A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Vermont Notice to Debt Collector - Falsely Representing a Document's Authority

Description

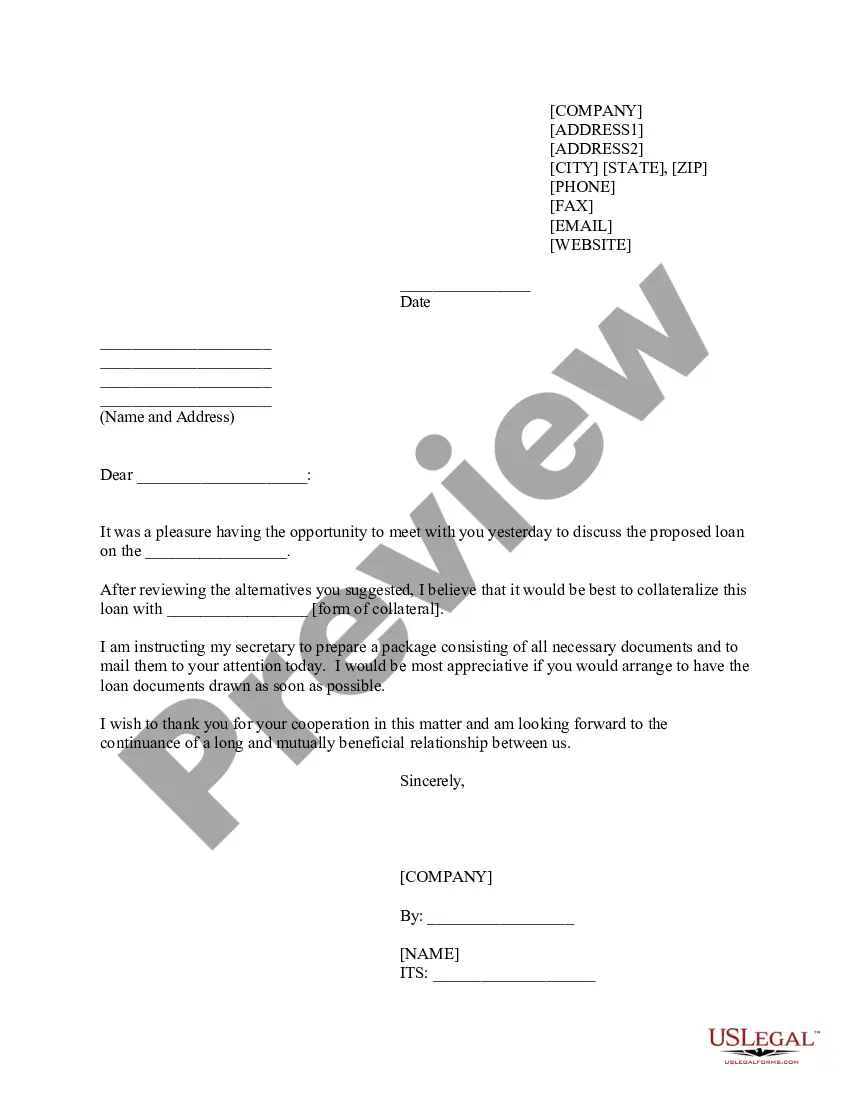

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

Are you in a situation that requires documentation for both corporate or specific reasons on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Vermont Notice to Debt Collector - Falsely Representing a Document's Authority, designed to comply with federal and state regulations.

Choose the pricing plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

Select a suitable file format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Vermont Notice to Debt Collector - Falsely Representing a Document's Authority at any time, if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Vermont Notice to Debt Collector - Falsely Representing a Document's Authority template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

- Use the Review button to examine the form.

- Read the information to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup area to find the form that satisfies your needs and requirements.

- Once you find the right form, click on Get now.

Form popularity

FAQ

Don't subject yourself to that abuse. Even if they aren't cursing or acting overtly disrespectful, a debt collector may still be crossing the line, particularly if they're making veiled threats about seizing your assets, garnishing your wages or letting others know about your debts.

You only need to say a few things:This is not a good time. Please call back at 6.I don't believe I owe this debt. Can you send information on it?I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter.My employer does not allow me to take these calls at work.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...

Top 7 Debt Collector Scare TacticsExcessive Amount of Calls.Threatening Wage Garnishment.Stating You Have a Deadline.Collecting Old Debts.Pushing You to Pay Your Debt to Improve Your Credit ScoreStating They Do Not Need to Prove Your Debt ExistsSharing Your Debt With Family and Friends.

5 Things Debt Collectors Are Forbidden to DoPretend to Work for a Government Agency. The FDCPA prohibits debt collectors from pretending to work for any government agency, including law enforcement.Threaten to Have You Arrested.Publicly Shame You.Try to Collect Debt You Don't Owe.Harass You.

Designed to a eliminate abusive, deceptive and unfair practices in debt collection without putting reputable debt collectors at an unfair disadvantage. You just studied 10 terms!

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

You can't be taken to court for a debt that has gone for more than six years without a payment. This is a Vermont law. If you make a payment, it adds another six years to the time you can be sued for the debt so don't make a payment just to get them off your back.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.