Vermont Work for Hire Addendum - Self-Employed

Description

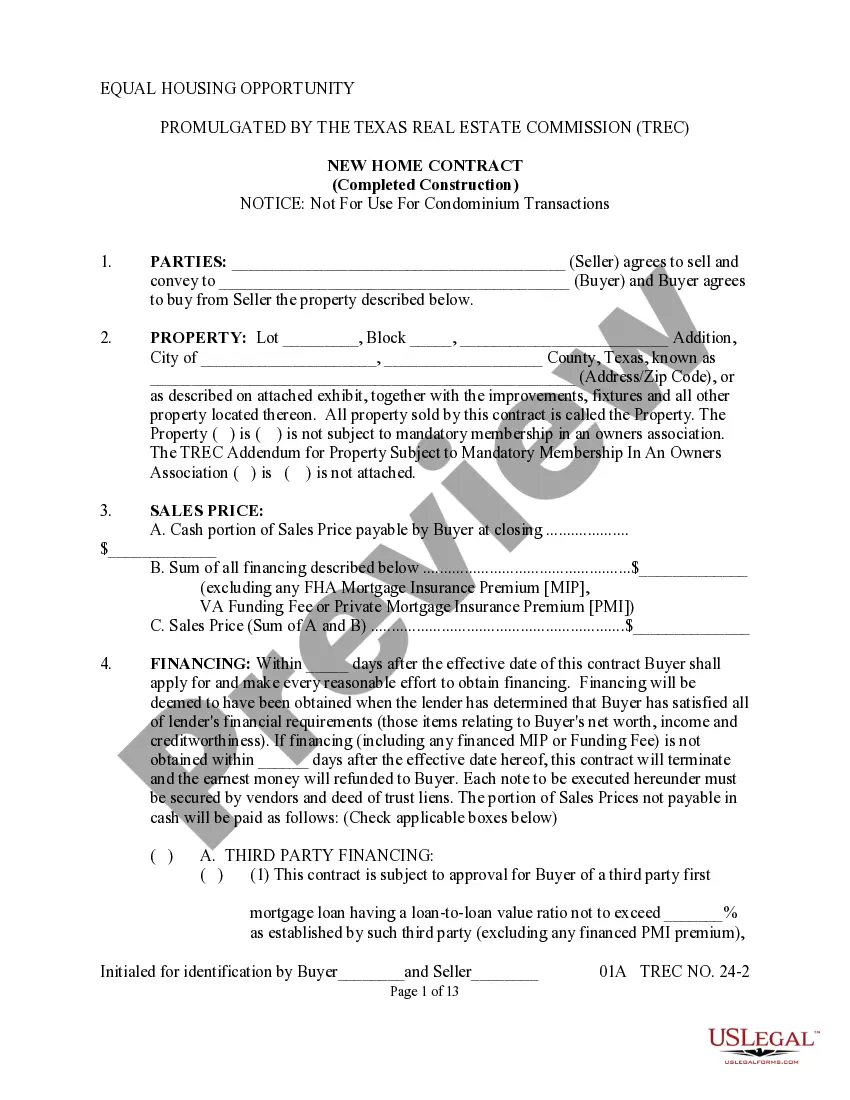

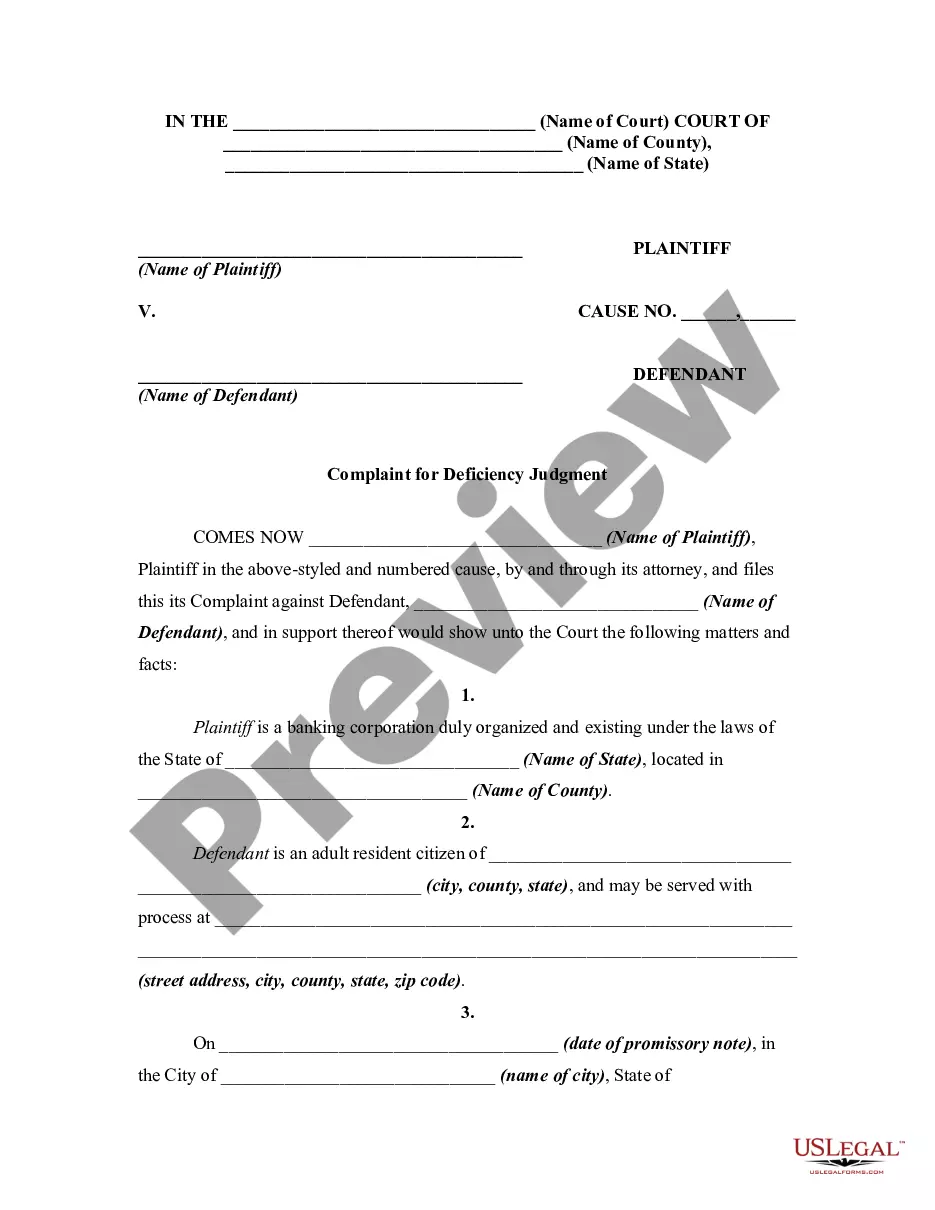

How to fill out Work For Hire Addendum - Self-Employed?

Finding the appropriate legal document format can be challenging.

Certainly, there are numerous templates accessible online, but how do you acquire the legal form you need.

Visit the US Legal Forms website.

First, ensure you have chosen the appropriate form for the region/county. You can review the form using the Preview button and examine the form details to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are confident that the form is appropriate, click the Buy now button to purchase it. Select the pricing plan you wish to use and fill in the required information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the document format and download the legal document to your device. Complete, edit, print, and sign the obtained Vermont Work for Hire Addendum - Self-Employed. US Legal Forms is the largest repository of legal templates where you can find a variety of document templates. Use the service to download professionally crafted documents that adhere to state regulations.

- The service provides a wide array of templates, including the Vermont Work for Hire Addendum - Self-Employed, suitable for business and personal purposes.

- All of the forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Vermont Work for Hire Addendum - Self-Employed.

- Utilize your account to search for the legal documents you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you require.

- For new users of US Legal Forms, here are simple guidelines to follow.

Form popularity

FAQ

The self-employment tax rate in Vermont aligns with the federal rate, which is currently 15.3%. This tax rate includes 12.4% for Social Security and 2.9% for Medicare. By understanding how the Vermont Work for Hire Addendum - Self-Employed applies to your situation, you can better manage your tax responsibilities. Seeking guidance from experts can ensure you meet all necessary tax obligations.

In Vermont, self-employment tax consists of Social Security and Medicare taxes, similar to the federal level. This tax applies to your net earnings from self-employment and is vital for funding these social programs. Understanding how the Vermont Work for Hire Addendum - Self-Employed affects your earnings can aid you in planning for your tax liabilities. Utilizing resources like uslegalforms can provide clarity on these requirements.

To prove your self-employment, gather financial documents like bank statements, tax returns, and business licenses. You can also present client contracts or agreements that demonstrate your work history. Utilizing a Vermont Work for Hire Addendum - Self-Employed can strengthen your case by formally defining your work arrangement.

FEHA typically protects independent contractors as well as employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Steps to Hiring your First Employee in VermontStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.