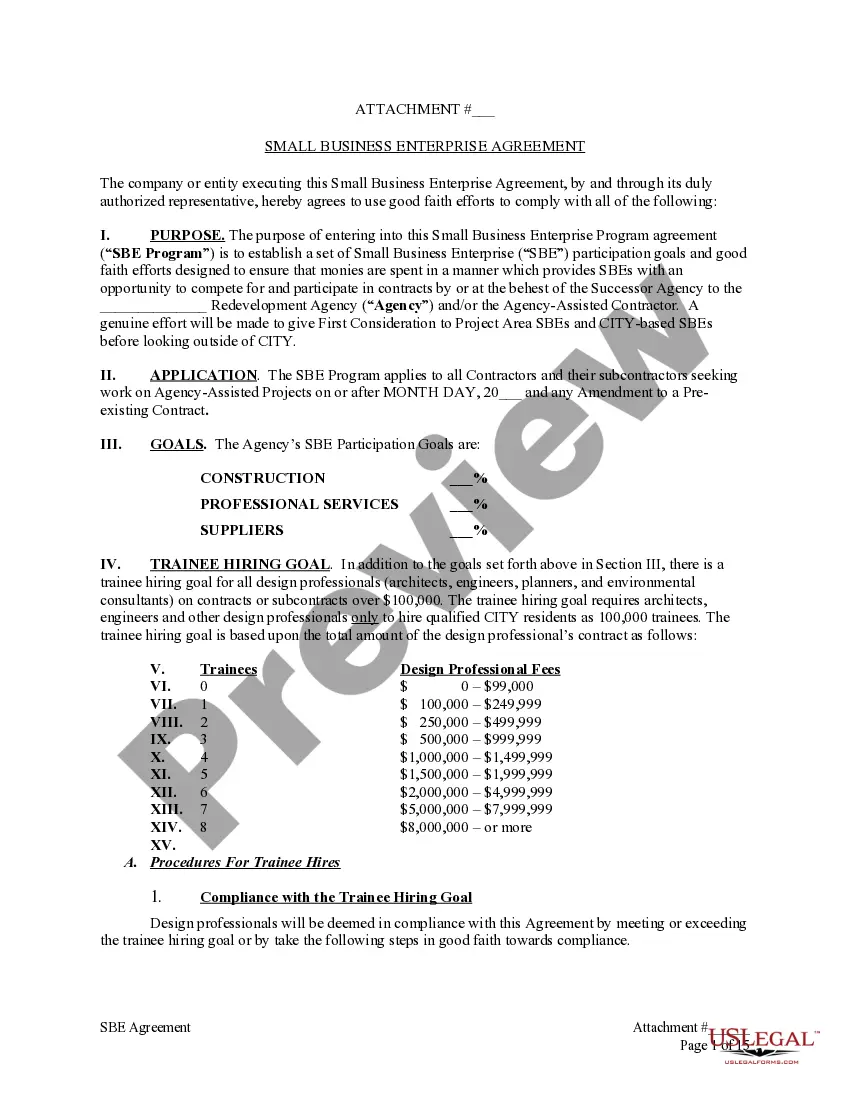

Grant agreement. ?Grant agreement? means a legal instrument of financial assistance between a Federal agency and a non-Federal entity that, consistent with 31 U.S.C.

For the 2022 tax year, the income tax in Vermont has a top rate of 8.75%, which places it as one of the highest rates in the U.S. Meanwhile, total state and local sales taxes range from 6% to 7%.

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota ? which both received a B ? also have no state income tax.

Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks. Soft drinks are subject to Vermont tax under 32 V.S.A. § 9701(31) and (54).

The personal income tax rate in Vermont is 3.35%?8.75%. Vermont does not have reciprocity with other states.

Vermont has four income tax brackets, and the state still taxes Social Security benefits for some filers. Property taxes are high when compared to most other states, and Vermont also has an estate tax. However, the sales tax rate in Vermont is about average, and many types of essential items are tax-exempt.