Vermont Proposal to adopt plan of dissolution and liquidation

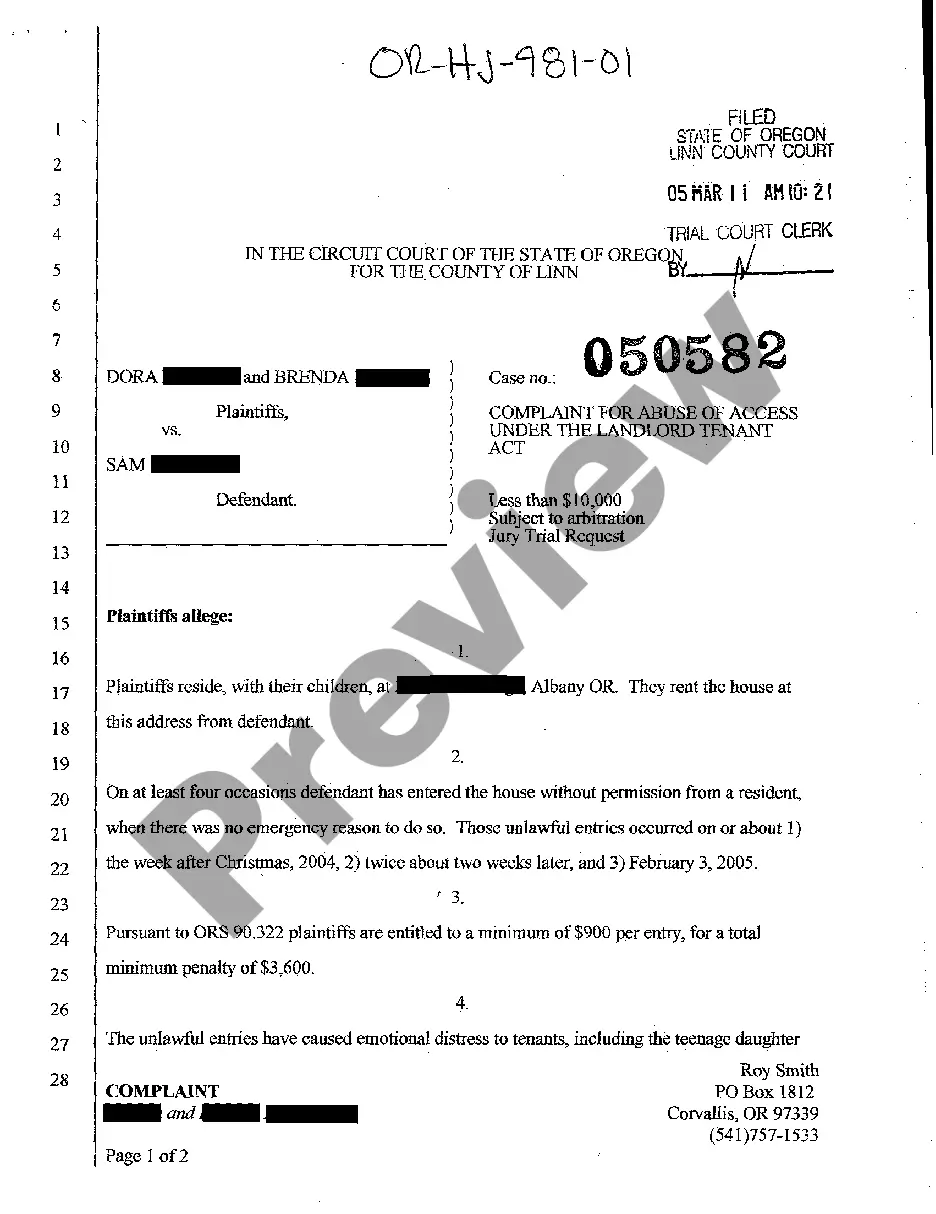

Description

How to fill out Proposal To Adopt Plan Of Dissolution And Liquidation?

Have you been in the situation where you need to have paperwork for sometimes business or person functions almost every time? There are plenty of legitimate file layouts accessible on the Internet, but getting ones you can trust isn`t effortless. US Legal Forms provides a huge number of develop layouts, such as the Vermont Proposal to adopt plan of dissolution and liquidation, which are created in order to meet federal and state requirements.

In case you are currently familiar with US Legal Forms site and have a merchant account, just log in. After that, you are able to acquire the Vermont Proposal to adopt plan of dissolution and liquidation format.

If you do not have an account and need to begin using US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is for that correct area/county.

- Use the Review key to check the shape.

- Browse the explanation to ensure that you have chosen the right develop.

- When the develop isn`t what you`re trying to find, use the Look for industry to find the develop that suits you and requirements.

- When you find the correct develop, click Acquire now.

- Select the pricing plan you desire, submit the necessary details to create your money, and purchase the order using your PayPal or charge card.

- Pick a handy document structure and acquire your copy.

Discover every one of the file layouts you possess purchased in the My Forms food selection. You can get a further copy of Vermont Proposal to adopt plan of dissolution and liquidation at any time, if possible. Just go through the needed develop to acquire or print the file format.

Use US Legal Forms, the most considerable selection of legitimate forms, to conserve time as well as avoid mistakes. The assistance provides appropriately produced legitimate file layouts that can be used for an array of functions. Generate a merchant account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

When you dissolve a Vermont LLC, you must file a Limited Liability Company ? Termination form with the Vermont Secretary of State, Corporations Division (SOS). You are not required to use the forms provided by the Vermont SOS. You can draft your own articles of termination.

How much does it cost to form an LLC in Vermont? The Vermont Secretary of State charges $125 to file the Articles of Organization. You can reserve your LLC name with the Vermont Secretary of State for $20.

What typically has to be done. Notifying creditors that the LLC is dissolved. Closing out bank accounts. Canceling business licenses, permits, and assumed names. Paying creditors or establishing reserves to pay them. Paying taxes. Filing final tax returns and reports.