Vermont Worksheet Analyzing a Self-Employed Independent Contractor

Description

How to fill out Worksheet Analyzing A Self-Employed Independent Contractor?

If you require extensive, download, or print genuine document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's user-friendly and effective search function to locate the documents you need.

Various templates for commercial and personal applications are categorized by type and state, or keywords. Use US Legal Forms to locate the Vermont Worksheet Evaluating a Self-Employed Independent Contractor with just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account.

Navigate to the My documents section and select a form to print or download again. Complete and download, and print the Vermont Worksheet Evaluating a Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms subscriber, Log In to your account and click the Download button to obtain the Vermont Worksheet Evaluating a Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the template for the appropriate city/state.

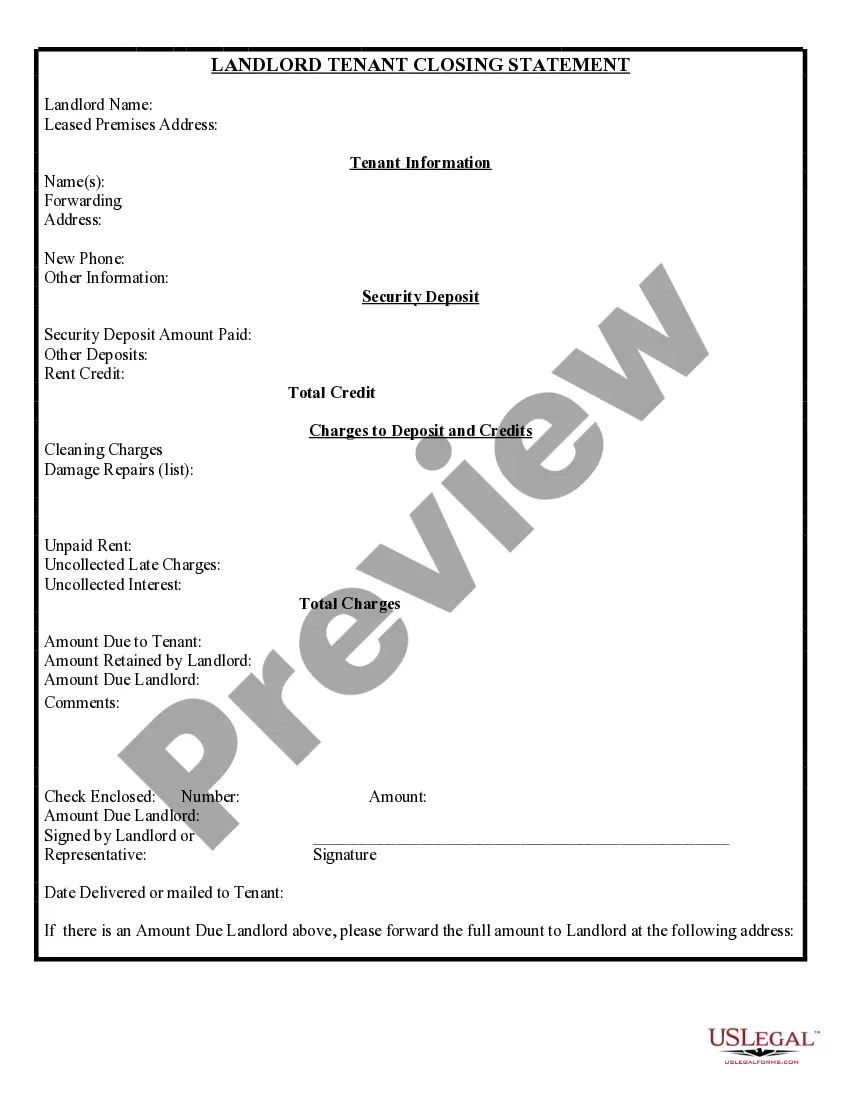

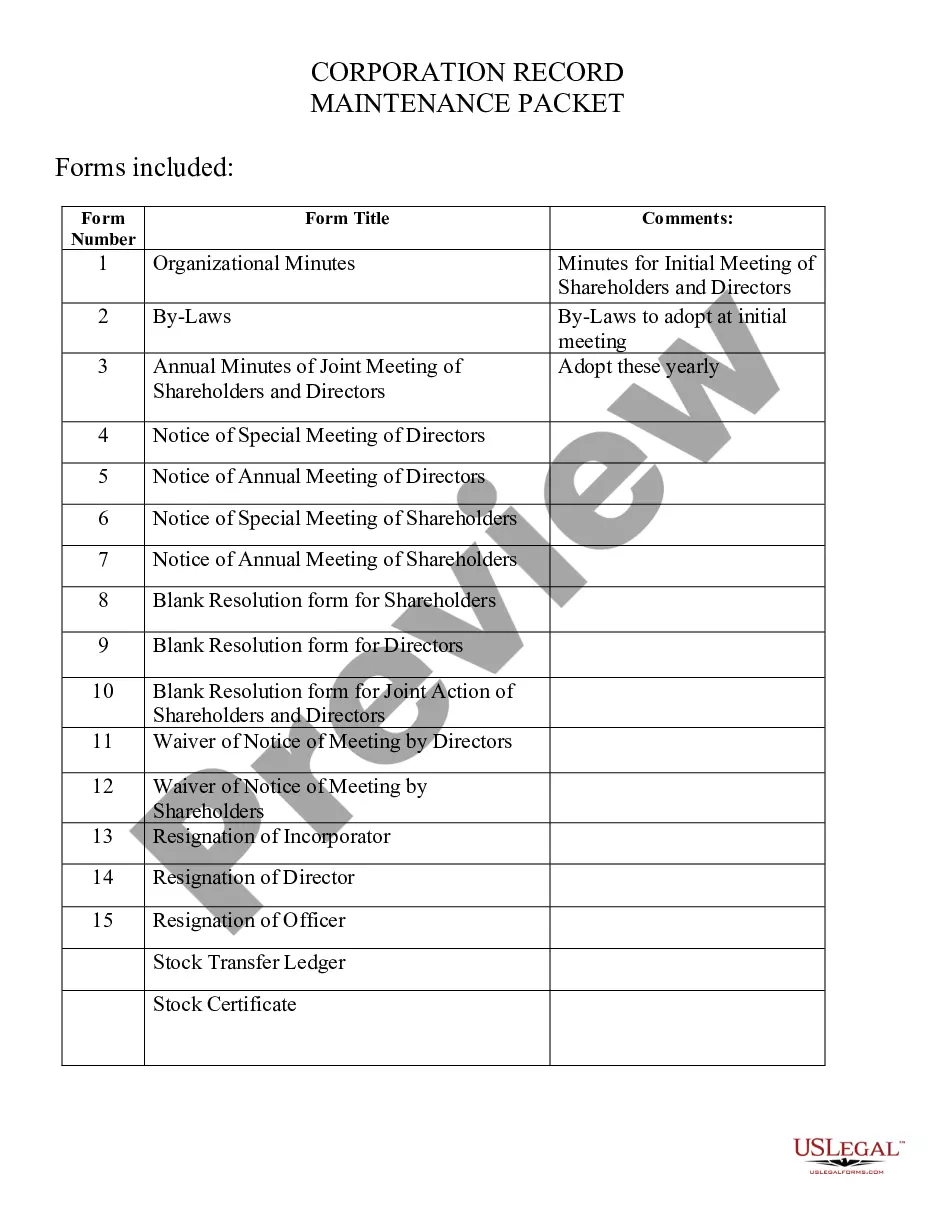

- Step 2. Use the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to explore other models of the legal document format.

- Step 4. Once you have found the form you require, click the Download now button.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Vermont Worksheet Evaluating a Self-Employed Independent Contractor.

Form popularity

FAQ

To calculate self-employment taxes for independent contractors, you must first determine your net earnings, which are your total income minus your business expenses. You then apply the self-employment tax rate to your net earnings. Utilizing the Vermont Worksheet Analyzing a Self-Employed Independent Contractor makes this calculation more manageable by providing a structured format to track your income and expenses.

Yes, another name for a self-employed person is indeed an independent contractor. Both terms refer to individuals who provide services independently, rather than as employees of a company. Understanding these terms is essential for navigating the world of self-employment. The Vermont Worksheet Analyzing a Self-Employed Independent Contractor is a great resource to understand your tax obligations.

Another name for a self-employed person is a freelancer. Freelancers operate independently and may offer their services on a project basis. This term encompasses a wide range of professions, from writers to graphic designers. The Vermont Worksheet Analyzing a Self-Employed Independent Contractor can help freelancers maintain their financial records effectively.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income tax. For the 2021 tax year, the first $142,800 of earnings is subject to the Social Security portion.